Fintech Goes Global: What It Takes To Build Products and Teams That Scale Beyond Borders With Erica Dorfman at Brex

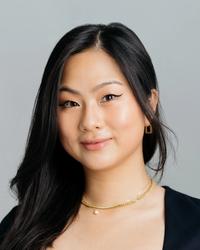

As EVP of Global Financial Products at Brex, Erica took Brex global into 100+ countries. We sat down with her to unpack the work that went on behind the scenes in Part 1 of this series

For any ambitious high-growth company, international expansion is always a major strategic lever at a certain point of scale. It’s never easy but for fintech companies looking to scale beyond borders, it’s infinitely more complex.

For this series, we sat down with a handful of seasoned operators who had firsthand experience helping take their respective companies to new international destinations.

This first interview is with Erica Dorfman, EVP, Global Financial Products at Brex. Erica led the charge to take Brex’s platform to 100+ companies across the globe. I sat down with Erica to dig into the strategic and operational decisions they made at Brex as well as her career and how this was informed by prior experiences at SoFi and Tally.

I want to start with your career. You started in the more traditional banking and private equity before moving over to fintech startups. What drove that change?

Each time I made a career move, I ended up getting closer to the rails. When I was in private equity, I wanted a better understanding of the operating level—the building and the executing.

I joined SoFi in 2016 on the capital markets team with very little experience. It was a steep learning curve and a unique time in the interest rate market for lending businesses. Within two years we went from ~$500m of total issued securities to issuing $1b of bonds a month and being one of the top ten largest asset-backed securities issuers in the US. As I was looking at what I wanted to do next, I decided to take on a more expansive role at an earlier-stage company and joined Tally Technologies right after their Series B to lead finance and operations.

I kept in touch with a lot of the team that I worked with at SoFi during that time, and a few of them (Michael Tannenbaum and Ben Gammell) had already gone over to Brex. They mentioned a really interesting new business banking-like product that I thought would be a huge value proposition to customers (as I was already a customer of Brex at Tally). They asked if I would come over to help launch and GM the business. As I met the team at Brex and as I heard more about the growth strategy, it became impossible for me to say no. I joined Brex in the summer of 2019, and since then have had a lot of different roles across finance and partnerships, and now lead our Card and Banking businesses as VP of Product.

As we built out the enterprise and our business’s software upmarket side, we realized that we needed to add global to make the offering compelling to larger customers with international teams. That became a large focus area for us when I moved over to the product team because it’s very challenging to build.

Around a year ago this time, Brex announced that you were extending the capabilities of Empower into 100+ new countries. This was roughly seven years into the life cycle of the company. How early did you guys start to think about going international?

Brex has a really international employee base. Our co-founders, Henrique Dubugras and Pedro Franceschi, are Brazilian and we were pretty early to open up international offices in Canada and Brazil because we believe in hiring from the global talent pool.

That said, the idea to make our product global though came from our customers. Growing internationally created a lot of new pain points for their finance teams. When we talked to them they would say, "I have separate card products in Europe, in Mexico, in Brazil, in Canada, and in the U.S. It’s really annoying to our finance team to manage all of these programs. We don't like it, but we don’t want everything in USD. We can't see everything in one place.”

It was an instant “aha” moment. In order for us to build something differentiated, we had to figure out how to give our customers the ability to manage their global teams with Brex’s software and cards, including offering truly local payments and money movement that matched or exceeded incumbent global banks.

Our goal with global is to serve customers who have both US and international operations.

So it wasn’t a growth vector, so to speak.

That’s right, it wasn't a TAM expansion in the sense of, “Let's add all the startups in Germany.” That said, our ability to serve global companies has definitely contributed to growth.

A lot of companies talk about global expansion and it's a bit different for someone who's selling SaaS versus someone who is a financial services provider. The difficulty is way vaster and deeper. What was the approach both organizationally and from a backend infrastructure perspective to make it possible to launch so many countries so quickly? What framework did you use to evaluate which countries you wanted to prioritize?

Every country or a lot of countries, most countries, have very different regulatory environments, very different rail systems in terms of how they move money, and very different tax and reporting requirements in terms of what that means for a company to move money or report on moving money and what sort of validation you need to say, "hey, this was a corporate expense."

A lot of “global” offerings are just experience wrappers around USD, that don’t do much for the customer and it wasn’t what we wanted to build.

We started by defining our ideal end-state for the product. The first order of business was like, hey, what do we want to create here? And starting at that foundational level of “What's the user experience that we're trying to create”. Along with the technical aspect of local currency payments and visibility, it was also important to us to create an amazing, localized user experience for each employee. So thinking about it from the customer's perspective was the base layer of informing what we need to build on the infrastructure side. That led us to realize that, hey, there isn't a one-size-fits-all. We're going to have to use a bunch of different components to make this work.

What framework did you use to evaluate which countries you wanted to prioritize? And how did you think through what infrastructure providers to use?

We also did a ton of customer and market research. I think I must have talked to 200+ customers in our initial phase alone let alone any infrastructure providers and banks. From that, we optimized for creating full solutions for the largest number of customers. We set a first tier of priority countries through that process.

As much as you're like, okay, great, there are X countries we can just go and there must be some solution for this – the reality is there aren't that many. We evaluated everyone under the sun because a) there weren't that many to evaluate, but b) we wanted to make sure we had this maximum amount of coverage and focus on the breadth of our offering.

When we look at partners, one of the things that's most important is what their tech stack looks like. Are we working with someone who is building with us? Are they going to have a tech stack that we can leverage that's not going to be brittle?

How do you build the culture and the organization internally to be able to manage a global product?

We definitely benefit from our team's international background and current location. There has been a huge amount of dog-fooding at Brex. Culturally and organizationally, making sure the company understood our objectives and maintained consistent focus required strong communication across teams. Our staff engineers and the leads on our global building did an incredible job.

How do you think about build versus buy when you’re trying to build the best product?

It depends on what you're building and buying. Revolut, for example, has local licenses and individual country partnerships worldwide. It’s amazing and took time and a pretty large amount of capital to accomplish.

We have both built and partnered to create our global infrastructure. As a general rule, we favor building for our financial products but do so only when we think we have something unique to contribute and where the product will be materially differentiated. We partner where there is a clear problem that has already been solved that we can leverage (for example payments processing in the Philippines). Through this strategy, we were able to launch local cards and billing in 50 countries in less than a year and a half.

What I’m hearing is people should think about their core value proposition and product, and then build from there.

Product market fit is the name of the game. You have to have product-market fit to start, and then can expand outward.

You're also an angel investor and a scout. What are you excited about today in fintech?

There are still a lot of unsolved problems in fintech and money movement in particular. For fintech, I like infrastructure teams that are looking at problems that are unsexy and challenging to solve. The challenge with that is often distribution though. I recently invested in Backpack, which is a company modernizing the payment rails and dramatically increasing the usability of 529 College Savings Plans. The volume of payments is enormous, there’s a lot of regulatory change in the space, and the status quo user experience is terrible.

I have also recently become excited by a few products that directly drive B2B revenue and sales efficiency. I invested in a stealth company focusing on go-to-market rapid learning. The B2B software space is competitive, but if you can quantify the value delivered, the customer's decision becomes much easier.