Building the Fintech (and AI) Holy Grail: Data Assets

The ‘Next Act of Next Acts’ That Unlocks $10B+ Outcomes

As investors, our job isn’t simply to assess whether businesses are working today, but to prosecute whether they can create durable, long-term value (ideally as large and standalone companies!). We often debate whether a business has a meaningful moat, which we define as a structural – and ideally compounding – advantage one company enjoys relative to its peers.

While discussions around moats have always been a central feature of our internal debates, they’ve become the topic as we’ve watched (a) AI businesses scale at historically unprecedented rates and (b) virtually every venture-investable category become saturated the moment it’s deemed obvious to investors. We’ve also observed that most of our conversations – both internally and externally – end with a comment around data as key to long-term defensibility.

We’d like to add more fidelity to the idea of data as a moat. As investors who study financial services companies for fun, we believe an elegant way to do so is by examining how financial data and network businesses (our favorite subset within financial services) become self-reinforcing, monopolistic market juggernauts – largely by orienting their businesses around a unique and compounding data asset. While revenue ramps are steeper and competition is fiercer in 2025, our view is that the market forces that govern which companies ultimately endure remain the same

Approach

We started by asking: if we study the origins of financial data businesses, can we (a) reverse engineer their paths to juggernaut-dom and (b) reconcile those paths with venture capital as a funding source tuned for hypergrowth (vs. slow-and-steady growth over years or decades)?

After speaking to founders and builders of some of the most consequential financial data businesses, our hypothesis is that the next great, venture-backed data and network business won’t start off looking like pure-play data businesses. Building a valuable data asset simply takes too much time.

Instead, we find that the successful venture-backed companies invert the sequencing: they begin as valuable software businesses in their own right, and only later earn the right to “flip” into data business territory once they’ve amassed a critical, valuable data asset. In short, data businesses tend to work best when they represent the end state – the Next Act of Next Acts.

Data Assets & Businesses: The Holy Grail

All of the largest businesses in financial technology have proprietary data assets at their core. Each of these companies operates in an effective monopoly (or oligopoly) in their respective categories.

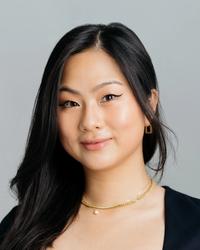

Exhibit 1: Incumbent Financial & Data Network Businesses

But if these are such valuable businesses, why are there few historically venture-backed companies in this comp set? There’s many potential explanations but we asked ourselves — are data businesses structurally incompatible with the startup game?

The Pragmatic Challenge of Data Businesses

The issue with data businesses is that they either:

- Were built so deliberately (think consortium models) by industry insiders that they hit critical mass on market participants from day one; OR

- Became behemoth data businesses by (near) complete accident

On Consortium Models

The card networks are the best example. Mastercard began as the Interbank Card Association — originally a group of regional banks reacting to Bank of America’s refusal to provide Marine Midland Bank with a BankAmericard regional license. The formation of Visa — fka the International Bankcard Company (IBANCO)—was a “counter”-consortium in reaction to the looming threat of Mastercard.

While some venture-backed startups have looked to launch “consortiums” of sort – the ownership structure required to truly align participant incentives in this model is fundamentally at odds with how startup cap tables look.

On ‘Happy Accidents’

Accidental behemoths are perhaps even more challenging, as their existence implies that building and funding a data business from the get-go requires founders and investors to bet on something smaller and less exciting before any real economic value accrues. Some examples:

- Native Distribution + Corporate Balance Sheet. MSCI—a $43 billion market indices business that powers $15 trillion of AUM—started as a free set of stock indices published initially by Capital International (CI) in the ’60s and later by Morgan Stanley (MS) in the ’80s... hence the name MSCI. It took 10+ years of close-to-free distribution for MSCI to monetize its indices at scale.

- Deep-Pocketed Individual. Bloomberg—a business last valued at $23 billion when it bought out Merrill Lynch’s remaining stake in 2008—started as a bond calculator designed with Merrill. When Michael Bloomberg left Salomon Brothers with a $10 million buyout, he rolled $4 million of that to start Bloomberg in the ’80s.

- Long-Enough Time Horizon. Moody’s—an $86 billion credit ratings business—started as a financial publishing (i.e. books) business, whereby John Moody would assign ratings to railroad businesses. It took 70+ years for Moody’s to chart a path to becoming the credit ratings juggernaut it is today. In fact, the debt capital markets that they serve today weren’t a thing until the the high-inflationary era of the late ’70s.

This works when done within the “comfort” of a large corporate balance sheet, deep-pocketed individual, or long-enough time horizon that does not align with a 12-18 month fundraising cadence and a 10-year fund cycle.

