Q4 NYC Seed Deals Show Promise

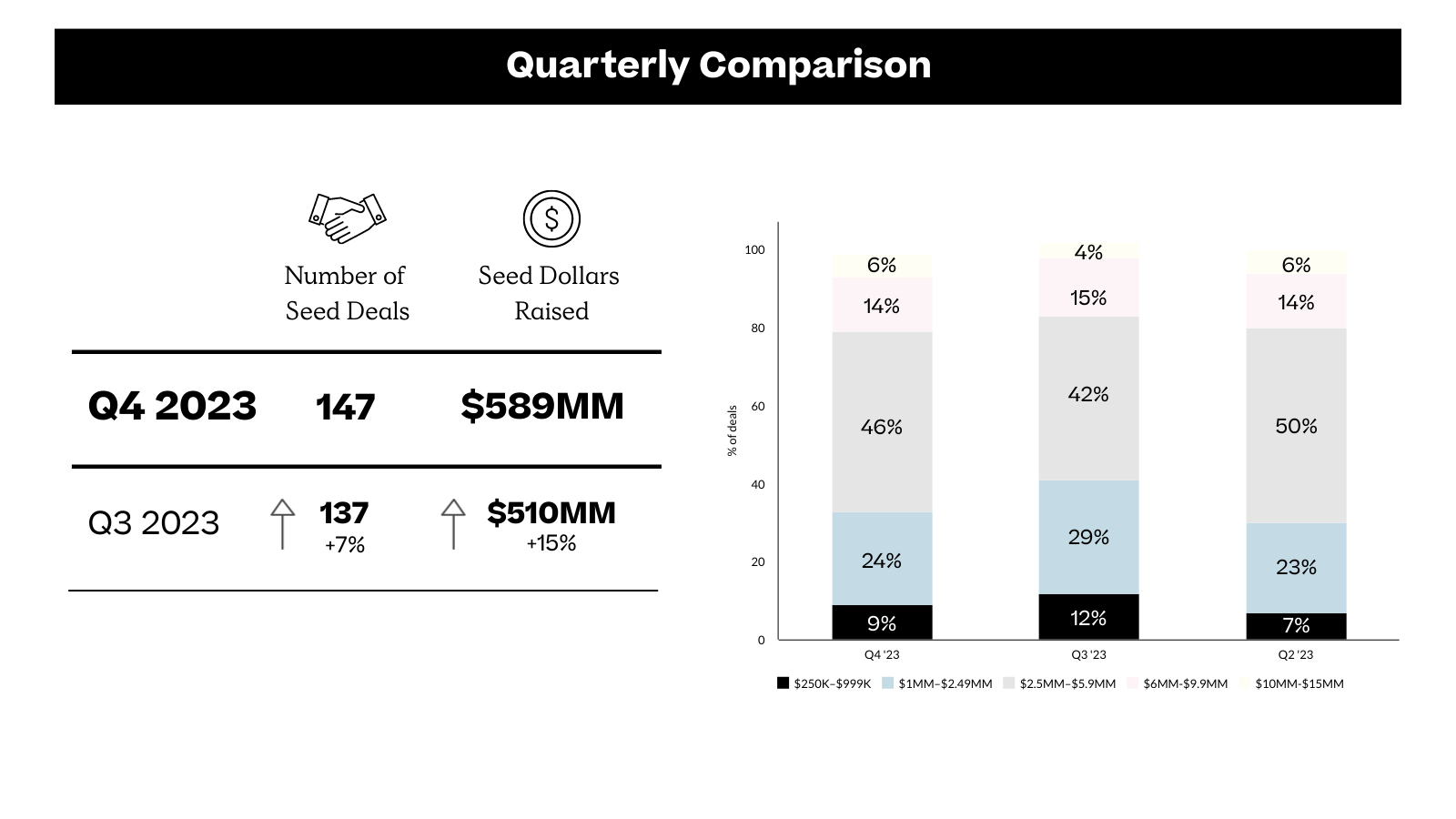

The total number of deals increased 7% this quarter, and the average amount raised grew by 15%. While the SaaS frenzy slows down, healthcare and AI show promising growth.

