Navigating Toward Your North Star Metric In Telehealth

The data points that define success at companies like Calibrate, Curex, Hone, K Health, Paloma Health, Perry Health, and Tia.

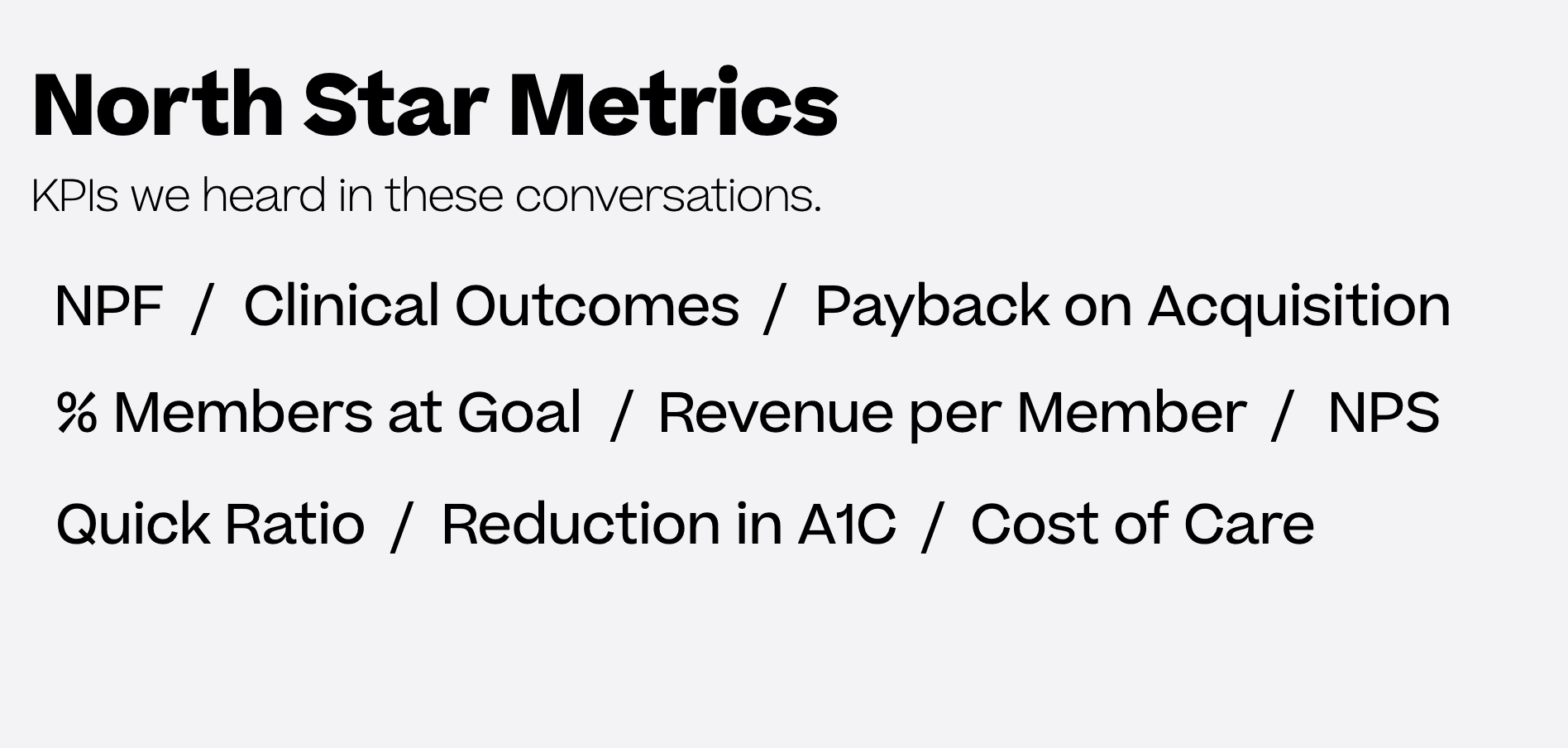

After we close an investment in a new company, one of the first meetings we hold is one to evaluate the milestones for a Series A and discuss north star metrics. We’ve found time and time again that conversation tends to create a guiding light and helpful framework for founders in day-to-day decisions and operations. As we interviewed dozens of telehealth founders, operators, and investors to help develop our theses, one of the most important questions we asked them was what their north star metric was: the data point around which they built their business and honed their strategy. Here’s what we found.

And don't miss the rest of this series, which includes an inside look at our favorite digital health trends, top advice from successful NYC founders, guidance on north star metrics, and an in-depth founder interview series.

What was your north star metric?

