Why Transportation Management Systems Are Due for a GenAI-Fueled Unbundling

Brad Svrluga and Zach Fredericks on why this category of supply chain innovation holds venture-scale promise.

Subscribe to future editions of the Supply Chain newsletter here.

We’re back for a second edition! Last time, we outlined the Opportunities We See in Supply Chain Tech at a very high level. Over the next four issues, we plan to dive into each of the four high level challenge areas we discussed.

We are kicking that off with a look at the ways we expect application software and AI will make it easier to manage increasingly complex supply chains. We’ll spend most of this piece looking into companies building applications on top of the Transportation Management System (TMS), the core system underlying logistics orgs. The TMS has done a great job of accelerating the availability of supply chain data, but has become clunky as users have demanded more and more custom functionality. Despite their relative success in bringing supply chain orgs into the digital era, the TMS hasn’t actually done much to drive true automation. At the same time, we know that companies are constantly trying to automate more of their supply chain operations, and we believe that will lead to the adoption of new applications on top of the TMS that drive further automation.

After years of investing in healthcare and fintech, we see some parallels in this story. Companies like Epic Systems in healthcare and FIS in banking were just the first entrants in what would become much more robust software ecosystems. Like the TMS, these companies made it much easier to structure data, but ultimately still left their customers with mountains of manual work.

A very brief history of the TMS

How did we get here? In the early days (~1980s), TMS pioneers like Manhattan Associates and RedPrairie (now part of JDA Software) laid the foundation with rudimentary systems primarily focused on route planning and load optimization. However, a lack of standardization made it challenging for these early TMS platforms to communicate and integrate with other software or hardware. Given that supply chain is all about cross-company collaborations, this was a big issue. In the 1990s, leading players such as Oracle Transportation Management and Descartes Systems Group integrated TMS with Electronic Data Interchange (EDI) systems, improving communication with carriers and suppliers. EDI integration via professional services became a huge part of the TMS business and customization, rather than cloud adoptions, became the status quo in industry. In the 2000s, MercuryGate, Kuebix (now part of Trimble), and 3Gtms spearheaded the expansion of TMS with the introduction of cloud-based solutions, offering greater accessibility and scalability. Still, the lack of unified standards continued to hinder seamless data integration.

The TMS alone can’t meet the demand for more supply chain automation

To summarize the above, we don’t think the TMS has evolved into a flexible enough platform to support modern supply chain needs. Conversations with supply chain leaders at Amazon, Walmart, Nike, etc have convinced us that companies are prioritizing supply chain diversification. This is true especially in the wake of the pandemic and subsequent geopolitical shocks. This McKinsey report shows that most Fortune 500 Chief Supply Chain Officers are focusing on dual sourcing strategies, regionalization, and more supply chain visibility. Conversations we have with supply chain leaders overwhelmingly validate these concerns. We know they are trying to diversify their networks, but we think it’s going to be really hard for them to do that at scale. The pre-covid equilibrium in America’s supply chain was characterized by a collection of mostly large enterprises working through intermediaries to access SMB capacity or just avoided them. Diversification means working with more and more vendors, which ultimately leads to operational complexity. As a result, diversification strategies lead to higher transaction costs, more perceived risk, and thus frequently get put on the back burner.

One would think software would have already solved a lot of these complexities. Many turn to the TMS for answers. We think that the TMSs have been great for keeping a digital record of supply chain data, but have only skimmed the surface of what can be done to automate workflows related to supply chain management. Like EMRs and cores in healthcare and fintech, they have been asked to do too much. As supply chain complexity increases, demand for more workflow automation has too, and legacy TMS players can’t keep up without customizing their solutions. With the existing TMS platforms, true interoperability and automation demands customization and professional service support. That’s a pretty slow and expensive status quo. Looking at the gross margin profiles of legacy TMSs, it’s pretty clear that professional services is a big part of their business: E2Open has 51% gross margin, Manhattan Associates has 53%, Trimble at 60%, the list goes on.

