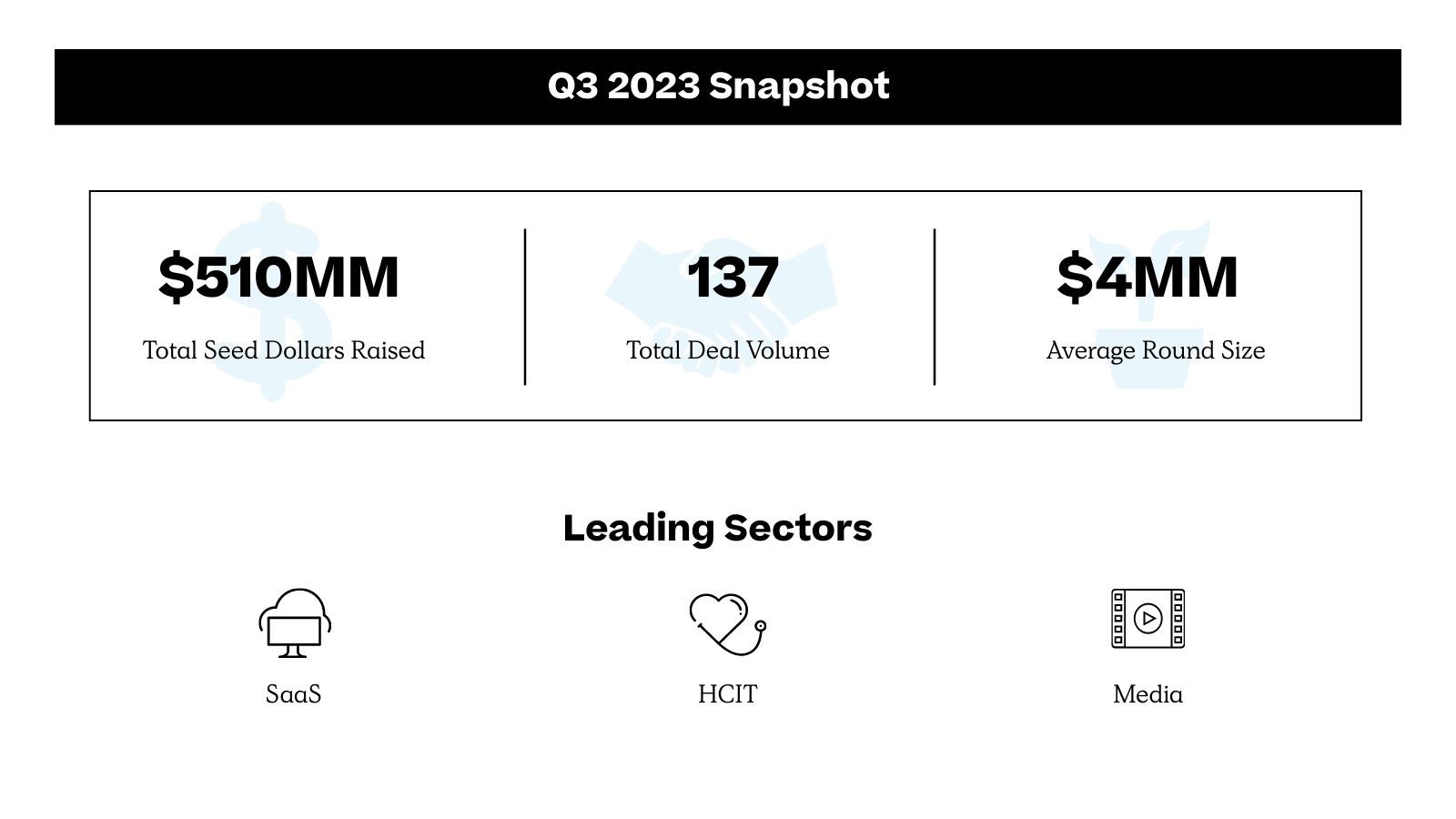

NYC Seed Deals Slightly Dip in Q3

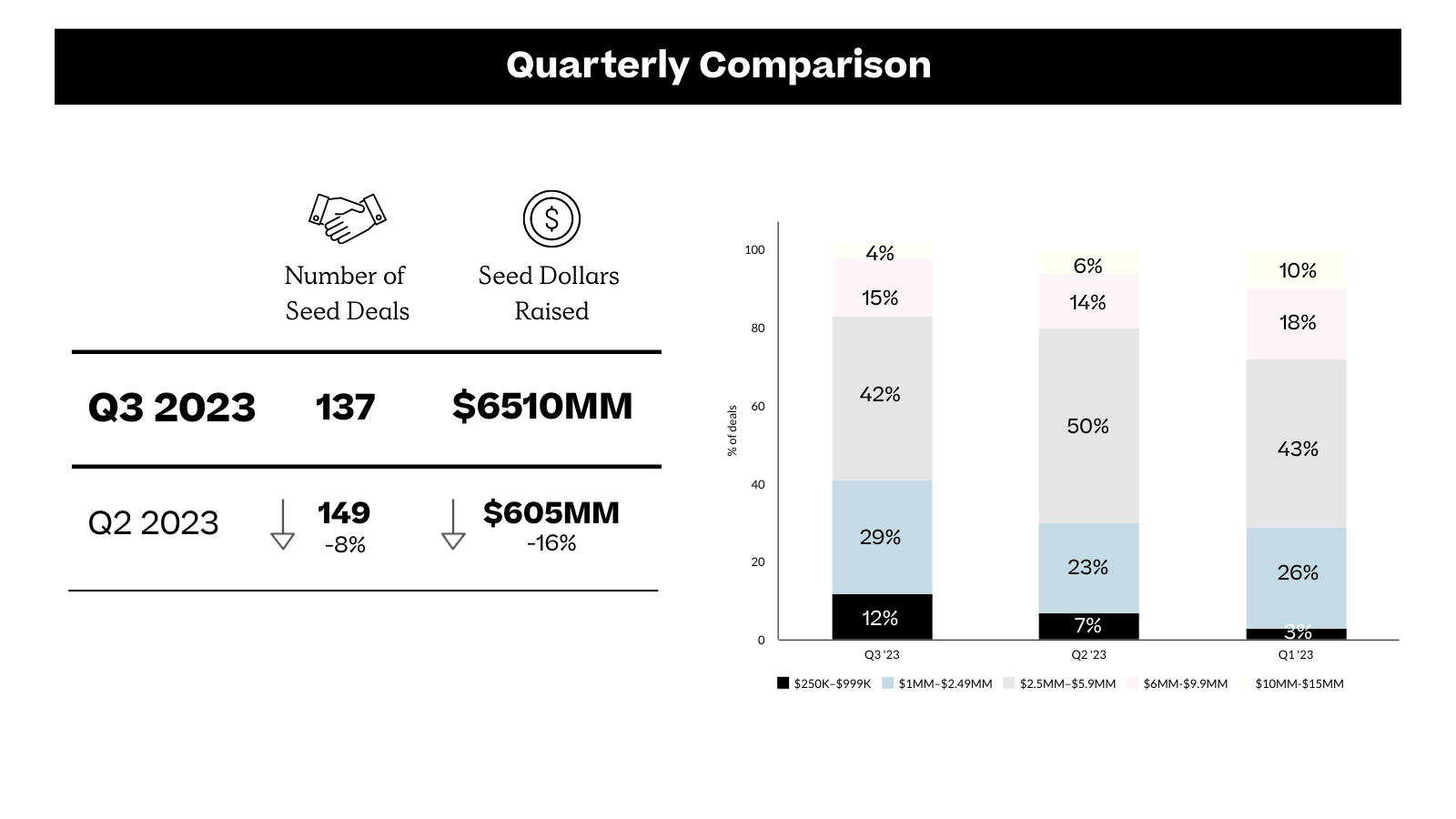

The total number of deals ticked down 8% this quarter, and the average amount raised declined by 16%. While the AI frenzy slows down, healthcare shows promising growth.

For Primary's NYC Seed Report, Marisa Bass, Tobias Citron, Zach Fredericks, Gabi Monico, Bryce Johnson, Gaby Lorenzi, and Austin Peng dive into sector-specific trends in Q3.

In New York City, as in most of the country, Q3 revealed a slower fundraising environment. Across deal stages in the U.S., 2023 is on pace to see the lowest total fundraising since 2017.