“Great patient outcomes and NPS.”

—Gene Kakaulin from Curex

“Our north star metric is reduction in A1c and other clinical outcomes, but the metric that we can directly influence is engagement. Engagement derives from patient experience and trust, and outcomes are directly influenced by engagement levels.”

—Pan Chaudhury from Perry Health

“Member outcomes, which we measure by % of members at goal. Our north star has always been that our business will work if our product works.”

—Isabelle Kenyon from Calibrate

“We are obsessed with a metric that is usually used by SAAS businesses: the Quick Ratio. To calculate the Quick Ratio you simply divide new subscribers by lost subscribers. To put it in a formula: Quick Ratio = (New Users + Resurrected Users) / (Churned Users). This ratio tells us how many subscribers we are adding versus how many are churning. In one metric we can see if we are sustainably growing our membership base, and if there are issues with growth and/or retention. The higher the ratio, the healthier the growth is at the company.”

—Guillaume Cohen-Skalli from Paloma Health

“Demand, NPS, and economics: those are the three things we needed to deliver on to prove that primary care, which is traditionally a loss-seeing business, could be thought of as venture-scale and profitable.”

—Carolyn Witte from Tia

While we got a variety of responses specific to each founder’s business, there were a few key themes that emerged:

- Patient safety

- Patient engagement

- Patient outcomes

- Patient satisfaction

We then stepped back from that north star metric to ask founders about the broader set of KPIs they selected for their business and the mental model for doing so in tandem with growth of the company.

According to Allon Bloch, founder of K Health, it’s crucial to keep the big picture in mind. “It's so easy, in healthcare, to chase revenue and bring in the wrong kind of revenue. Then the entire company is focused on that.” Allon’s perspective about thoughtful growth raises a critical point that came through in our founder conversations: the value of layering each metric into the long-term vision you have for your company.

“Growing at a good rate is important, but doing so sustainably is even better. While we monitor our top line growth, we are obsessed with the quality of the patients we are bringing in–are they people who will benefit from our services? Are they so satisfied that they keep coming back? Are we able to deliver care affordably and maintain a healthy business? If your business is a high retention, high LTV business, don’t think in terms of ROAS (Return on Ad Spend) but in terms of LTV/CAC ratio. It is important to not only chase growth at the top of the funnel, but to connect with the patients that will stick around.”

—Guillaume Cohen-Skalli from Paloma Health

As we got deeper into the weeds of growth strategies with telehealth founders it became abundantly clear that every business’s acquisition funnel looks different and some healthcare companies might be the most complex ones you’ll see in consumer investing. Saad Alam from Hone noted that as you iterate on and optimize that funnel, founders may need to adjust or completely shift their north star metric.

“When you're first starting a business you don't know until you don't know. I think that we had a hypothesis of what happened along the entire way of the funnel, but the reality is it depends on how long it takes the patient to progress through the funnel.”

The funnel for Hone Health, a hormonal health company for men, is:

- Sign up on the website and order home assessment

- Take home assessment and ship back

- Schedule AND attend physician consult

- Take AND ship back an additional confirmatory test (if it's a controlled substance )

- a retest and additional physician conversation every 90 days

Given all of these touch points where the process could potentially break, Saad found he and his team had to keep their fingers on the pulse of the funnel every single day.

“The single biggest metric at the beginning was total number of assessments. That very quickly became total number of assessments being sent back. Then it became total number of consults happening. Then it became total number of medications purchased. And arguably now, the one that is probably the most important to us that we're still trying to understand is customer satisfaction,” said Saad.

Naturally, selecting the metrics matter most for your business is one of the hardest things an entrepreneur has to decide. And the metrics that matter for one healthcare business are not necessarily the metrics that matter for another. Carolyn Witte, founder of women’s healthcare company Tia, shared with us that she saw Tia as a relationship company in the business of acquiring, engaging, retaining women across the entire healthcare ecosystem. Given that, branding growth was of paramount importance. For another healthcare services company that sells into a payer, that doesn't matter at all. It's irrelevant.

“I think the biggest thing is figuring out the metric that actually matters for the moat that you're selling. Why is this company going to be more differentiated than anything else? And then what's the comp in the market for that? And then how do you give an investor a mental model to compare that? At Tia, we look at payback on acquisition more than specifically a growth clip because that shows acquisition and engagement together. We also look at NPS, revenue per member, and cost of care, and those are probably the four most important metrics that we look at.”

—Carolyn Witte from Tia

Curious to learn more, share feedback, or swap ideas about digital health? Reach out to me at jason@primary.vc or @jasonrshuman on Twitter.