The total number of deals increased 7% last quarter, and the average amount raised grew by 15%. While the SaaS frenzy slows down, healthcare and AI show promising growth.

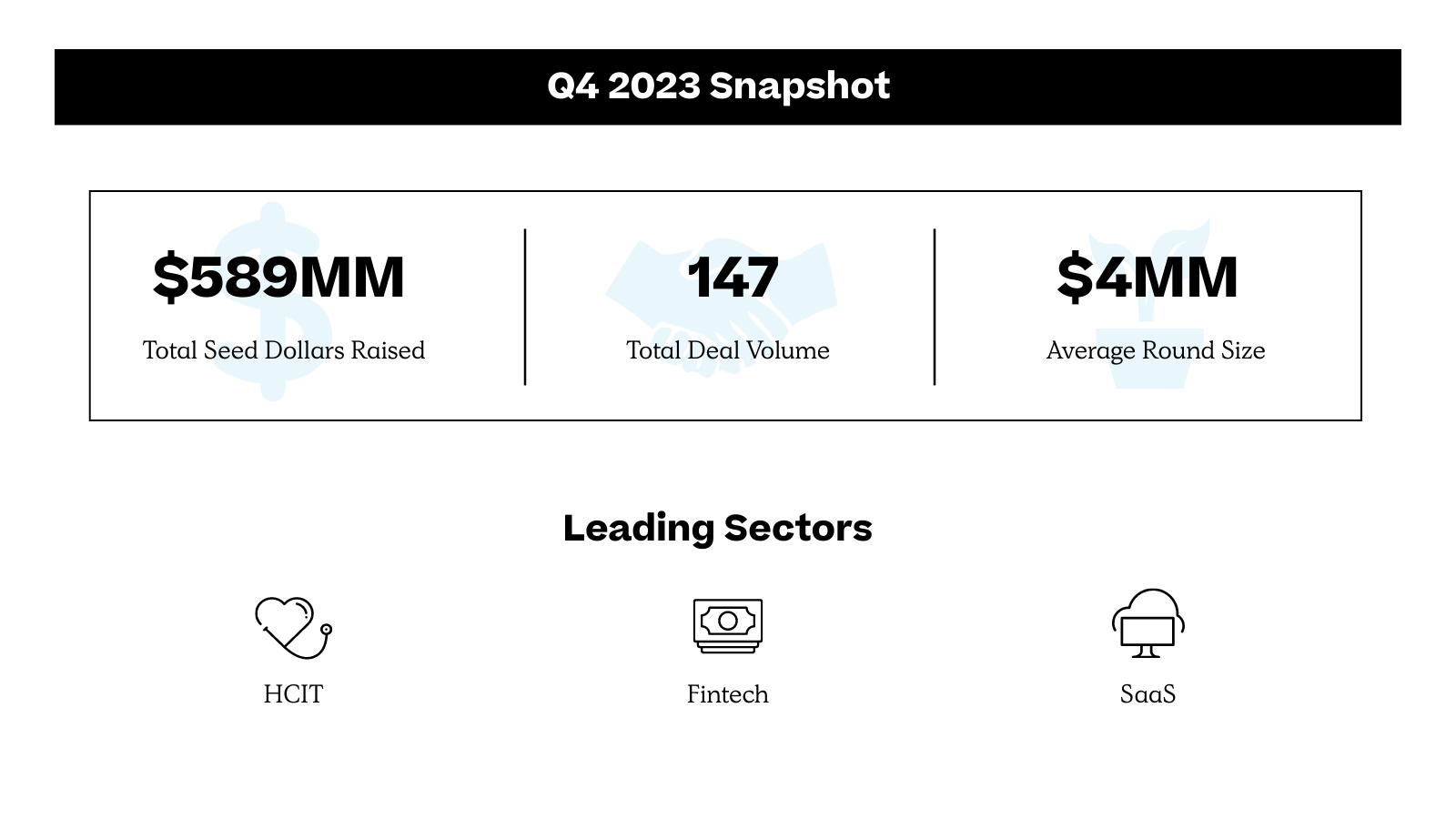

In New York City, Q4 brought promise for the local startup ecosystem. Quarter to quarter, we’re seeing more seed deals, increases in total investment dollars, and an uptick in average round size. Year over year from Q4 2022, we’re seeing double-digit percentage growth across all three categories.

