Still Riding High: NYC Seed Deals Remain at Record Volume and Round Sizes Q3

Our Q2 NYC Seed Report shattered records, but Q3 showed no signs of slowing. In fact, the checks are getting on average larger.

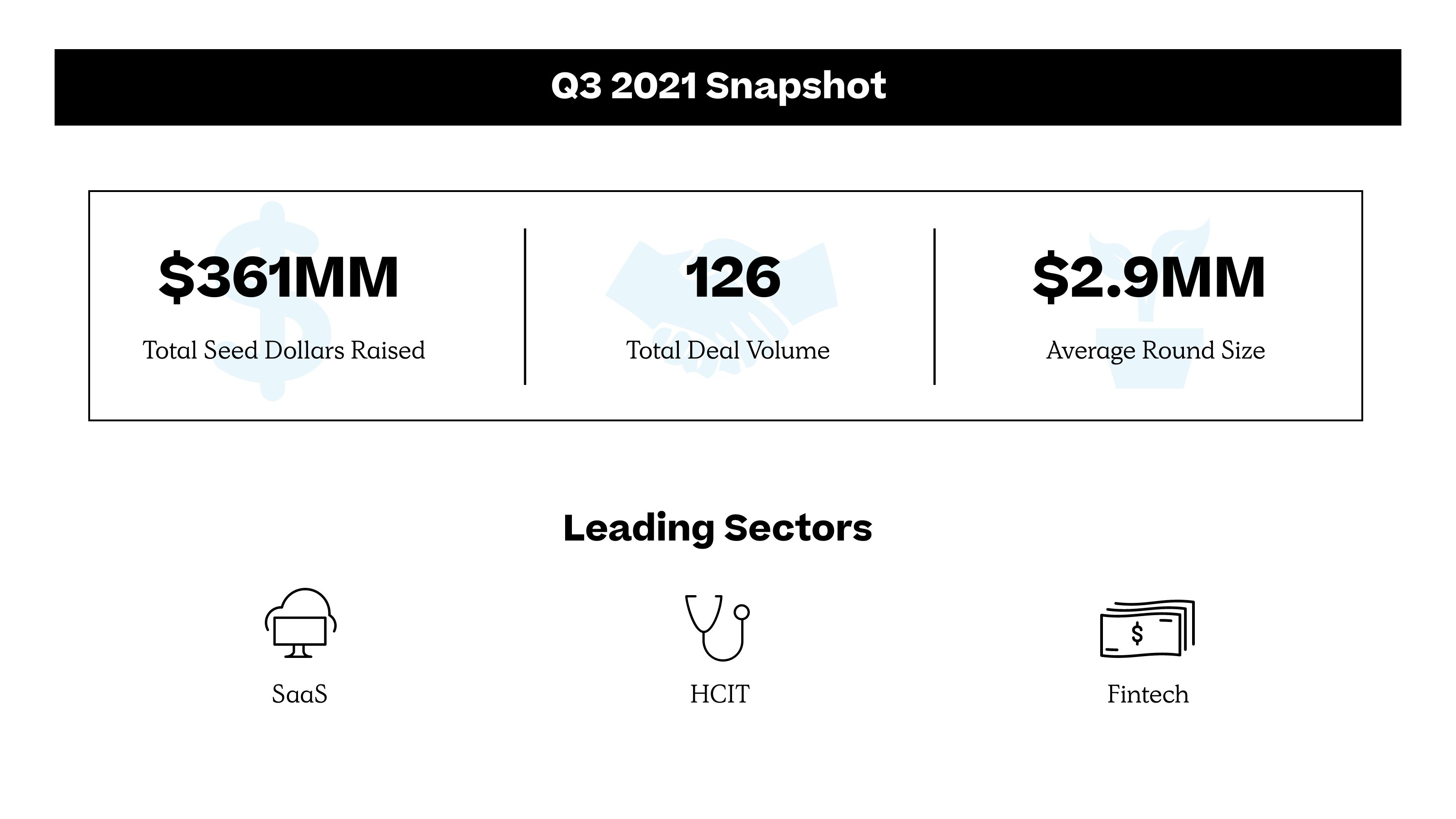

