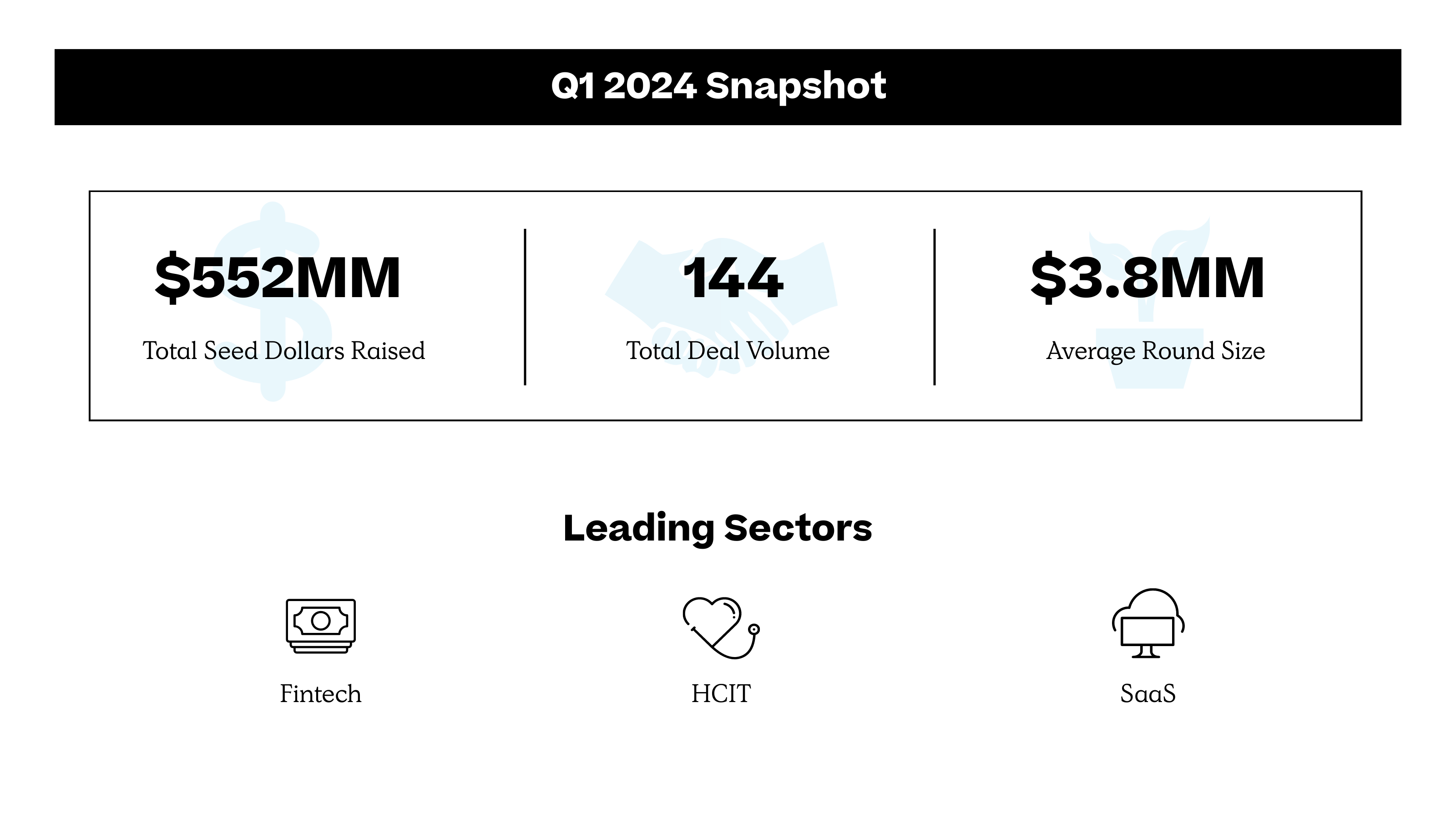

Consistency Prevails in 2024

In Q1 2024, we saw a steady continuation in the NYC seed fundraising ecosystem. Here are the sector-specific trends our team spotted in this quarter’s fundraises.