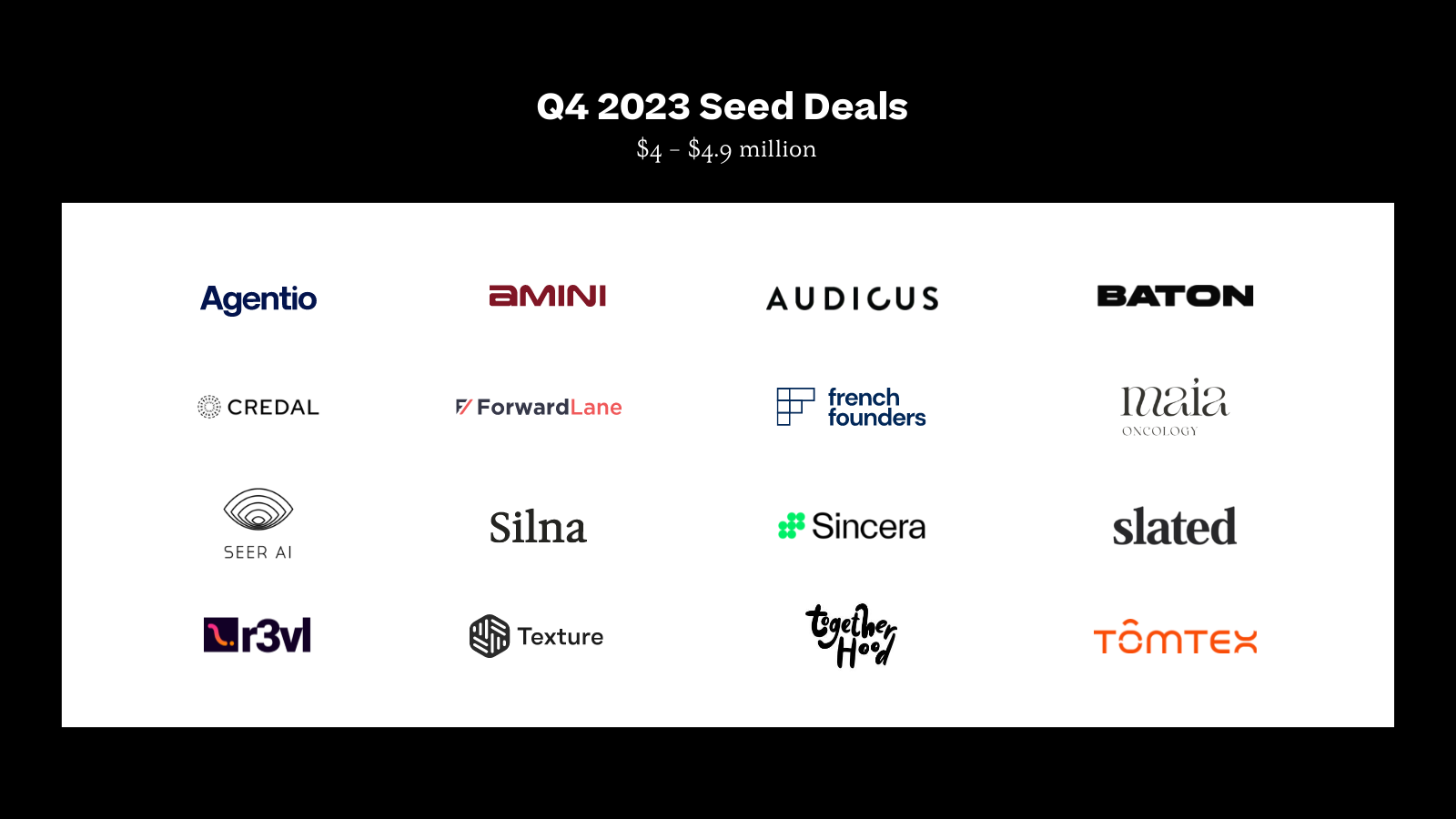

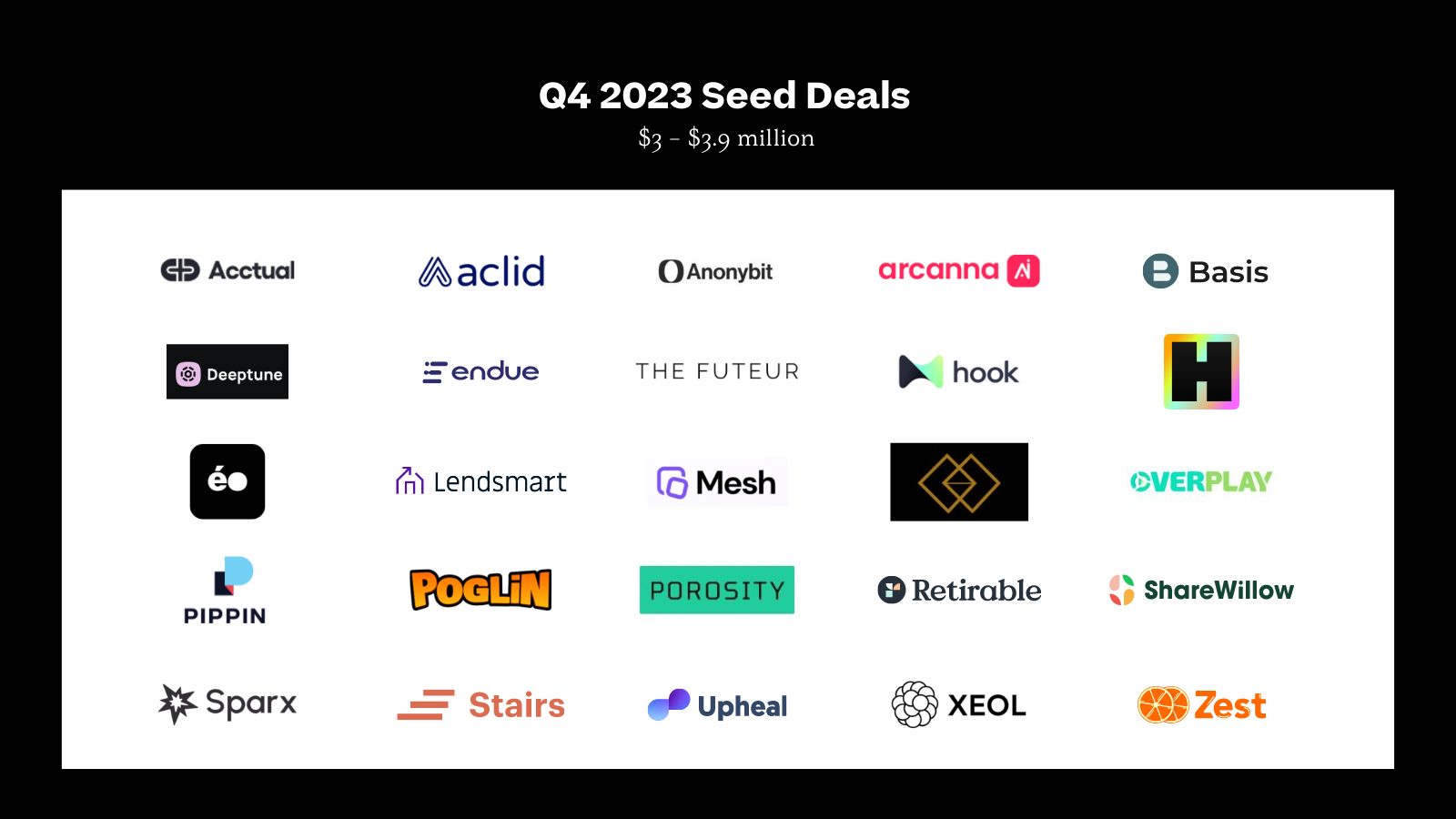

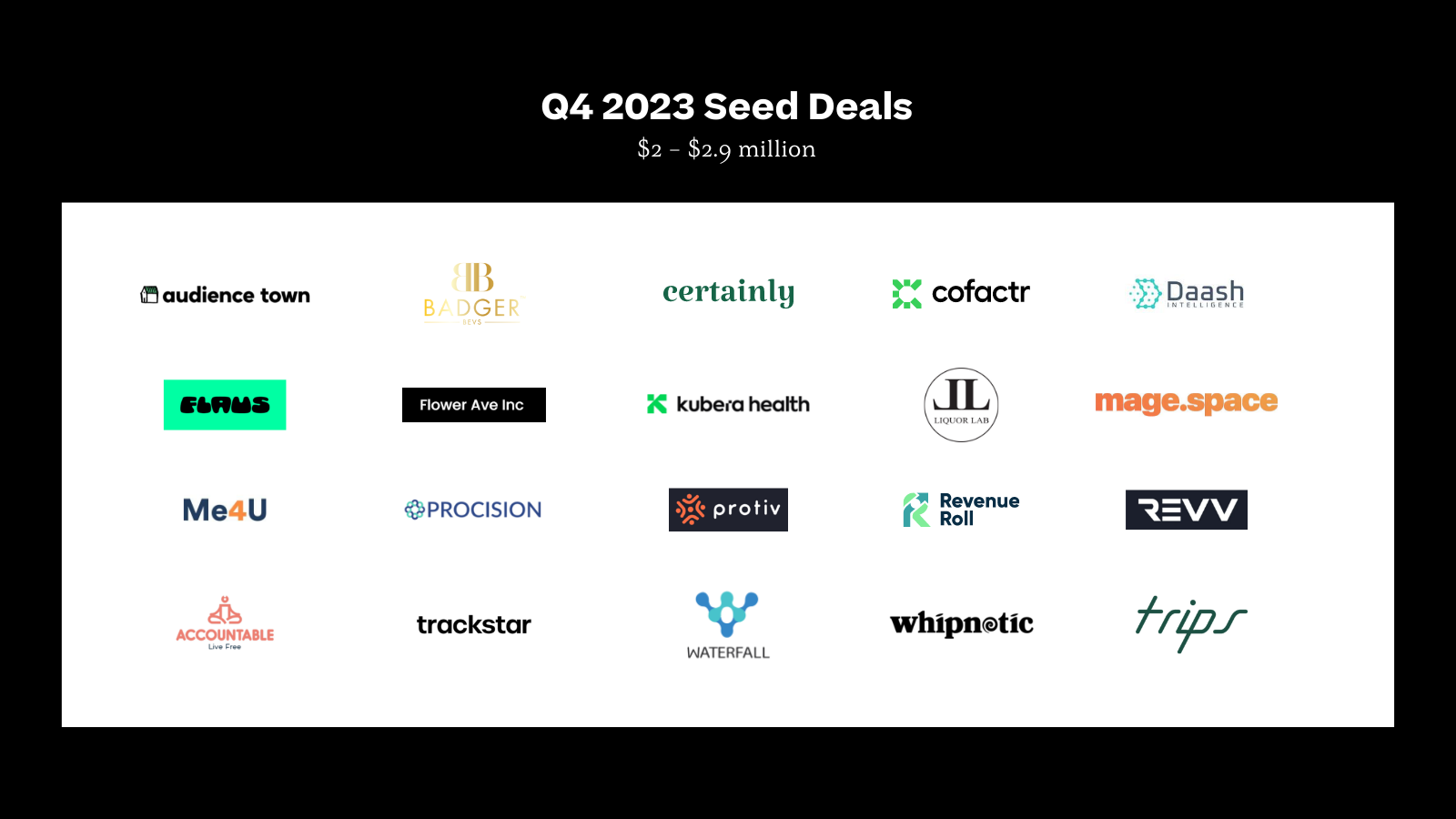

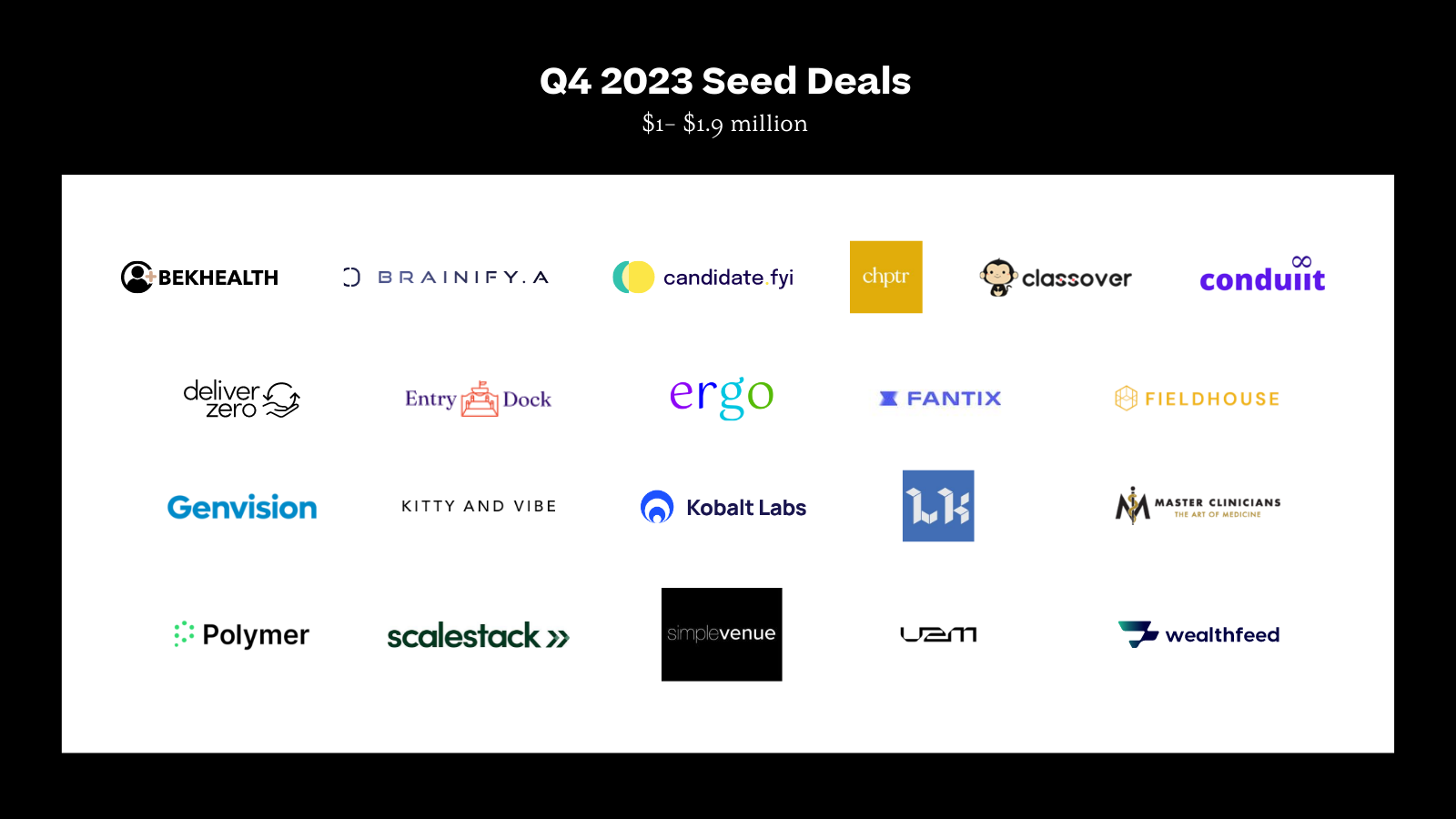

NYC seed deal volume, at 147 total, increased by 7% compared to Q3, and the average amount raised, $4 million, increased by 16%. We know Q4 is typically big for fundraising, and that showed with total funding raised increasing by 15%.

This quarter, we saw our main funding categories live in HCIT, AI, and SaaS. HCIT makes up 20% of startups invested, up to 29 from 19 in Q3. We also see AI more than double in total count, up to 17 investments from 5 in Q3. Overall, SaaS saw a slowdown in the fundraising frenzy. SaaS deals are up in sector representation this quarter, but down in total number of companies to 20 from 28 in Q3. SaaS deal sizes remained high, however, with 72 million total investment dollars in the sector, while only representing 14% of total deals.