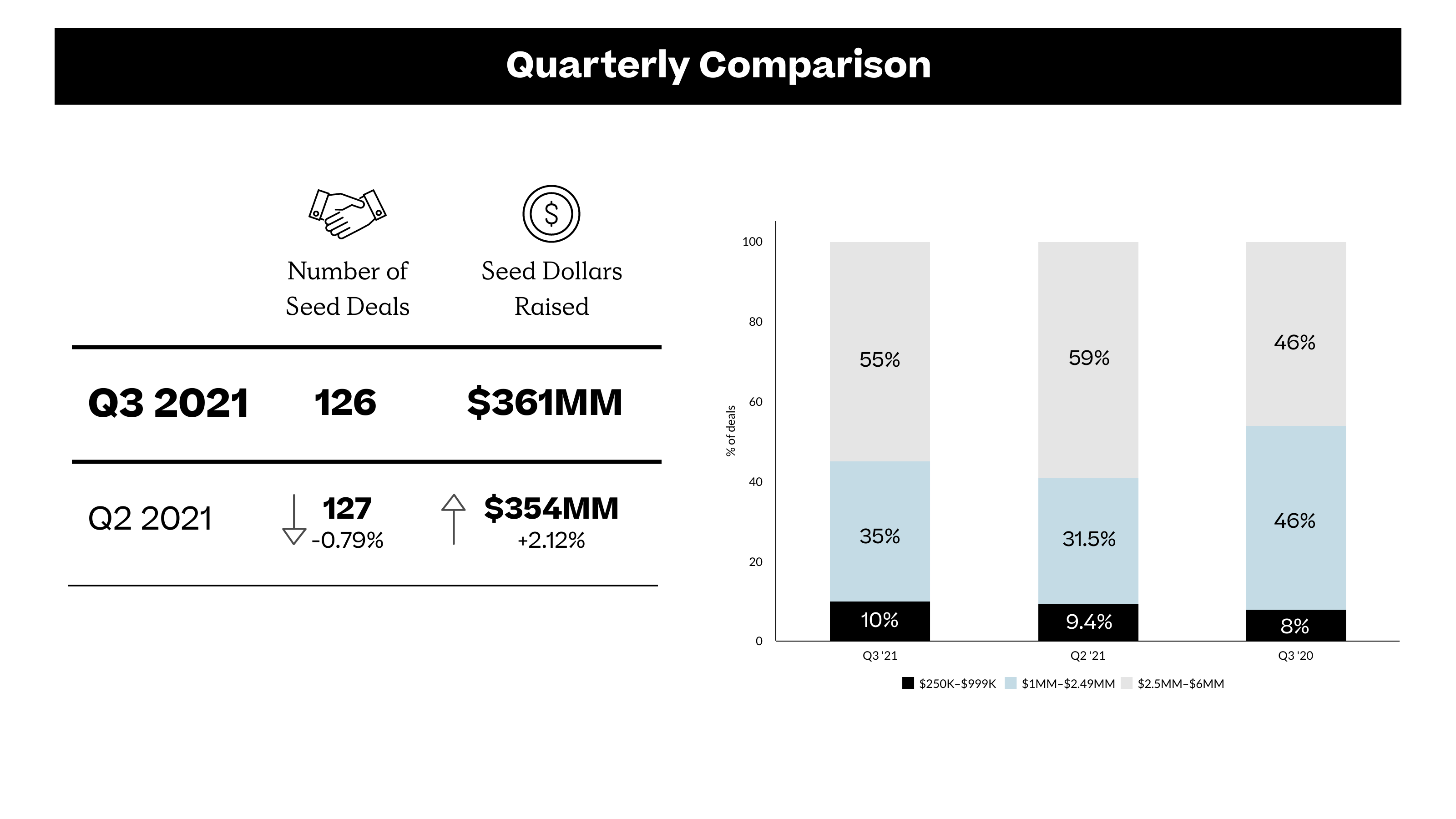

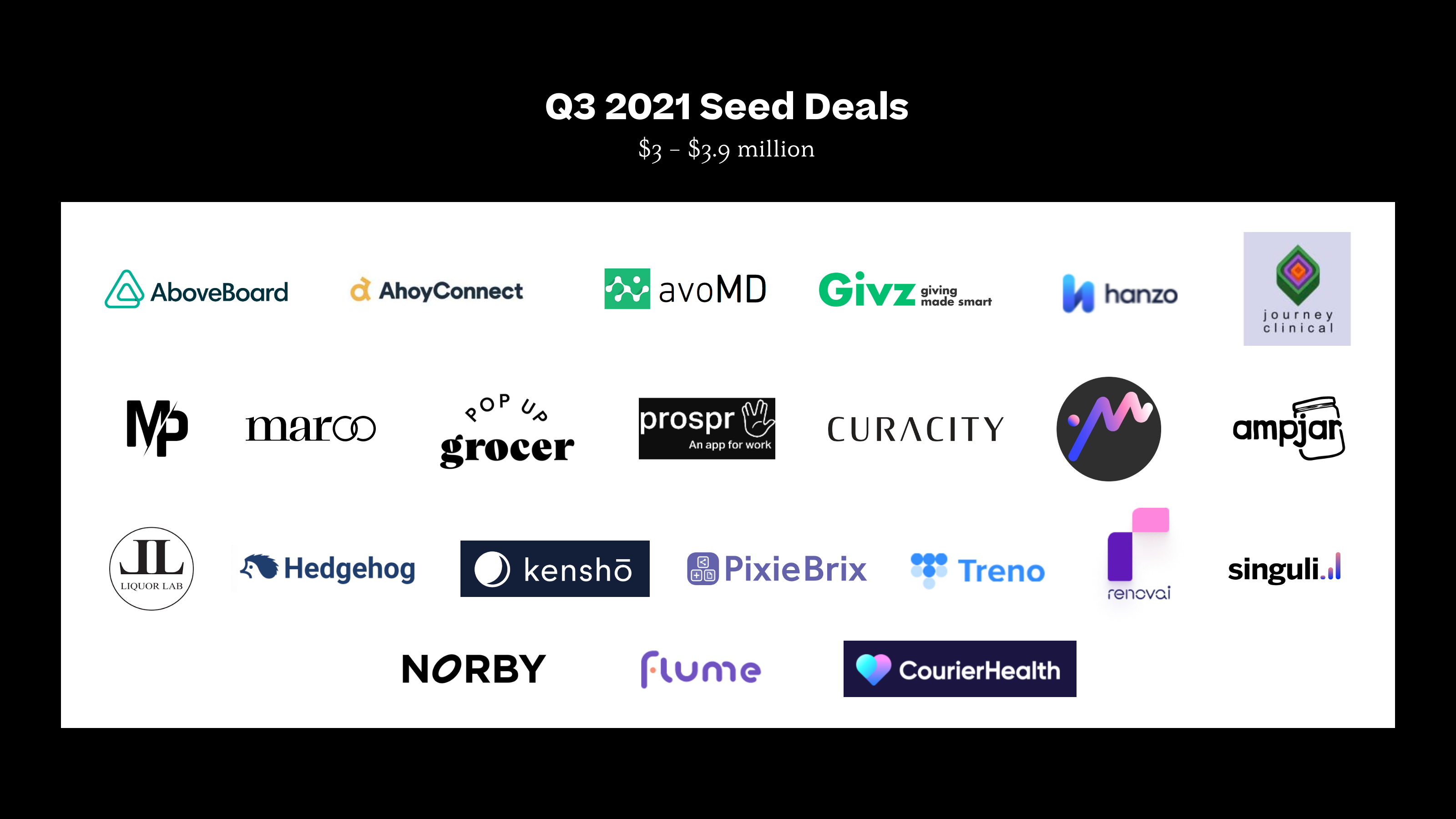

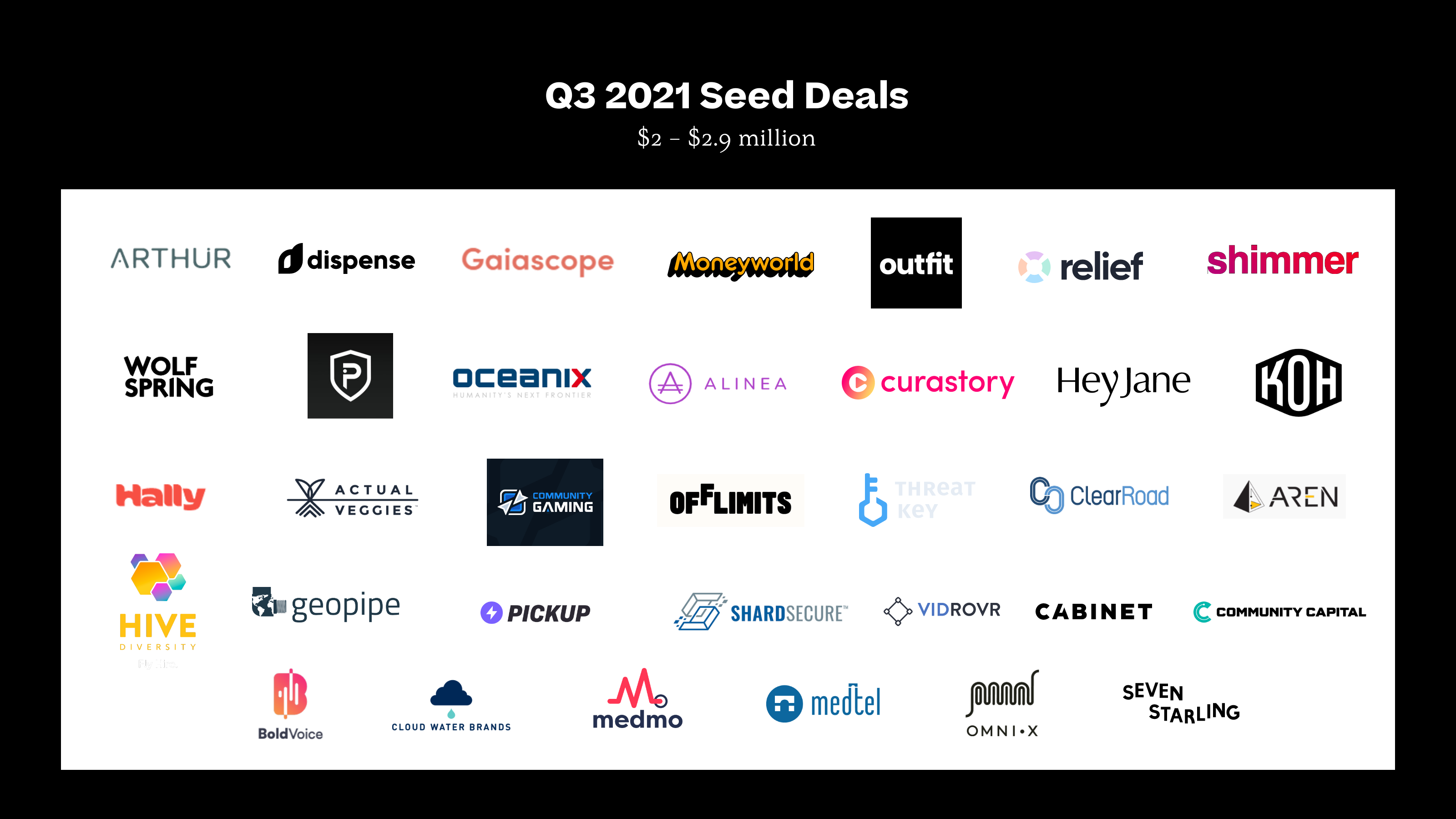

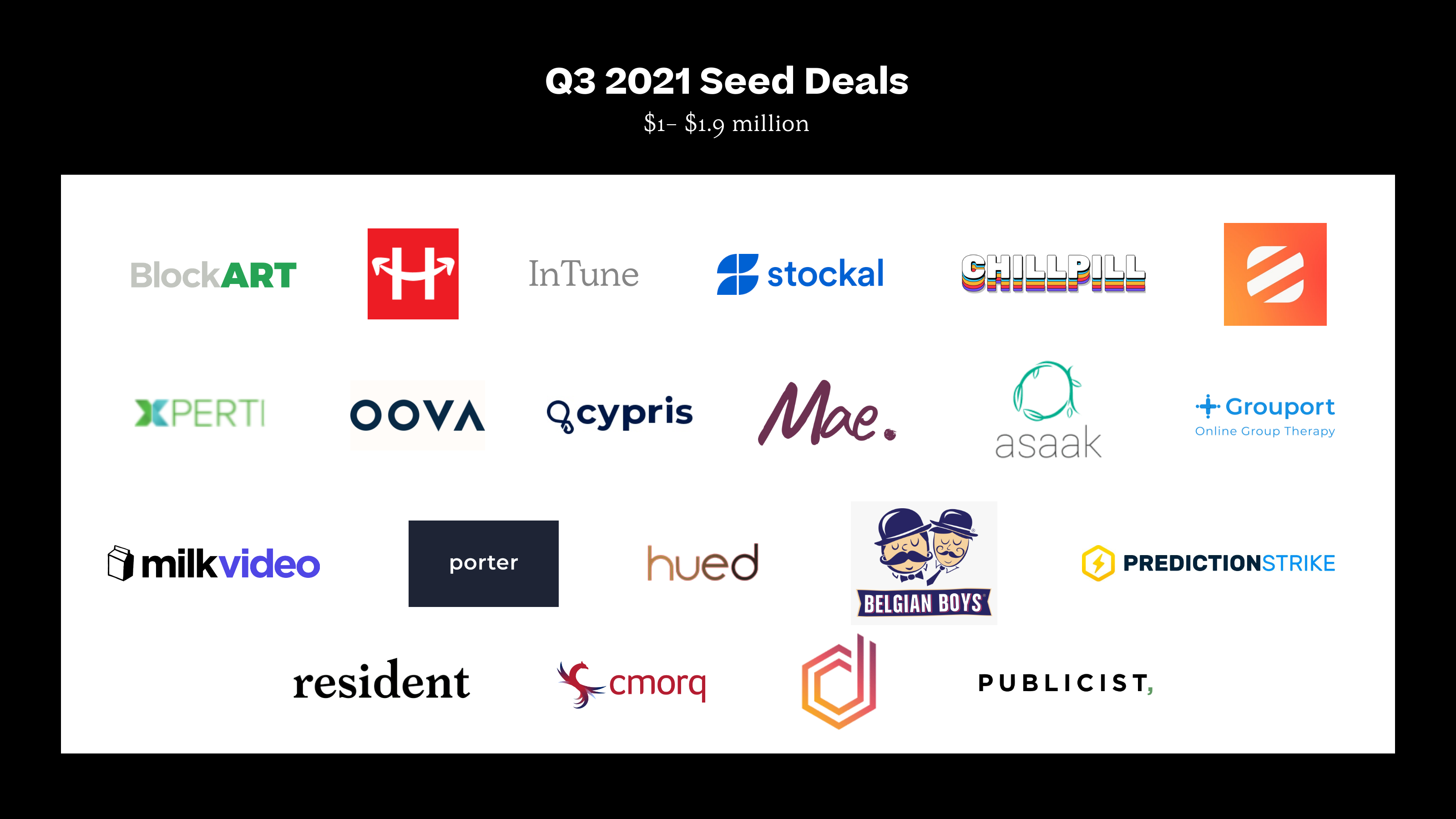

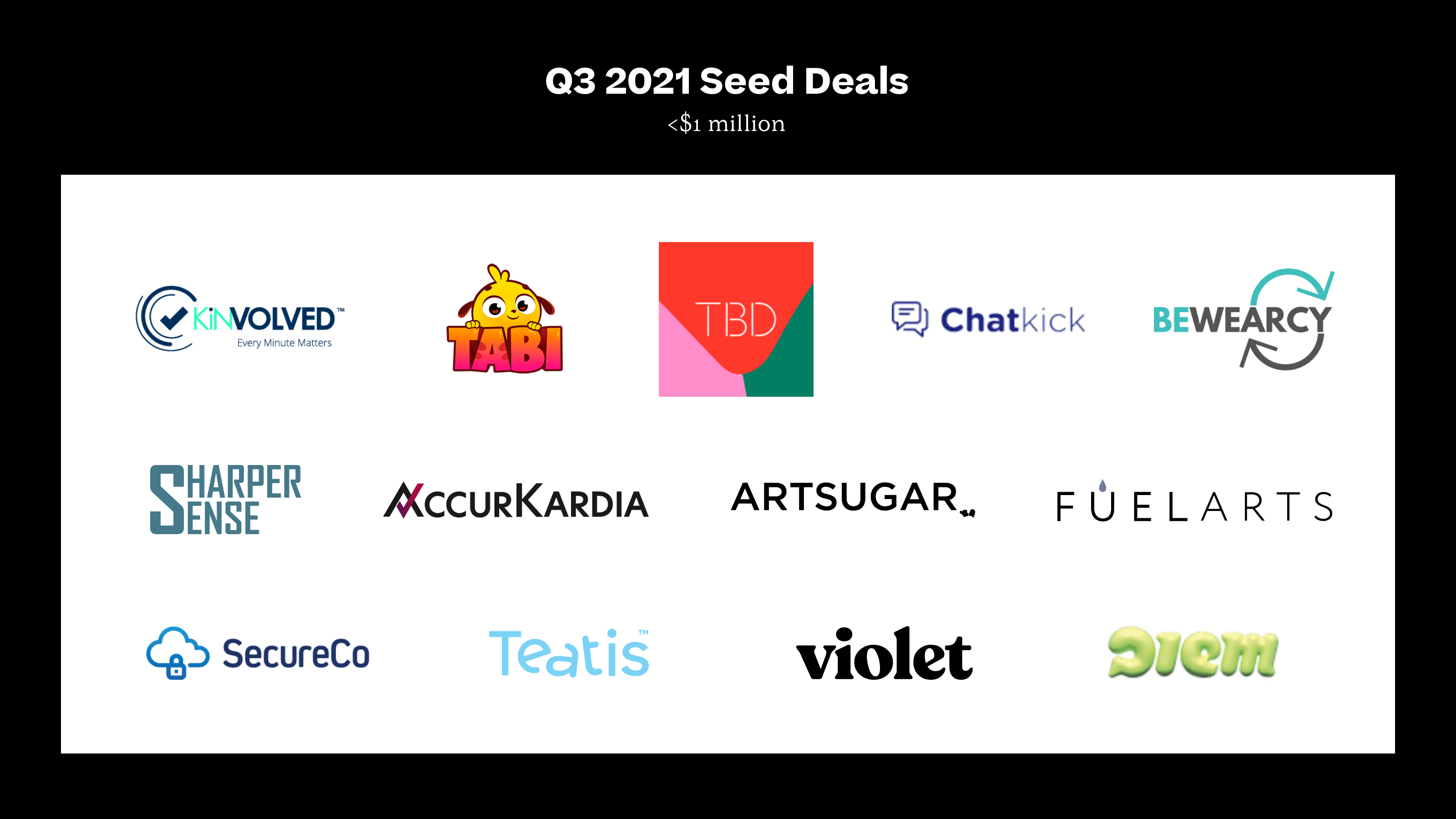

When we crunched the numbers for spring 2021’s Quarterly Seed Report, we did a double take: 127 seed deals, blowing past NYC records out of the water. But maybe that’s just the new normal. Over the course of Q3, we saw that rate of investment hold pretty steady: 126 seed deals. This quarter’s average seed round size even went up (just a bit, by 3%) to $2.9 million.

This reflects larger trends; Q1 2021 marked the first time global venture funding exceeded $100 billion in a single quarter, then Q2 saw $159 billion invested, Q3 kept it going with $160 billion. But while Crunchbase sees seed-stage funding up year-over-year by 47%, globally the number of deals dropped 20% between Q2 and Q3. A sharp contrast to the continued activity here in New York.

We’ve also seen New York City’s ascendance more qualitatively, whether in former YC president Sam Altman tweeting “Feels like every fourth bay area tech person I talk to is moving to New York,” or about a dozen California firms setting up new outposts here. The more the merrier.