Charting a Path to a Venture-Compatible Data Business

Although the historic paths of building juggernaut data businesses fundamentally do not lend themselves to startups, the wrong conclusion to draw would be to avoid them entirely.

What if there’s a way to be highly intentional about building and investing in the next great data business?

There are a handful of venture-backed “hero companies” that we believe have earned the right to scale and monetize a data asset:

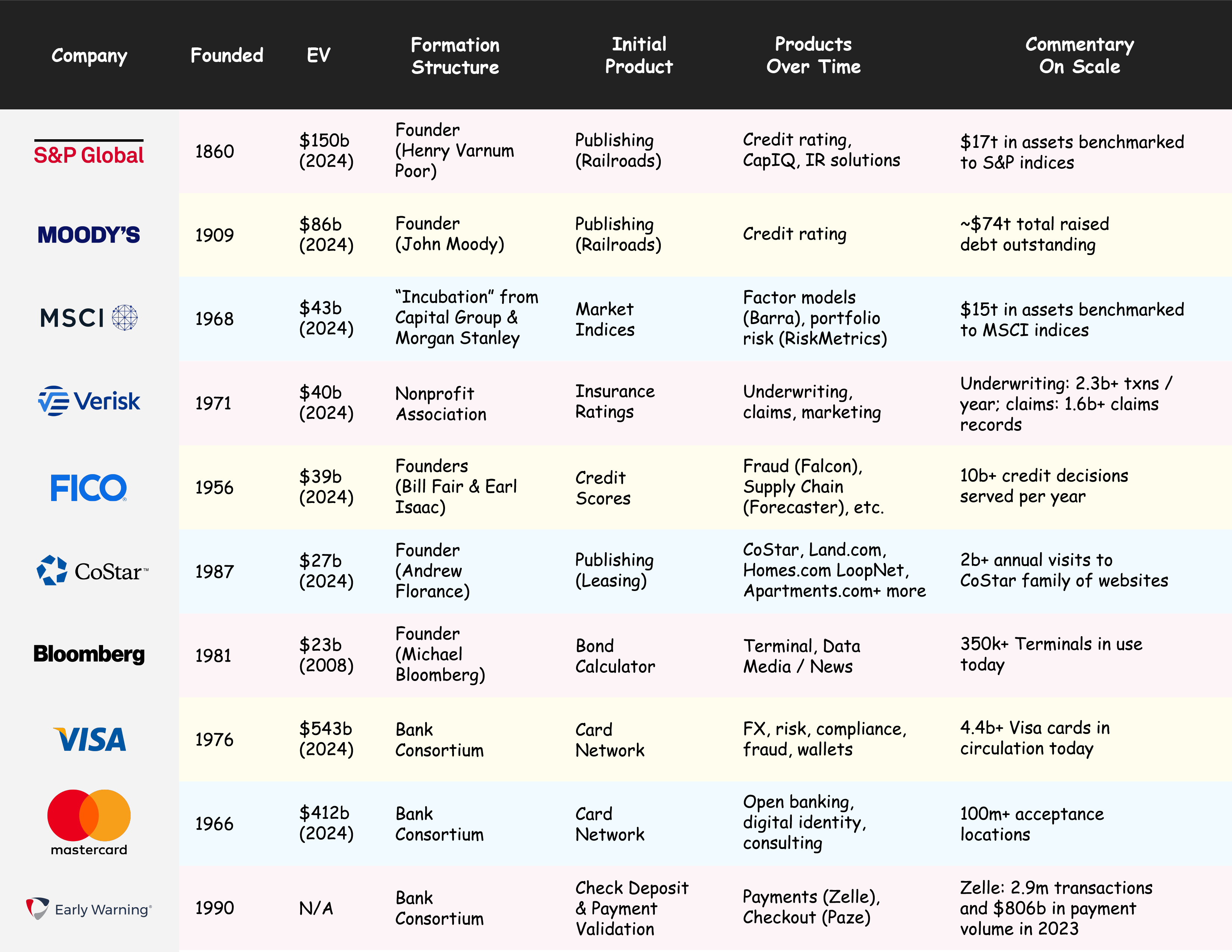

Exhibit 2: Venture-Backed “Hero Companies”

Early observations from studying these businesses lead us to a strong set of beliefs. Namely, to build a great, venture-backed financial data asset business one has to start with a strong standalone software wedge. Then, with enough market capture and scale, a player can earn the right to 10x TAM through the monetization of a critical data asset.