Here are the sector-specific trends our team spotted in this quarter’s fundraises:

The positive momentum we observed in Q3 shows no signs of letting up, with an increasing number of companies dedicated to liberating healthcare providers' precious time. In the realm of industry-level platforms striving to alleviate administrative burdens, several companies have distinguished themselves by adding value through targeting specialties or specific facets of a clinician's workflow. What is particularly interesting about this quarter’s companies is that it speaks to the software transformation we expect to continue to see in non-hospital (traditional large enterprise) settings. These companies specifically target infusion centers, ASCs and independent practices - and we expect there will more to come in the coming quarters. Enter Endue, securing $3M in funding to enhance the efficiency of infusion centers through operations management, spanning from patient intake and scheduling to inventory oversight. Meanwhile, Procision, which raised $2.5M back in December, is making waves by streamlining workflows for ambulatory surgery centers to offer better patient care through the automation of scheduling, pre-operation management, and billing processes. Lastly, Silna, fueled by its recent $5M raise, is on a mission to expedite patient clearances by managing prior authorizations, benefits, and eligibility checks for physicians. While its concentration is on a few clinician types, Silna is strategically honing in on a pivotal point in the provider workflow, aiming to significantly increase bandwidth. It will be interesting to see how each of these companies continues to help providers increase their quality of care.

The last five years have been plagued by multiple global supply chain shocks (global pandemics, clogged canals, ground wars, etc). To build more durable supply chains, companies need to diversify their supplier and transportation provider networks. To do that, they will need better ways to find and connect with new vendors. We see companies making it easier to connect with new vendors via supply chain specific infrastructure technology. Trackstar raised a seed round led by TMV after coming out of YC and is building a universal API for Warehouse Management Systems (WMS). Their product should alleviate the burden of connecting to new warehouse and fulfillment vendors and make it easier for other applications to build on top of WMS data. We also continue to see B2B marketplaces and SaaS platforms that make it easier to find and discover new suppliers in specific verticals. We are very familiar with this model, having previously backed Ply in the building materials space and Odeko in the coffee industry. Cofactr raised $9M and helps electronics manufacturers plan and source the procurement of electronics parts from global suppliers. We expect to see a lot more companies pursuing vendor diversification and supply chain interoperability in 2024.

Despite all the hype around AI, enterprises are still slow to adopt – although many are experimenting with AI, very few are productionalizing AI projects. One of the core reasons for this is concerns over security of AI tools and apps. Last quarter, we saw security tools raise capital across the tech stack to combat this problem. Credal, which raised $4.8M from Drive Capital, Spark Capital, and Pioneer Fund, is enabling secure AI use through their APIs and custom copilots, enforcing access and security controls. With more third party and open source AI tools, vulnerabilities, licensing and maintainability of software has become more cumbersome. Xeol, which raised $3.2M from Shield Capital, secures code at rest, visualizing vulnerabilities of your software supply chain. These solutions are empowering developer teams with shift-left tools to ensure security across the AI stack.

Generative AI has unlocked significant new capabilities for content creators; allowing them to make content faster, expand the reach of their content, and engage with their audience in more personalized ways. Companies like Hook Music, which raised a $3m seed round led by Point 72, leverage genAI to enable creators to make new music through simple text prompts. Other startups like Deeptune ($3m seed round led by Seven Seven Six) vastly expands the reach of creators by using genAI to dub content in every language and distribute that dubbed content to millions of new fans. Finally, companies like Me4U ($2.5m seed round) allow AI characters of influencers and celebrities to engage in intimate, one-on-one conversations with fans. Content creators have an unparalleled opportunity to leverage next-gen creator tools to supercharge their platform and find new and exciting avenues for monetization.

As the shift towards open banking gains momentum in the US following the launch of 1033, the demand for seamless financial data connectivity across systems is reemerging. The last quarter offered a sneak peek into the future, featuring the emergence of Necto ($8M from Nyca partners) —a multi-bank aggregator that connects data from financial institutions directly into the software businesses use for treasury operations. Others are stepping up to provide the essential infrastructure for open banking to flourish. PrismData ($5M from Obvious Ventures) utilizes historical financial data to generate key insights into consumer credit risk, fraud detection, and insurance. The stage is set, and we're eagerly anticipating how these teams will capitalize on this dynamic shift towards open banking, reshaping the financial landscape for the better.