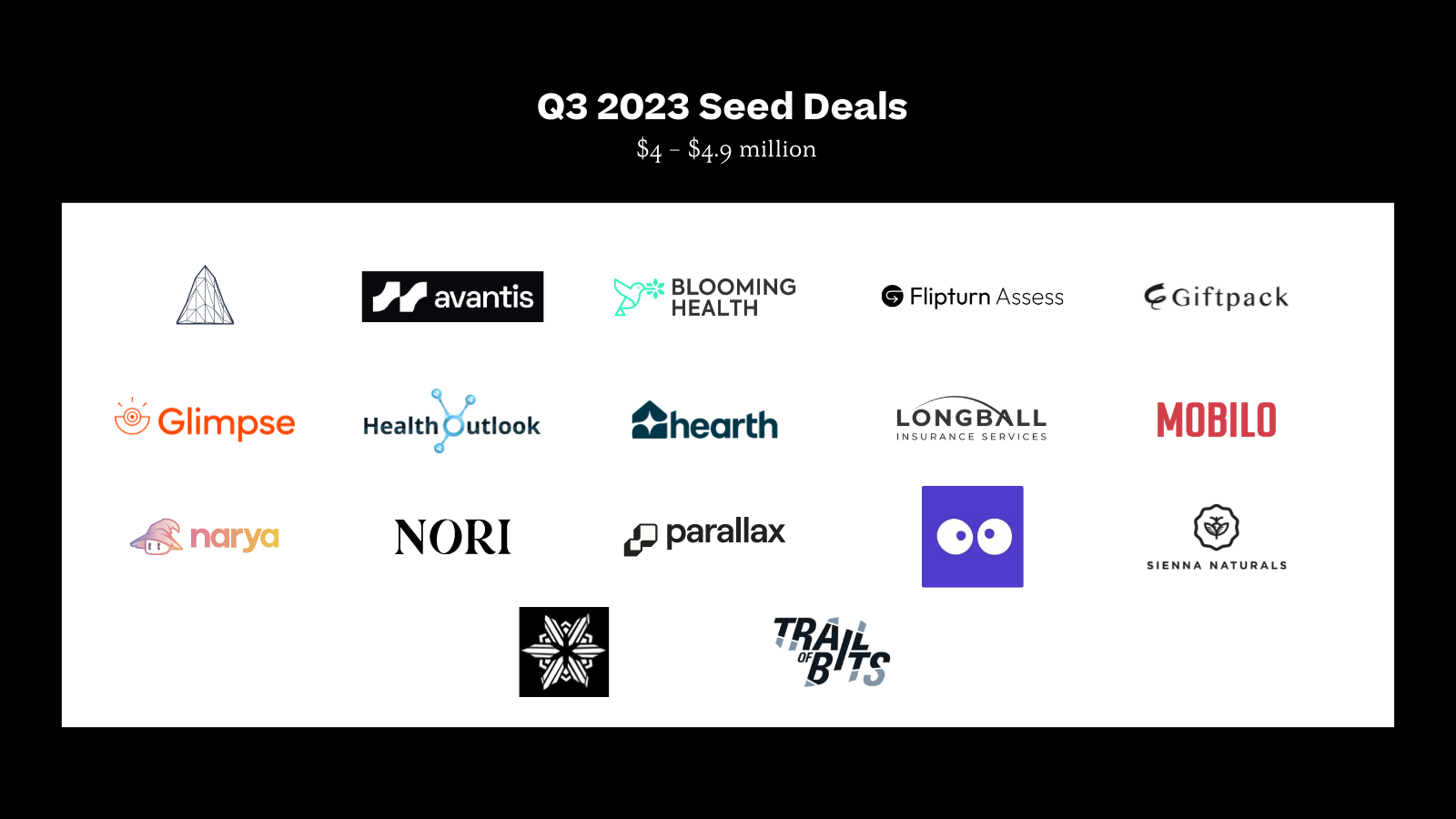

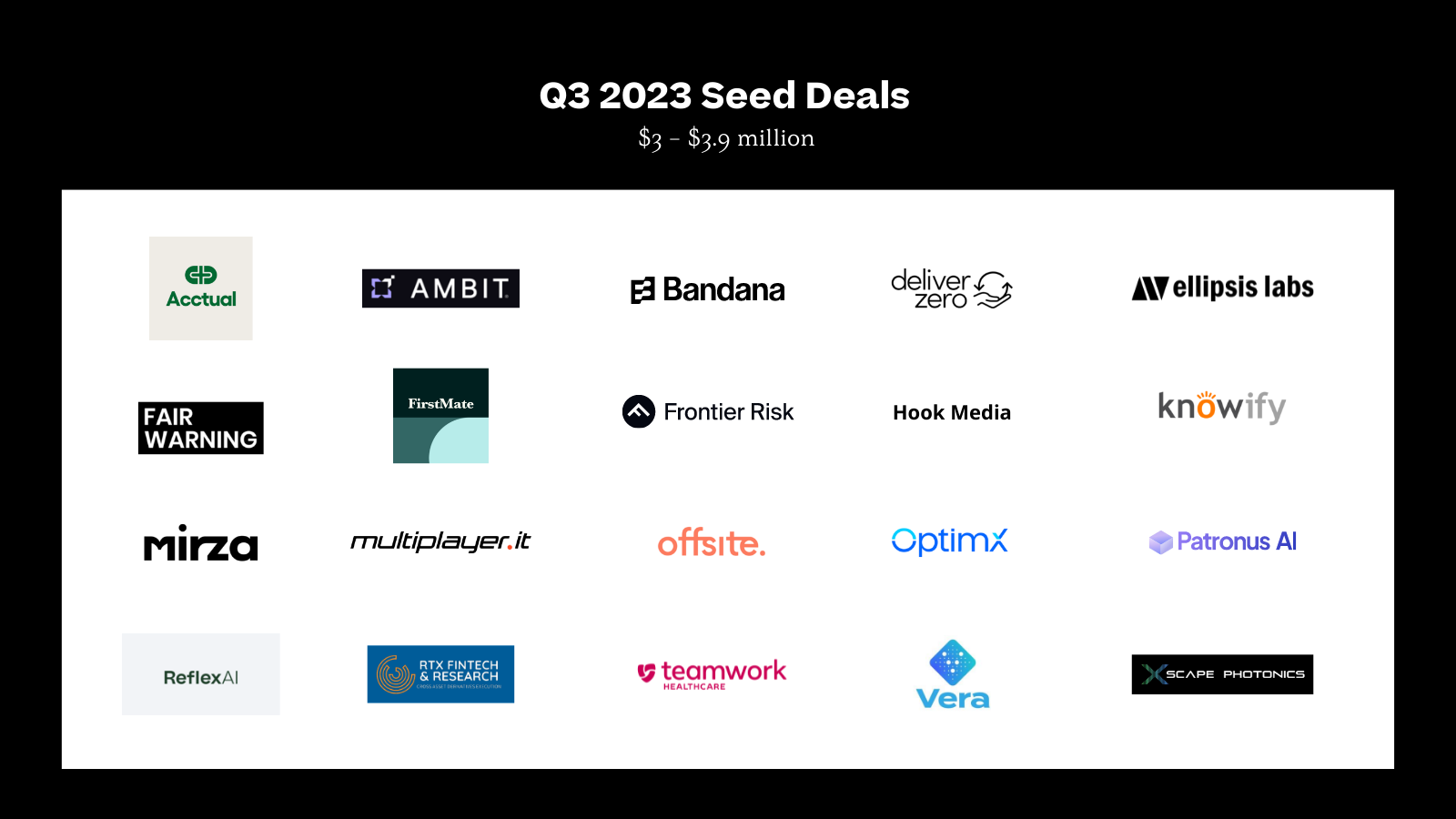

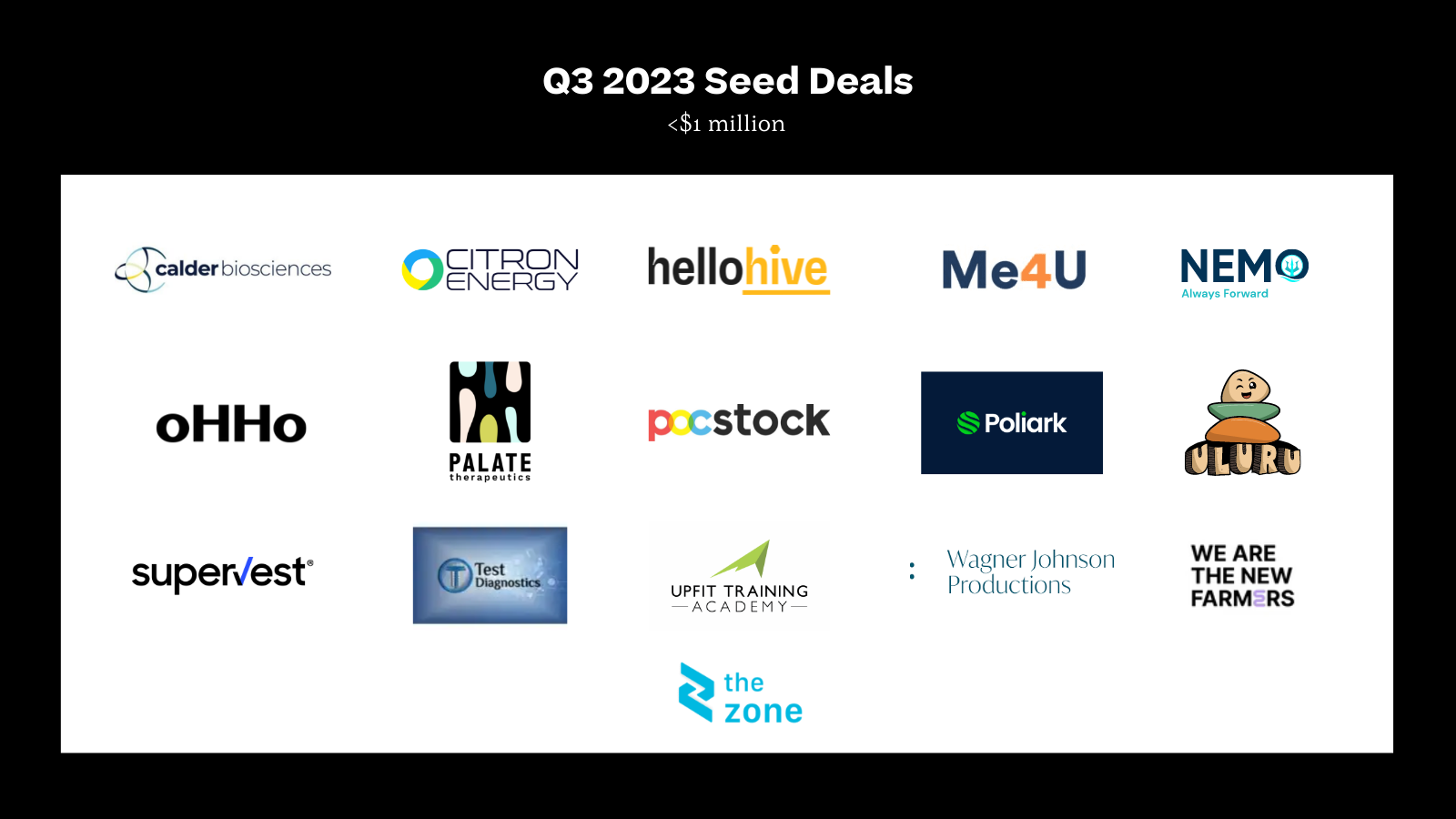

NYC seed deal volume, at 137 total, decreased by 8% compared to Q2, and the average amount raised, $3.7 million, also declined by 8%. Summers are often slow for fundraising, but volume is down 26% and total raised is down 41% year over year.

This quarter, we saw a spike in healthcare seed rounds. HCIT deals are up 35%, from 14 in Q2 to 19 in Q3. Those deals saw an average seed round of $4.5 million—close to $1 million higher than the average round size overall. 21% of those companies self-classify as AI companies, tying into the buzzy narrative of AI solutions disrupting the clinical landscape.