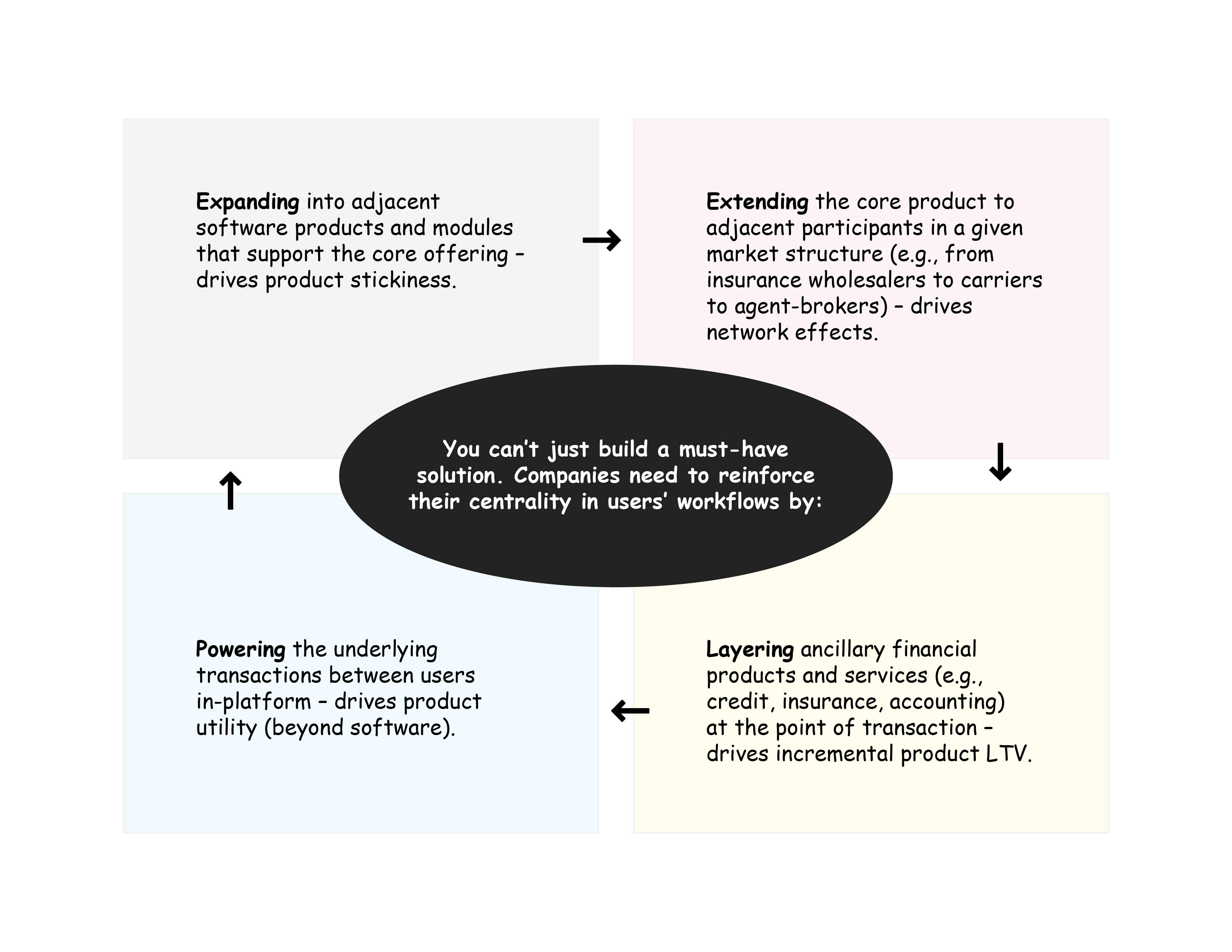

There are some critical flywheels and strategies that can help accelerate this journey:

As the cost of developing software trends lower thanks to AI, better product and distribution is at best a medium-term differentiator. Building towards a core proprietary data asset around the software can become a tenant of true long-term defensibility.

Building an Eventual Venture-Backed Data Business

Distilling what we’ve learned, our current operating framework for building a data asset necessitates:

- Scale and Patience. Folks grossly underestimate the critical mass at which a business can start to monetize a data asset, which is also a function of the time to reach readiness. Only now 12+ years down the road do established players (e.g. Plaid) have the scale and penetration to truly take this path.

- A Good Enough—Ideally Great—Standalone First Act. The above implies that getting to the end state is virtually impossible without a great core business. The core must be a scalable, high-margin business from the start capable of getting to a $1B outcome. The data asset play is a force multiplier that unlocks the $10B+ outcome but the strong core business must come first.

- An Unconflicted Value Proposition. The data asset cannot be in conflict with the core customer or value delivered as this introduces existential risk to the business. We believe this is why even if a business shouldn’t explicitly operate as a data business from day 1, there needs to be a sense of intentionality in foundation building ASAP.

So What?

Amassing a critical data asset is a wonderful way to build and sustain a moat – so much so that we believe this style of company-building should extend far beyond financial services! We’re excited to spend time with founders who not only (a) can solve a pressing customer pain point with software today, but also (b) have the end-state foresight to use that software to capture data that can generate tremendous downstream value over time.