Productizing the PE Playbook: 5 Reasons Why All SMB SaaS Startups will become GPOs

Why Group Purchasing Organizations (GPOs) and Vertical integration is the next frontier for those in search of growth and market dominance.

Last month we sat down with a Managing Partner at one of the leading roll up focused Private Equity firms to unpack their playbook for a roll up they own. The business, which does $375M of EBITDA(!), has consistently grown the EBITDA of these acquisitions by 50-100% without adding ANY additional labor.

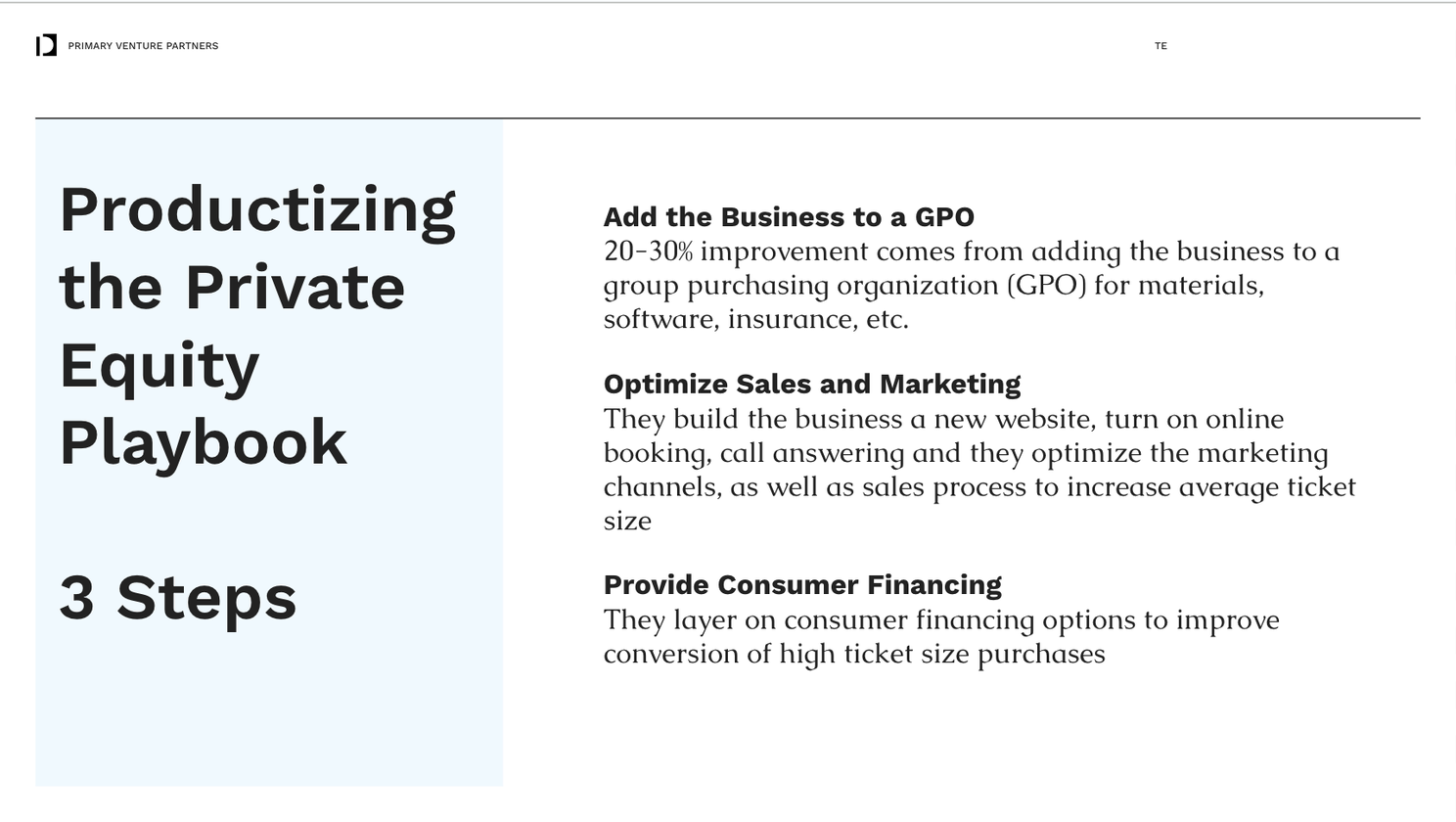

When we asked him what the playbook was, he said it was 3 clear buckets:

As he walked us through the process I had a giant smile on my face and he asked what was up.

I told him that we fundamentally believe the next generation of SMB Tech will be productizing everything he was talking about and that we’re investing heavily behind that thesis.

