2022 in Review: New York City Startups’ Year of Resilience

Even in a more challenged market, the city’s early stage ecosystem continues growing strong.

What a year. At this point it’s trite to say the best startups develop in bad markets, but as the Primary team looks back on 2022, we wanted to explore how that truism is unfolding in New York City.

In short, it was a year that showed this startup scene is not just roaringly ascendant, but also resilient. We connected, helped each other, bounced back, bounded forward, and led with honesty.

There were countless examples of this, but here are a few that stood out:

Back together again: Big swings on huge offices, Silicon Valley gets FOMO, IRL events rule

Though still with some covid caution, getting together came back in a big way. Iconic New York City firms like USV and AlleyCorp invested in new spaces with lots of room for entertainment. And many of the world’s top shops—Sequoia, Index, GGV, Lightspeed, and Greylock, to name a few—opened New York offices.

We saw an onslaught of “intimate dinners” (and requests for intel on the city’s best private dining rooms) early in the year, al fresco hangouts all summer, and in the fall we brought back the NYC Summit, an invite-only gathering of top VCs, Founders, and speakers like Andrew Yang, Andy Dunn, Brit Morin, David Fialkow, Deena Shakir, Kirsten Green, Mar Hershenson, Marc Lore, Neil Blumenthal, Zach Weinberg, and dozens more.

All in all, across virtual and in-person events, Primary alone hosted over 250 gatherings for NYC startups and investors, and attended hundreds more.

New startups chose New York City

Our team alone met with 1,705 founders this year. Our NYC Founders Fellowship for ascendant founders attracted nearly 800 applications. Our NYC Seed reports recorded 573 successful seed deals in the first three quarters of the year, totalling $2.4 billion raised. And anecdotally, we continued seeing a stream of talent leave the Bay Area.