We look at the legacy TMS professional service revenue as an opportunity for better software. There’s a growing number of entrepreneurs in this space who would agree and only a few of them are tackling that opportunity by building a next-gen TMS (Mastery, Rose Rocket, ShipperGuide, and Alvys are some good examples of more modern TMS platforms). The TMS is an extremely capital intensive product to bring to market – Mastery and Alvys were both self funded by their founders and early customers for years before they were able to go to market. The TMS is also hard to sell. At the enterprise level, it usually involves a rip and replace job and at the SMB end, the juice is rarely worth the squeeze. So instead, most founders in this space are taking a stab at providing better versions of single feature workflows within the TMS.

The unbundling of the TMS

We believe that the next generation of technology in this space willunbundlefeatures within the TMS to introduce specific workflows that enable automation. We view this evolution of supply chain software as very similar to the unbundling of the EMR in healthcare. There are countless companies doing this in TMS land today, but many have struggled to reach venture scale due to business models that 1) have subscale TAMs, 2) exposure to freight market volatility, and 3) heavy reliance on data integrations with on-premises systems. In the remainder of this post, we’ll outline how companies are attempting to unbundle the TMS and how generative AI will impact the scaling challenges those companies have faced to date.

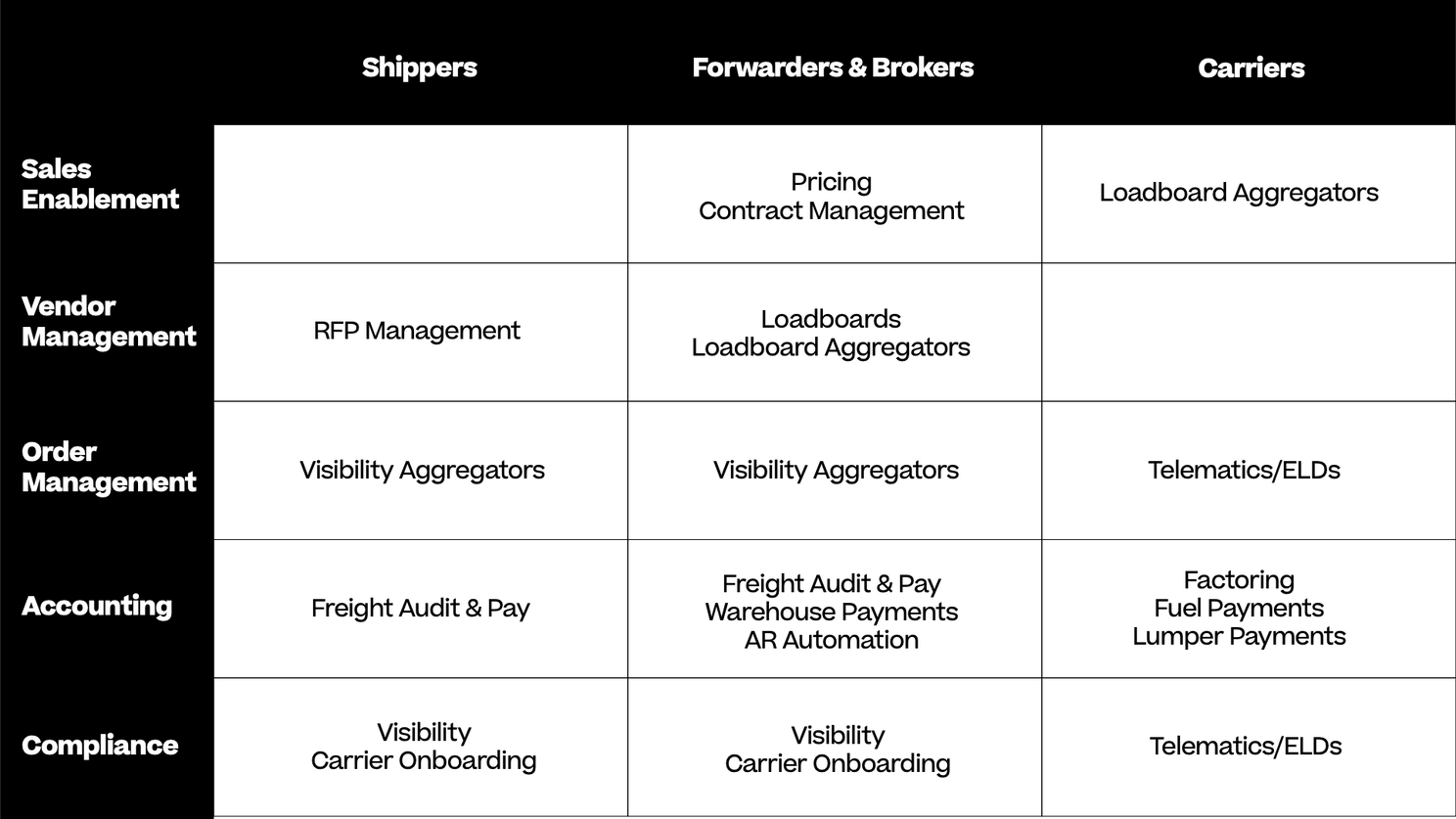

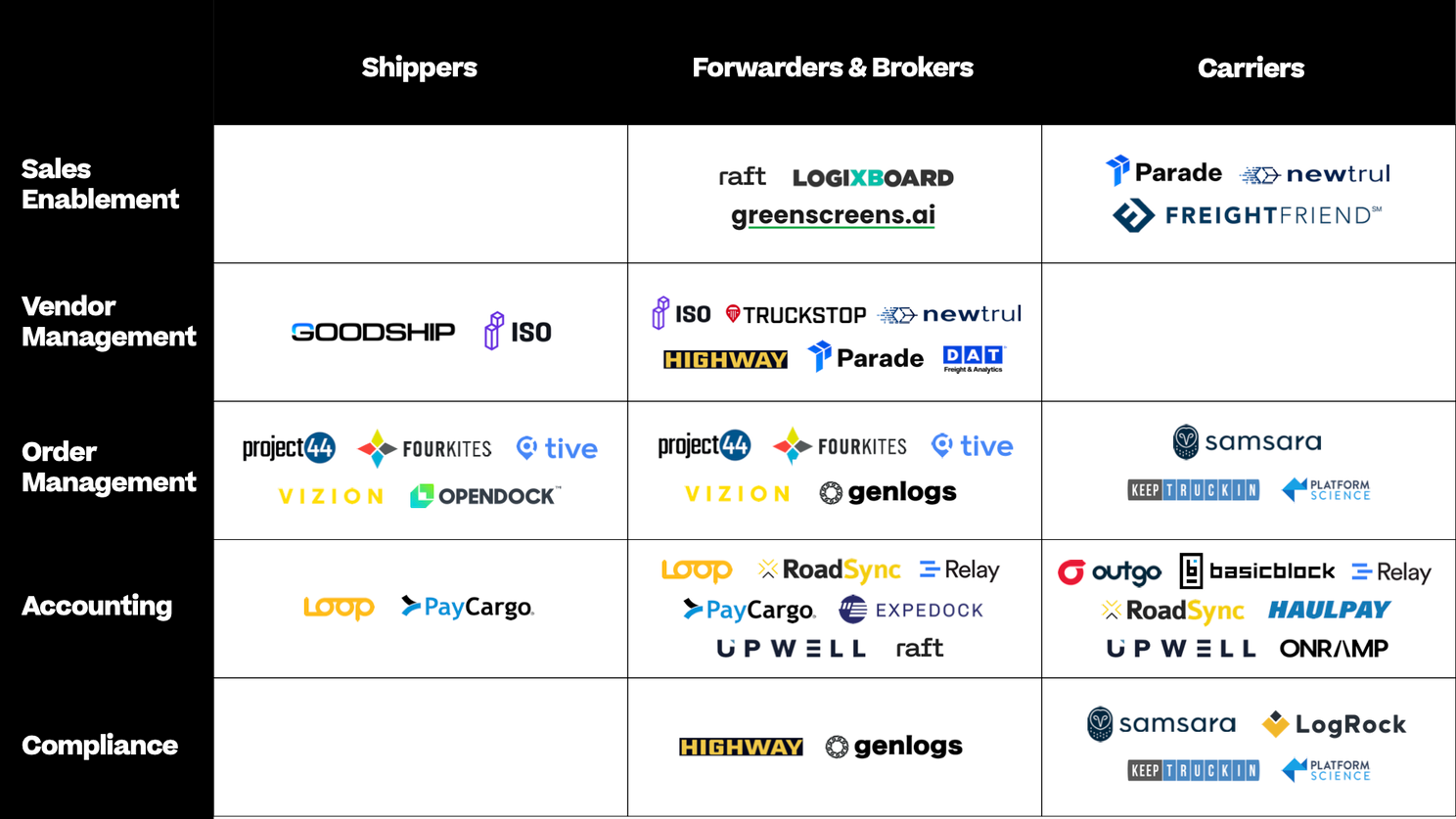

There are usually different TMS products for different participants in the supply chain. Shippers, forwarders, brokers, and carriers all have TMSs that were built specifically for them. The TMS also gets used for a lot of functions within the supply chain org. Sales uses it to interact with customers, procurement uses it to interact with carriers, accounting uses it, ops uses it, compliance uses it, and so on. Software companies entering the freight tech ecosystem today usually pick one job function within one stakeholder and build a product to make their job easier, or so they claim. Generically, we can categorize these companies as below:

We also wanted to bring that to life with some examples of companies, most of which you’re likely familiar with (we don’t intend for this to be an exhaustive list).

Most of the products above—especially some of those sold to 3PLs—don’t have software TAMs that are venture-scale on their own without exposure to freight markets (the big exception to that would be those products in the compliance buckets). Companies in the vendor management and visibility buckets bundle SaaS fees with pricing that is usually tied to load volume. Companies in the accounting row usually take a percentage of the total freight invoice. In both cases, their business models are highly exposed to freight market volatility, but have to rely on the overall freight TAM to have venture scale opportunities. Bit of a Catch-22. Many of them also have high CACs and long sales cycles due to the complexity of implementing products that are reliant on data exchange with a TMS.

Opportunities in the unbundling

So with this dour outlook on many corners of this market, where do we see the important opportunities? For one, we believe that there are still venture-scale software opportunities in the shipper market. Ultimately we believe that shippers will pay more for automation and analytics, so companies selling to them can be less reliant on transactional revenue models. The vast majority of Chief Supply Chain Officers still say that data and visibility is a huge pain point for their operations and they are spending tremendous amounts to solve that problem. We’ve heard that a large retailer in Northwest Arkansas is going to spend almost $300M on “visibility” this year. $100M of that will go to third party tech providers and only $2M of that will go to transportation/tracking visibility providers that most people think of when the term “visibility” gets thrown around. This tells us that shippers are spending big on supply chain software. To all supply chain leaders we know, visibility goes way beyond tracking a trailer or a pallet. It’s a collection of data that covers everything from invoices, to supplier inventory, to packing operations, vendor compliance and more.