But overall, AI saw a slowdown to the fundraising frenzy. AI deals are down this quarter by 53%, from 15 in Q2 to 7 in Q3. Deal sizes remained high, however, with 43% of those deals greater than $5 million, while only 25% of overall deals fell into that range.

Here are the sector-specific trends our team spotted in this quarter’s fundraises:

While there has been a lot of buzz about AI in healthcare—excitement, curiosity, and a healthy amount of skepticism—this quarter we saw two AI companies funded focusing on empowering healthcare providers with the right information at the right time. With the volume of administrative work that has been added to the plates of providers, it's been harder for providers to find the capacity to provide care in between appointments and proactively manage conditions. It’s not surprising then, that we are seeing AI attempts to solve this—empowering providers with tools to increase the quantity and quality of data available while mitigating the administrative burden overall. The first company, Reflex AI, raised $3.3 million from Altman Capital, Emerson, Collective, Google.org, and the VA, among others. The company’s AI focuses on providing frontline workers of all types (crisis services, emergency response, social services, and healthcare) real-time reporting to help with staff training, quality improvement, and in-the-moment contact support to help staff in high-need situations. The second company, Medical Brain, raised $5.4 million and is a clinical decision support platform that similarly helps to identify emerging health risks and helps providers address them. We’re looking forward to seeing how these and other companies are able to embed within the physician workflow.