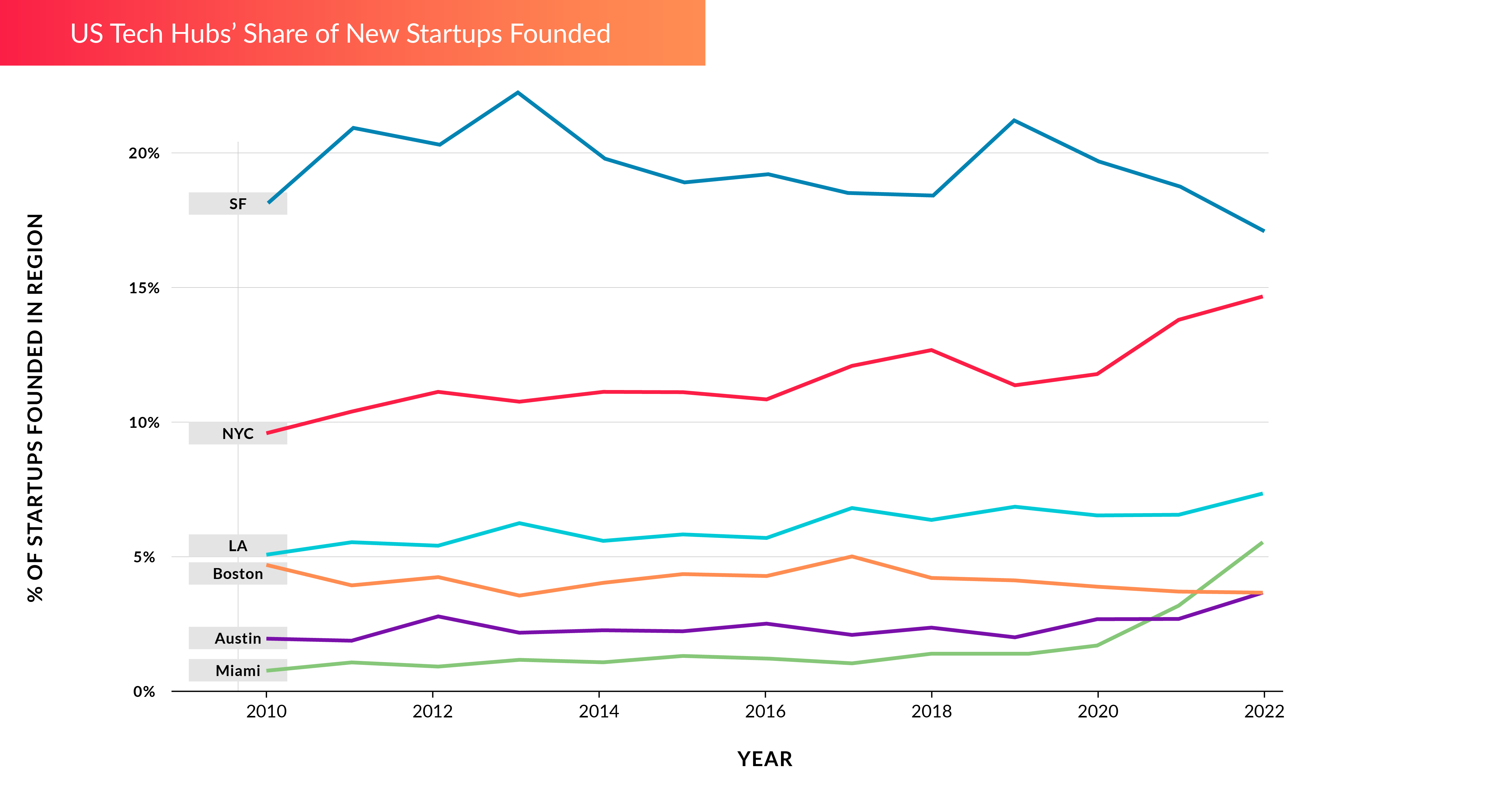

In August, Two Sigma Ventures published Pitchbook-sourced data proving the continued uptick in our city’s share of new startups founded, alongside a decline in SF’s. (Once again, Miami, we love you, but there’s no way that will last.)

Women win with Chief's unicorn status and expansion

In March, Chief, the private membership network for women executives, reached a valuation of $1.1 billion with a Series B from Alphabet’s CapitalG, General Catalyst, GGV Capital, Primary, Inspired Capital, and Flybridge.

It was a moment of power for cofounders Carolyn Childers and Lindsay Kaplan as well as the 12,000+ executives that make up the community. Since then, the company has gone on to expand with new clubhouses in London and San Francisco, and has plans for new announcements coming soon.

Adam Neumann had his comeback—twice

The local tech community and fans of the Apple+ series WeCrashed were more than a little surprised to see Adam Neumann back in the founder seat this year.

In May, he announced Flowcarbon, a crypto solution to the climate crisis. a16z led the $70 million Series A round—General Catalyst, Euphoria creator Sam Levinson, The Unbearable Weight of Massive Talent producer Kevin Turen, and others participated. (You have to wonder if the Hollywood crowd got in partly for firsthand access to the story of what Neumann is calling the Goddess Nature Token.)

Just a few months later, a16z announced its $350 million investment—the largest single individual check the firm has ever written—in a separate proptech move called Flow, bringing the incipient company’s valuation to more than $1 billion.

The war for talent gave way to quiet quitting

Primary Partner Rebecca Price has been a senior People leader for well over a decade. "The demand for talent in the last several years was like nothing I'd ever seen before," she says, "and in the last few months we've seen a similarly dramatic turn toward efficiency and doubling down on the highest performers and the most critical skills. There is a generation of talent who has only experienced booming economy conditions of more jobs, more comp, and more perks. "

But this was the year that tide turned. Remote staff were called back to the office, in many cases forcefully and foolishly. (That’s the closest we’ll come to discussing Elon in this article.) Workers got burnt out. In a TikTok video, Brian Creely coined the term “quiet quitting.” And then, with the economy souring, the mood has shifted once again. Layoffs have hit thousands of tech workers, and as many more worried for the longevity of their positions.

Through all of this, the People and Networks team at Primary has been a huge resource to local job seekers, making thousands of intros, serving more than a thousand up-and-coming operators through Mastermind Networks, and placing hundreds of hires. The Executive Network helped over 1,000 senior brand leaders connect and leverage our tech insights to advance their work. In 2022 the team also built scale around their services, launching a self-serve job-search database fueling thousands of intros between hiring team and both active and passive candidates. At any given time, it includes over 900 fresh candidate profiles.

Crypto fell hard; Zach Weinberg rose as its star critic

Before prices fell, before Celsius Network zeroed out, before SBF said the “ethics stuff” was “mostly a front,” the prolific NYC-based founder and investor Zach Weinberg found a special calling in life: Humiliating crypto enthusiasts.

Through his frequent appearances on the Cartoon Avatars podcast hosted by Redpoint’s Logan Bartlett, Zach made frequent fun of the logic that’s driven so many to digital assets. It’s almost as simple as “speculation=scam,” but his inquisitive, quippy, eyeroll-heavy style turns it into a comedic spectator sport, which he brought to stage at the NYC Summit.

The city's foundational seed firm swung for the fences

Since 2015, Primary has been building the early stage VC firm cofounders Brad Svrluga and Ben Sun saw New York City needed—one that deeply invests in only the top echelons of founders and equips them with C-suite, full-time talent to see around corners and complete high-impact work.

As we close 2022, that model is humming: The portfolio includes 8 unicorns; Ben debuted on the Forbes Midas list and Brad got a top spot on Insider's Seed 100; Fund IV and Select III closed, which Forbes announced with commentary on how the firm played a sizable role in setting New York City's startup wave in motion. The fundraise brings assets under management to just under a billion. We're staying hungry and looking forward to a year of meeting even more of New York City's best founders.