Last month, Gabi and I wrote about how we believe AI is unlocking the businesses that legacy SMB tech can’t acquire. While we see AI as a strong wedge to unlock growth, it’s what is on the other side of scale that gets us incredibly excited for the next generation of vertical SaaS companies. GPOs and Tech-Enabled Distributors or OEMs. For the sake of this post though, we’re going to focus on one - GPOs.

What is a GPO (Group Purchasing Organization)?

A Group Purchasing Organization (GPO) is an entity that helps businesses or organizations save money on products and services by leveraging the collective buying power of its members to obtain discounts from suppliers.

Examples of GPOs

Many types of GPOs exist, but industry specific GPOs are frequently used in markets such as healthcare, hospitality, and municipal purchasing, where organizations need to purchase large volumes of supplies regularly. They tend to be in markets where the supply side is incredibly concentrated, but can have significant value even in more fragmented markets.

Two Great Examples of this include:

Vizient (Healthcare)

Representing $130 billion of annual purchasing volume, Vizient is the nation's largest health care performance improvement company (fancy way of saying GPO), serving more than 50% of the nation's acute care providers, which includes 97% of the nation's academic medical centers, and more than 20% of ambulatory care providers. Vizient also provides expertise, analytics and advisory services.

Avendra (Hospitality)

Acquired by Aramark for $1.35 billion, Avendra was founded in 2001 by five hospitality leaders: Marriot, Hyatt, Fairmont Hotels, Club Corp and IHG. The company manages nearly $5 billion in annual purchasing spend and has over 16,500 customers including more than half of the Top 30 Hotel Chains as of their acquisition in 2017.

Why we believe everyone will become a GPO or Tech-Enabled Distributor

1. It provides immediate time to value for your customers

One study suggests that on average GPOs can save customers between 18-22%.

As I pointed out though, the PE firm is adding 20-30% by putting these businesses on a GPO. When you consider that many small businesses spend upwards of 30% on materials, insurance, software, etc, you’re talking about these owners being able to bring home an additional $20-30K for every $100K of EBITDA they already have with the click of a button.

That’s college tuition, a family vacation, a down payment for a second home or a new kitchen right there.

Vertical SaaS companies going after SMBs have a massive advantage in not only being able to build a GPO because of the data they likely have access to if they’re the core operating system, but they’ll be able to build a 10X better experience even if a company is already using one.

2. It increases TAM massively

Businesses are ultimately valued on their future cash flows. The total addressable market that makes up those future cash flows includes the gross profit pool you are ultimately going after.

When I think about how manufacturers and distributors like US Foods, Watsco, Ferguson, Saint Gobain are worth $10-40 billion - I think about how their margin is our opportunity BUT I also think about how a well executed SaaS company launching a GPO could help these businesses lower their sales and marketing costs, a large pool of spend you can dig into

3. GPOs strengthen moats including network effects and switching costs

The more end customers you have the more that suppliers and distributors will want to get access to them and the bigger the discount they’ll give you. The better the discount you get and the more embedded in the end customers ordering flow you are (which you likely can take over a lot of using AI), the less likely they will be to switch off you.

4. GPOs will improve retention

As your network effects get stronger and your switching costs go up, your net revenue retention will grow dramatically. Additionally, you’ll be so deeply entrenched in the day-to-day of a business that it will require something 10X better to get them to churn.

Add financing into the mix and the sky's the limit.

5. Rolling out a GPO unlocks your ability to spend more on customer acquisition and customer success

GPOs and those daring enough to become tech-enabled OEMs or distributors will see large increases in average revenue per customer.

Extending into the value chain can be lucrative with take rates from 0.5% to 3% of gross merchandise value (GMV). For those who successfully build a two-sided marketplace model that truly helps businesses lower sales and marketing costs, rewards are even greater, with a typical take rate of 3-15% on large GMVs, whereby you charge both sides of the market.

With higher net dollar retention and higher average revenue per customer, you can pile that back into growth and a better customer experience team. This can unlock additional go-to-market strategies including field sales.

Just how good can it be?

