Fintech Goes Global: On M&A-led International Expansion through M&A with Eric Rosenthal, Chief Strategy Officer at Rapyd

Why it can make sense to “buy” rather than “partner” to really own the end-to-end product experience

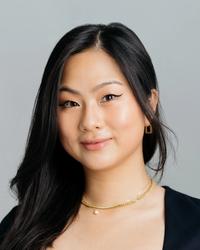

Having spent more years abroad than at home, Eric Rosenthal has scaled teams and companies across the globe many times over. Today, he’s the Chief Strategy Officer at Rapyd which has quickly become a major player on the global payments scene.

Below, we discuss why it’s never a good idea to hire a Head of International, how Rapyd landed its first major customers, and the different skills needed to take a company from 50 people to hundreds of millions in revenue.

For more like this, check out our other installments of “Fintech Goes Global” with Erica Dorfman (EVP Global Financial Products at Brex), Dan Westgarth (COO at Deel), and Marco Mahrus (Head of Revenue at Bridge).

Your career has taken you across the world. How did your international experiences culminate in your current role as the Chief Strategy Officer of Rapyd?

My career comes from maintaining relationships built over a significant amount of time. It’s not only about my network, but how subsets of my network know me and keep me top of mind over a long period of time.

For example, I’ve been very conscientious with my career’s storyline, which is working tip-of-the-spear in international emerging markets. I realized either consciously or subconsciously that, to move forward in my career, I needed to put myself in a situation where I had a unique insight, ability, and way to navigate. That’s why I've been overseas for nearly my entire career.

I met Arik Shtilman from Rapyd a few years later in 2017. When Arik and I met for the first time, I was struck by his ambition to go global from day one. He was building a consumer-facing app based in Europe from Israel, and his model of acquiring users was very difficult to scale. I told him, “I speak Spanish fluently. I’ve lived in Latin America, Europe, and Asia for almost my entire career. I can work in and out of the region like the back of my hand. I understand how and why their markets are fragmented.” I think that’s why he hired me.

Rapyd went from solving a consumer-facing problem to accepting and sending payments across 900 different methods all over the globe. How did Rapyd evolve as a business with a global scale in mind on day one?

It was timing and luck. Rapyd was lucky that when we timed its pivot from B2C to B2B in 2018. The market was not necessarily at the peak but it was still buoyant. We had the luxury of spending two years painting a picture of what we were going to build. We'd go into pitches and say, “There are 2.1 billion people that don't have bank accounts,” or “Today there are 500 payment methods, but in three years there's going to be a thousand payment methods, and RTP is going to do this.”

We were able to paint a story that required a significant amount of edification for American investors, to be fully transparent. We'd go in and say, "Not all the world is carded. Not all the world pays the same way that we pay." Investors thought we were completely nuts or said, “You know what? This is the next frontier of growth, which is everything outside of the U.S. that's unique and difficult.” We effectively sidestepped a lot of the U.S. market expansion, despite me pursuing it.

The second good timing happened when Uber and Rappi came to market. They helped us paint a story of a huge opportunity. We had the luxury and the luck of not being pressured to deliver meaningful revenue from 2017 up until 2019. It's ludicrous, particularly in today's context, that a company can say, “I'm going to spend two years building out my product that you can’t look at or feel.” We had clarity of the product vision, and that drove us through.

In 2023, Rapyd found itself again in a bit of luck by raising a significant amount of money in 2020 and 2021 at the peak of the market. There was interest in the digitization of payments, and e-commerce was growing significantly faster than anyone expected because of COVID-19. We had a war chest of $350 million to build and buy. We ended up with a unified brand, some organizational structure, integrations, and a significant amount of revenue.

The product evolution made a significant shift, however, after our early days focused on the world not having cards, alternative payment methods, and wallets. Even though we still believe in our unique core product—45 different RTP networks, cash networks, bank transfer networks, virtual account networks, and a ledger that allows us to do pay-ins and payouts—we also began to realize that we could do a wedge approach from a sales perspective. We could come in and solve something esoteric and long tail for a merchant, like cash in Bolivia. We could show up and say, "Hey, I can do that and core card processing and Core FX for you.” We had the right to be at the table, which helped the product evolve. It's very rare for companies to be able to do that seamlessly.

We realized that you could do a wedge approach from a sales perspective. We could come in and solve something esoteric and long tail for a merchant. We were able to go to a merchant and say, “Oh, I can do cash in Bolivia for you.” They’d say, “Well, thank God, no one else can.” I’d say, “Great. Let me also do all these other three long tail markets for you.” It didn't necessarily resonate, and if it did, it didn't necessarily lead to significant volume. But I still can show up and say, "Hey, I can do core card processing for you, I can do Core FX for you, I can do all these things for you. We’ve been performing well for you for the past two years. We have the right to be at the table."

A major evolution was acquiring two card acquirers in 2020, then another in 2022. We then acquired a license in Hong Kong, Iceland, and the UK. When it comes to licensing, it’s extremely difficult to partner. You can only get so far in a partnership model when it comes to touching, holding, and having programmatic control over merchant and client funds. It's a very difficult model to do when you don’t have the license.

Did you try to partner first and then realize it wasn’t going to work?

Yes. We would try to partner on a variety of capabilities, but it led to a very unpredictable experience, so acquiring made better sense. In the U.S., however, we have partners, because it's very difficult to go all-in unless you become a bank, which opens up a completely different can of worms.

Rapyd sits on the more acquisitive side of the large fintech companies. What’s the rationale behind the strategy?