The second reason we believe there’s opportunity in unbundling the TMS is that we believe generative AI can unlock value in automation that software couldn’t touch until recently. Transportation orgs are still extremely people reliant and so much of what those people do is centered around text-based communication and data entry based on interactions with vendors and customers. These are challenges ripe for the genAI taking. Software companies in the space should be able to leverage genAI to deliver more value than ever before. If they can, they should also be able to justify larger ACVs that help create larger TAMs. Compliance solutions that drastically reduce the effort of onboarding new vendors or accounting solutions that structure unstructured customs data are two compelling use cases we’ve seen for generative AI where software alone had previously struggled. We think there are lots of viable starting points here, and we're excited to explore with founders building against these or related ideas. Unlike in most other verticals, there are so many workflows still largely untouched by software in supply chain that these new entrants actually stand a real chance of building a data set that incumbents don’t already have.

There’s a lot of naysaying in the supply chain tech world these days. We totally get why. At the same time, we’re more bullish than ever that there is a wide array of venture-scale opportunities here. Enterprise customers are more focused on visibility and supply chain durability than ever before, and are eager to find ways to automate their operations. The mass adoption of supply chain-specific ERPs has unlocked a treasure trove of data ushering in a new generation of software. We believe that enterprise demand for supply chain automation, combined with the innovative new software and AI in the space will create the right breeding ground for venture scale opportunities. We have our thoughts on where those opportunities actually lie and, importantly, where they won’t, as many will likely be in still subscale markets.

As always, we also encourage you to share thoughts, agree, disagree or bounce ideas off us as we continue to explore new solution sets in this space.