We’ve been fans of the tech-enabled outsourced procurement model since our investment in Odeko in 2019. Odeko sells procurement software to independent coffee shops, which serves a wedge that allows it to bundle other operational services into its offering. It now has since scaled to servicing more coffee shops than Dunkin and has raised over $175 million. We find this model interesting for a few reasons. When coupled together, software and outsourced procurement create more demand lock-in and justify higher margins. The vertical specificity also allows the company to build density around a specific supply chain vertical, giving it pricing power over suppliers. CornerUp is building a tech-enabled outsourced procurement product for convenience stores and raised a $1.5 million note from FJ Labs. Prelude, a company building “Odeko for cannabis dispensaries,” raised $2.6 million from Casa Verde Capital. In the current fundraising environment, it will be interesting to see how each of these companies balances software and operational services into its offering.

This quarter, many fast-moving AI startups that raised money in the previous months finally went live and released their products to the outside world. This includes both infrastructure companies trying to reimagine the MLOps stack and AI startups applying LLMs to previously manual engineering or security workflows. On the infrastructure side, companies like LastMileAI ($10 million seed led by Gradient Ventures), Vellum ($5 million seed led by Rebel Fund, Eastlink Capital, Pioneer Fund, and others), Vera ($3.3 meed seed), and Patronus ($3 million seed led by Lightspeed) are all trying to provide LLM tooling and enable engineers to build generative AI apps. More specifically, Vellum and LastMile AI are building end-to-end developer platforms for building apps with LLMs, while Vera is focused specifically on deployment and policy creation and Patronus is focused on model evaluation. On the application side, some novel use cases and products are emerging for technical practitioners. Grit ($7 million seed led by Founders Fund, 8VC, and A*) is using generative AI to fix technical debt automatically. Gomboc AI ($5.2 million seed led by Hetz Ventures and Glilot) is using AI to remediate cloud infrastructure vulnerabilities for security teams. Overall, we expect continued evolution of AI use cases and the development of more infrastructure tooling to support these applications.

Advancements in AI will revolutionize the Built World, especially in industries like construction that seemingly missed out on the efficiency gains of the SaaS revolution. If 2022 was defined by investment dollars flowing to SaaS models for enterprise property managers, construction GCs, and capital owners, 2023 is the year of augmenting those SaaS models with recent technology advancements, particularly AI/ML, robotic process automation (RPA), and computer vision. This quarter, we led a $6 million seed round in Gryps, a NYC-based company leveraging RPA technology to standardize and analyze data across systems for capital owners operating large construction projects. Poliark, another NYC-based startup, is taking advantage of advancements in AI to construct digital twins for the Built World. Poliark raised a $500,000 round led by APY Ventures, KT Portföy, Sustainable Impact, and Rubellius Capital. As AI continues to advance and macro-tailwinds in the construction ecosystem (aging workforce, climate provisions in the IRA, etc.) further push the industry to prioritize efficiency, we’re excited to see a new crop of companies leveraging cutting edge technology to revolutionize one of the most digitally laggard and large industries in the world.

As belts and budgets tighten, companies are increasingly scrutinizing their payments ops workflows to watch the dollars in and out. There's a ton of leakage in the billing, reconciling, and cash flow management side of businesses across industries and customer types and we're seeing software being built to increase visibility and decrease manual workloads. Statement raised $5 million from Insight to build a platform that allows finance teams to better manage cash flows end to end. Some verticals have especially complex funds flows and require specialized solutions. TripSuite, which raised $2 million this quarter, helps travel agencies manage invoicing, commission payments, and reconciliation back into the general ledger. Although (announced!) fintech seed fundraising has been a bit slower than usual, we've continued to see great teams building software to solve headaches for AR/AP and treasury teams.

As consumers become increasingly individualistic, we’re noticing AI driving a shift towards hyper-personalization. Earlier this year, we saw Klaviyo go public, fortifying the industry demand for personalized marketing. In Q3, seed-stage companies only reinforced this trend. Glimpse raised a $4 million seed round to build a self-service research platform that delivers AI-driven insights analyzing consumer behavior. Sizzle raised $7.5 million to provide AI-powered personalized learning for school subjects. Yaysay raised $8 million to offer a unique shopping experience, leveraging AI to recommend relevant brands. In this era of advancing AI, we're excited to see technology that redefines the way businesses deliver hyper-personalized experiences to their customers.