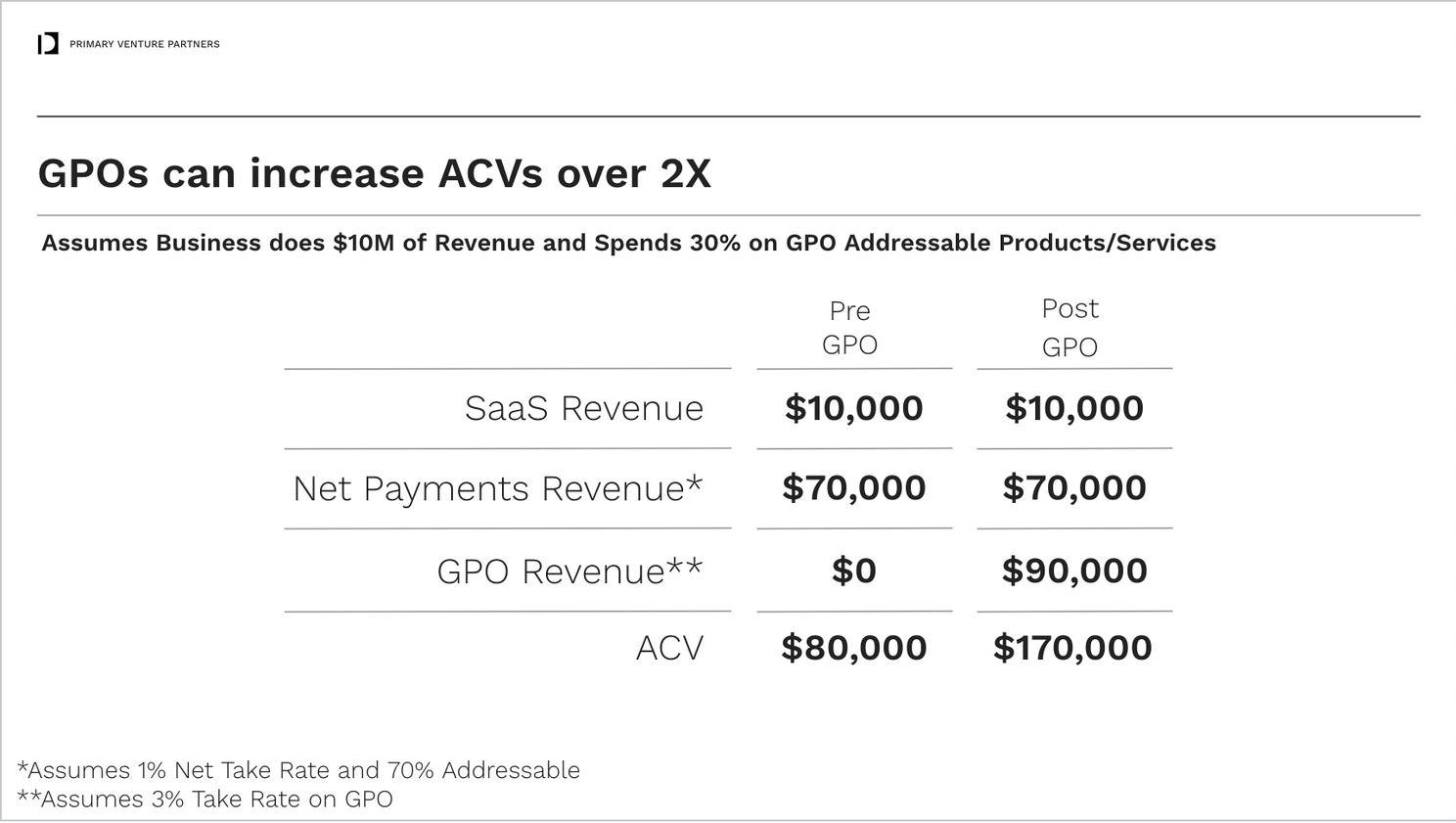

Let’s say an HVAC company is doing $10M of topline and spends 30% of revenue on materials, equaling $3M/yr.

Every market structure is different, but validating potential take rates and addressable spend is key

At a 3% take rate that’s $90K of additional revenue with minimal sales, marketing and CS expenses required.

That’s more than the total net take home of payments revenue that most VCs are excited about in an upside case depending on the percentage of transactions that flow through the business with credit cards.

This is why we got so excited aboutPly, a Primary portfolio company that helps mechanical, electrical and plumbing businesses manage their materials inventory better, automate procurement and save on materials spend.

For the very bold

In some markets we believe that it will be even better to get into manufacturing (e.g.Dandy- a Primary Portco) or distribution (e.g.Odeko- a Primary portco) eventually.

We believe that if you were to relaunch some of the largest OEMs and distributors of today, you'd want to build a vertical SaaS company first and then back your way into the manufacturing.

Why? Because the gross profit pools are massive and in some markets you'll not only be able to capture 5X+ gross profit per customer, but you might even have the opportunity to create 10X better products or cost structures leveraging advancements in manufacturing, robotics, etc.

If you're working on a vertical SaaS company looking to productize the PE playbook or vertically integrate one day, please reach out to us at Jason@primary.vc or Gabi@primary.vc.

Interested in more insights on vertical software, building companies and more? Subscribe to Change Order or check out some of our recent interviews with Ryan Serhant, Michael Rudin, and more.