So hopefully our quarterly tradition of rounding up high-level NYC seed stats and offering our team’s takes on a few specific trends will be helpful to an even wider community of founders and investors looking to build here. Read on and let us know if you have thoughts or want to make introductions.

Psychedelic treatment (Journey Clinical), abortion care (HeyJane) and Gen Z women’s mental health (ChillPill) all got more attention last quarter to the tune of $6.22M in funding combined. With MAPS’ psychedelic clinical trial results and Texas’ abortion laws hitting the mainstream media, some investors are beginning to play in markets that have historically been looked at as taboo for the investment community.

Traditionally, our cousin to the north has been the center of all things Biotech. Although Boston continues to hold the top spot, New York has seen a large increase in biotech company formation in the past quarter and we are excited to see this innovation in the city. Some of these businesses include: Evvy, an at-home vaginal microbiome test, Redesign Science, a platform focused on helping new drug discovery, and BioSymetrics, a developer of a biomedical artificial intelligence platform designed to provide better disease understanding and more personalized drugs. Given New York deep’s pharmaceutical ties, it was only a matter of time until we got a dose of the action, and we’re excited to see more in the future.

Decentralization across consumer platforms is becoming increasingly more common, and it’s awesome to see NYC becoming the clear epicenter for web3 and Defi. We’re certainly still in the early innings, but blockchain funding is expected to reach $14B this year, shattering the last big wave of 2018’s $4B in funding. Among them, some early stage companies include: Hedgehog, a platform that helps people create a stronger crypto portfolio, Unlock, an access control protocol that helps creators unlock ownership of their communities, and SZNS, a platform that helps curate and fractionalize NFTs.

An emerging trend across edtech is that fundraising looks like a “barbell” across the age spectrum. There is a lot of focus on young populations (early education) and older populations (continuing education). This quarter was no exception. Tabi Land, an educational app for young children, raised a $250K pre-seed, while Kinvolved, a platform to improve student engagement in the classroom, brought its total seed funding to $4.7M. On the other end of the spectrum, Medley, a group-based membership for working professionals, raised a $4.9M seed. BoldVoice, a tool to help non-native English speakers improve their accents, raised a $2.6M seed. For both younger children and post-grad professionals, we are seeing innovative new products and solutions across both consumer and B2B, as demonstrated by these four companies.

This past quarter featured the most definitive IPCC report the world has ever seen. COP26 is just around the corner and these startups are constantly reminding us that this is a critical moment to accelerate action and raise ambition to save our planet. Shimmer Industries raised $2M to shine a light on commercial scale automated energy code compliance. The company's application consists of code written to visualize, animate, and control LEDs. Gaiascope raised $2M to make the electrical grid easier to understand, valuing transparency over 'black boxes.’ Arthur Mining raised $2M to provide cheap and sustainable crypto mining. This is particularly relevant in New York where cheap energy persists. Arthur’s aim is to provide clients with efficient, profitable, and carbon offsetting mining operations. And last but not least, if you haven’t had a chance to visit the Little Island on the Hudson, Oceanix raised $2.1M to design and build floating cities for people to live on the ocean.

Bringing like-minded people together was always a mighty tool, but after 18 months of physical distancing, humans are craving social interaction more than ever before. Businesses have increasingly been inclined to invest into their community development—interestingly, the benefit to community building isn’t about augmenting brand love but rather improving customer success. Over the past year, we’ve seen capital being poured into platforms that improve communities, but this last quarter had some standouts. Norby is combining link-in-bio service, referral tracking, SMS, and other platforms into a single offering in order to manage online communities. Ampjar is creating a curated community of brands who share similar messaging to allow brands to reach new customers and customers to discover more brands. Then there’s AhoyConnect, a platform that helps manage online audiences and add value through a more granular deep dive into each member’s engagement.

Primary’s quarterly Seed Reports are created with data from Crunchbase, PitchBook, and our own knowledge of deals. Were there deals we missed? Are you getting ready to do your own early-stage fundraise? Feel free to get in touch with one of the team members linked above.