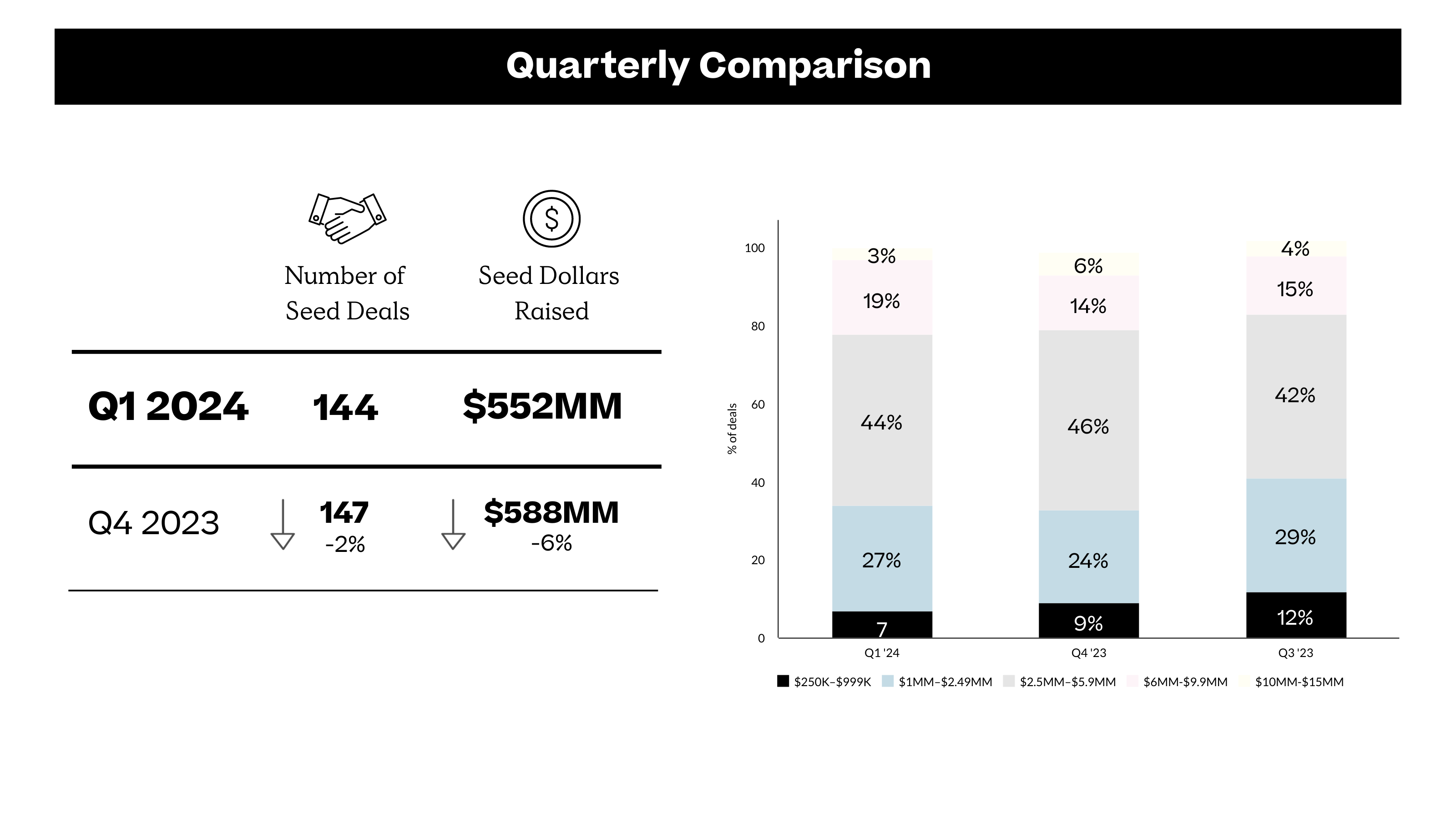

In Q1 2024, we saw steady continuation in the NYC seed fundraising ecosystem. Quarterly deal volume stayed roughly the same compared to Q3 2023, with average round size and total funding decreasing 5% and 6%, respectively. While SaaS, Fintech, and Healthcare deals continued to dominate the show, we saw a decrease in Edtech + Future of Work deals.

Out of the 146 companies that raised this quarter, 25 were Healthcare, 24 were SaaS, and 18 were Fintech, combined making up just over 50% of total deals. We saw a slight slowdown in the AI fundraising frenzy, with 12 companies having raised compared to 15 last quarter. However, if the way our team and portfolio founders consider AI to be any indicator, it’s possible that we’re approaching a level of normalization in which every company is an AI company, whether it lives under Healthcare, SaaS, Fintech, or elsewhere.

Year over year, we continue to see sustained growth in NYC’s seed-stage deals. Total deal volume has increased 16% to 146 this past quarter, up from 126 in Q1 last year. While the number of deals has grown the past year, we also noticed a 19% decline in the average round size—from $4.5M in Q1 2023 to $3.8M in Q1 2024.

Here are the sector-specific trends our team spotted in this quarter’s fundraises:

Team Healthcare at Primary has been embracing the shift towards value-based care (VBC) and its profound implications for the broader healthcare ecosystem. We are not only anticipating a substantial increase in the allocation of VBC dollars as a percentage of total care, but also foresee a deeper expansion of VBC into specialty care. This paradigm will impact clinical care delivery and material changes in the administrative and operational processes to support the model.

