Primary Is About Its People—and That Makes for Great Early Stage Investing

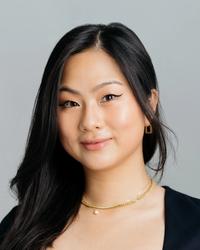

The firm’s new fintech partner Emily Man knows people and business are intricately intertwined, and that’s why she found a new home at Primary.

“The people are all that matter.” As a fresh hedge fund analyst itching to get into the secret sauce of valuations metrics and complex operating ratios, I couldn’t help but feel a bit disappointed hearing that advice. It couldn’t be that simple.

And yet—nearly a decade in—I’ve subscribed. Growing up, I attended 7 schools in 4 different cities around the world. Change was the only constant. In my career, I’ve invested in businesses at every stage—as early as pre-product ideation through to 100+ year old companies in structural decline, and I’ve seen trends come and go. Across cultures, cities, industries, and stages, there has been one constant: At the end of the day, it’s the people that matter.

It’s my one month anniversary of officially joining team Primary, and as we look towards welcoming friends this week who are local or traveling in for our best NYC Summit yet, I wanted to share some insight into why I joined.

The People Make Primary Special

“I’d work with him in a heartbeat.” Having known Laura Spiekerman, Cofounder and President of unicorn fintech Alloy for years, I knew this was not light praise. In that Berkeley coffee shop over one of our frequent catch ups, she pulled back the curtain on the rocky early days of Alloy and Primary Cofounder Brad Svrluga’s unwavering support. Tommy Nicholas, her cofounder and the CEO, echoed the sentiment: “Brad really cares about the people and then gets to know the business better than anyone.”

How we make 1+1= 3

At Primary we believe that it’s imperative to understand people to understand the business. To do so, the team devotes thousands of hours to working with our founders. My partner Cassie Young straddles our Impact efforts while also leading GTM SaaS investments. Rebecca Price, my partner who leads our talent work, and Lisa Lewin, our CEO in Residence, know the challenges and pitfalls of leading enterprise-scale organizations better than I ever will. Every leadership and investment discussion includes their invaluable perspectives. I know that having their lens makes us all better investors. In many ways, our Impact team is our (not-so) secret weapon. And it influences how our Investors work, too. It’s not uncommon for members of our Investing team to spend a whole day a week with a company leading up to an especially crucial period of growth.

Impact as a differentiator

In venture, there’s a lot of lip service about supporting founders. At Primary, we’re focused on showing up and delivering results. We’re ready to commit unreasonable resources towards it. This means $4.5 million on full-timer salaries and a 2x operator to investor ratio on the team. Most importantly, these folks are all seasoned experts on navigating the choppy journey to product-market fit. And the results speak for themselves. We have over 2x the industry average graduation rate from seed to Series A.

The growthiest seed investors you’ll ever meet

Seed is still early in institutionalization. Too often, early stage investing can feel a bit like a game of hot potato—packaging up companies to look good to downstream investors or an option bet to be at the table for the next round.

At Primary, we only invest with the highest conviction. It’s only been a month but I already know the analytical rigor and depth of work in our investing process is world-class. Over the last 18 months, Primary has deliberately moved towards specialization, something Brad has written about recently here. This forces each sector-focused pod of investors on our team to deeply understand the trends and dislocations impacting our respective industries while the broader investment team makes sure we don’t get too lost in the weeds.

The Beating Heart of Fintech Has Moved to NYC

When I started my venture career, the NYC tech ecosystem was consistently described as “collegiate” or “tight-knit”—aka small. After three years in the Bay Area, the New York tech scene I returned to is nothing like the one I left. Remote work leveled the playing field and erased borders.

I don’t doubt the Bay Area will continue to play a critical role in the tech and startup world. That said, NYC has some advantages – particular for fintech companies. NYC has long been the finance capital of the world, and in the last decade, the beating heart of fintech has shifted east. As fintech startups increasingly look to partner with, hire from, or sell to traditional financial institutions, being in NYC (and a stone's throw from DC) is a no brainer.

And the Valley has taken notice—many of our Bay Area investor friends have recognized the importance of the New York ecosystem and have opened up offices and built teams here.

As an exercise, I asked top investors which venture firm has been the driving force of change for the NYC tech ecosystem. Primary came up every time. Ben Sun and Brad have been champions of the ecosystem since long before it was obvious. I’ve seen firsthand the impact of the time and energy they’ve poured into building up the connective tissue and communities that a thriving ecosystem needs.

I’m Looking to Back the Next Generation of Fintech Leaders

Fintech is currently navigating choppy waters. The hype of the last couple years brought funding to unprecedented levels which are now coming back to earth. That said, we’ve just scratched the surface so far. This analysis from my friends at Coatue, public fintech companies are just 2% penetrated in the market cap of the financial services sector base. There’s infinite room to run.

The last decade of fintech was defined by scale and access. It has reshaped the way that consumers and businesses interact with our financial system. However, peel back a glossy UI and you’ll find tons of legacy tech, broken processes, and manual band-aid fixes.

The next generation of fintech winners will tackle the deeper, gnarlier problems that underpin our financial infrastructure today. They will draw best practices from best-in-class tech companies, traditional financial institutions, and multinational enterprises in adjacent industries. There’s no better place for all those to meet than NYC.

As someone who’s never really fit a mold, I’m looking for those who aren’t afraid of looking at the world differently. Who aren’t afraid to question the status quo and tackle very unsexy problems at their core.

That’s who I am, that’s who we are, and if that’s you—I’d love to hear from you.