It comes down to two questions:

- What's the rationale of a company deciding to do an M&A?

- What is the strategic rationale of this particular transaction and deal?

At the high level, there is an understanding that value could be created for shareholders. When you do the projection, you’ll say, "Okay, how much simpler would it be if I could grow in chunks of $50 million from one to another, versus the execution that would be required?" It becomes a dynamic of IRR.

When you do M&As with regulated entities, there are contractual protections around the material change in business. The world changes, too. People move. Things that didn’t appear complex suddenly are complicated. It will take you months of extra time. That impacts your IRR, even if it doesn't necessarily impact your cash-on-cash return.

To rewind the clock a bit, was there a framework or approach you used internally to block and tackle expanding to a new country or region? What was the ROI or tipping point?

We ran analyses and did the research, of course, but I also knew how to break into markets because I already had relationships there. Rapyd is very different from, say, Revolut. Revolut needs to have boots on the ground, understand consumer behavior, and know who they're competing with because they're competing for their consumers’ eyeballs and a share of their wallet.

For example, we weren’t targeting Mexican merchants or Malaysian clients. We were targeting those who had yet to be in those markets by giving them access to it. Because of this, the expansion didn't require getting on a plane. We would find the relationship, sell the story, sign a contract, and then manage integration—all in the cloud. That method made us say, "Okay, let's just go everywhere." From there, we made decisions mainly driven by client demand, particularly in the early days.

And look, there's always going to be some level of selling ahead. A client would ask, “Hey, do you guys have access to the Dominican Republic?” I would say, “Of course we do.” We’d then run out of the room and say, "Who do we know in the Dominican Republic?" and go from there. I could bypass teaching the team where the Dominican Republic was, and just go straight to speaking to so-and-so that we know there. You need to listen to what the clients say yes to and adapt quickly when they say no.

This approach to decision making has of course evolved materially, especially after completing M&A. We now need to make very finite decisions on where to invest when it comes to product, segment and geos. Why? Because when you buy companies, you inherently have to balance what is bought with what is your existing business and many times you pick-up business lines that on their own require further investment to get to scale. We also have done divestitures. Which is kind of like “giving up” on a product, but somehow, maybe because it actually generates revenue, it feels different to sell off a business line.

How has your strategy shifted now that Rapyd is bigger and at scale?

It shifted back in 2021 when the top 50 tech clients wanted reverse integrations. They said, “We’re not going to integrate into you. You need to integrate into us.” Suddenly, we needed to maintain someone else's API with constant updates and dedicated engineers. The realization was that scale is influenced by the scale of your clients. They can lead you to the water or they can have significant power over your roadmap, which meant we had to make hard choices to keep some and let others go. It’s everyone’s Achilles heel: sometimes you luck out when you get really big clients, but those big clients dictate the terms of how you integrate into them, which changes the dynamic.

When we were a team of 50, we had to hire for hustle. One of my teammates named Dennis waited outside the office of someone I wanted to work with. He followed someone in through the door, went up to reception, and said, “I need to speak with so-and-so.” He got the person to come to the front desk, introduced himself, and told him about Rapyd.

I thought, “Are you completely mad?” But at the same time, this bold action got him in the door. They told him, “I can't attend to you right now, but I'll set up a meeting next week.” That's similar to how we got in front of Uber. We spammed the former payments partner person until he took a meeting. It’s something that has always been part of our core DNA.

When we started scaling, however, we had to hire both for hustle and measurement. In the early days, measurement is a rapid-fire feedback of whether something is working or not. But when you have 40 salespeople, SDRs, BDRs, over $100 million in revenue, and 50,000 clients, it becomes a sales operation conversation. It’s radically different and more difficult. You can’t just break into the prospect's office to try and get in front of them.

How do you have your team set up?

We originally started with a regional structure with a GM with a matrix of every function except product engineering under them. The GMs would work with a Global Head of Sales, a Global Head of Engineering, and a Global Head of Support.

You need the freedom to run when you’re rapidly expanding. That way, you can chase clients, serve people in the same language, work in the same time zone, and sign new partners. From a global reporting of financing results, it worked. But from a perspective of efficiency, it didn’t. It became a dynamic where people fought over the roadmap.

Was it because tech and product were centralized?

Yes. It became who got to the Chief Product Officer faster, or who made a more convincing case. Arik would probably say he ended up having to be judge and jury all the time. It just became time-consuming. That’s why we shifted to having a CRO to help manage the three different sales teams. We then consolidated the marketing team to remove having regional marketing leads.

Once you scale, you can have a regional design, but it needs global functional oversight that can override or at least define the key protocols. A lot of how you need to organize is not so much just the design, but defining who you place where and what responsibility you give them. Companies make this mistake because of titling. I still talk to recruiters, and they’ll say, “Oh, this company is hiring a U.S. CEO,” but it turns out the role is actually a sales leader.

To be very honest, after we integrate PayU, it is very possible we revisit how to best organization for even further scale.

What advice would you have for an entrepreneur or company looking to expand globally? What do they need to keep in mind?

- Never hire a Head of International. Be thoughtful and clear on who and what you need. People tend to say, "I need a GM, I need a CEO, I need a Head of Sales," without thinking about it. What they need instead is a salesperson or a business developer.

- Don’t hold onto people who were the wrong hire. Not everyone can evolve into more or wants to do more.

- Finally, we've made so many mistakes in picking and managing partners. Understand what it means to manage partners, and make sure you’re programmatically managing them.

Primary is a NYC based venture firm that invests in early stage startups. If you’re building the next global fintech product we’d love to hear from you.