The first company illustrating this trend is Valendo Health, hot off of a $4M raise led by Redesign Health. Valendo is a VBC-focused software suite working to increase patient health outcomes by incentivizing endocrinologists to better address their patients through offerings like telehealth, remote patient monitoring, and patient engagement/tracking. Next, Conduce Health raised $3M from Connecticut Innovations, AlleyCorp, and Citylight Capital to build a specialty care platform that helps match patients with the right specialist while providing risk protection, accelerating VBC onboarding, and enabling better patient outcomes. Precision Recovery is another company targeting a VBC model for stroke patients. They are still early on their journey to increase the quality of care for members post-stroke and recently raised a little under a million to continue reducing readmit rates.

We are excited to see how these groundbreaking software solutions help proliferate value-based care models across healthcare specialties and drive patient care to the forefront of the ecosystem.

We saw a slower quarter for industrial technology seed rounds in NYC. That said, this quarter, we saw increased funding in the materials sector, from scrap yards to waste retrieval. Visia AI, which raised $6.4M from Shine Capital, empowers recyclers with increased visibility into inbound material by utilizing cameras and X-ray machines. Sourgum, which raised $3M from Founder Collective, is modernizing waste disposal, providing dumpster rental & waste on demand. Industrial businesses have always been bogged down by paperwork and manual tasks. In the past decade, we’ve seen a shift in willingness to adopt technology for core areas of supply chain operations like payments and communication. The tools of the last decade have only done so much for productivity. We believe that generative AI will be a catalyst to build for “heavy” industry, driving adoption in unsupported industrial use cases. We also believe the supply chain is primed for meaningful innovation over the next decade, with increased adoption into industries beyond the core.

With the proliferation of open-source products and more adoption of OS by enterprises, companies face a new problem – upgrades and dependencies. Companies may upgrade less frequently or avoid them altogether as their systems are so interconnected. Unfortunately, upgrading has become a low-level task for expensive, senior developers. However, avoiding upgrades is a security risk that only worsens with time. This quarter, Infield raised $3M from Foundation Capital to bring automation to the upgrade process, with a focus on complex open-source software like Node.js. Relatedly, dependencies and a complex software supply chain can lead to security vulnerabilities. Kusari raised $8M from J2 Ventures and Glasswing to solve the expanded attack surface that results from utilizing many open-source components. Software sprawl has accelerated the sprawl of dependencies, which is creating a market for solutions that ease upgrades and secure software supply chains.

Traditional enterprise SaaS businesses often aim to facilitate workflows and improve employee productivity. These businesses hope to become the singular platform where work gets done, with “power users” spending nearly their entire day in the system. However, with advancements in generative AI, we’ve seen a new crop of companies that are building AI agents not to make work more efficient, but to do work on behalf of businesses. These companies rarely have the luxury of owning a users’ entire workflow, and instead need to find other paths to defensibility.

B2B AI agent companies like Firsthand ($6.65m seed round led by Radical Ventures) leverage company data and LLMs to enable brands and publishers to engage with their consumers on every platform. With so many nascent companies chasing this space, Firsthand started by building a data management layer, owning the data asset, and creating deeper stickiness with the product. Distribution advantages are another way AI agent businesses are growing quickly and creating a moat. Hatz ($2.5m seed round led by Vestigo Ventures) is enabling MSPs to better serve their customers with AI chat and AI app builder. Consequently, each MSP that Hatz acquires pulls in hundreds of customers onto the Hatz platform. While we’re excited about the future of AI agents to dramatically increase the productivity of businesses by productizing services, we believe the best startups in this space will find creative and exciting ways to build long-lasting defensibility and moats.

There is a paradox in venture capital - while the startup ecosystem is vibrant, the reality is that 9 out of 10 businesses fail. Unfortunately, the process of closing a business is painful, and time-consuming, and exposes founders to the risk of accruing fines and penalties associated with non-compliance. Following the funding frenzy that was 2021 and 2022, this perpetual market pain point could not ring more true. Q1 saw a lot of buzz around companies addressing this, including NYC-based Sunset, which raised a $1.5m seed from Everywhere Ventures. They are building a solution to help automate the shutdown process of companies in a compliant and responsible manner by leveraging fintech, artificial intelligence, and legal technology. While this type of solution isn’t new, these next-gen automation platforms are shortening the wind-down process from months to days or weeks, allowing entrepreneurs to move on to their next venture, and giving them the opportunity to leverage existing IP that would otherwise be lost with the company.

We believe this fits nicely into the broader theme of productivity tools automating compliance. In an increasingly regulated business landscape, early-stage companies are prioritizing adhering to legal and regulatory frameworks as a competitive advantage that fosters credibility and mitigates risks.