The Q1 NYC Seed Report: Even With Dips, Still Ripping

Despite overall market cooling, the early stage landscape continues to flourish.

We knew it wouldn’t last forever, but even a bit of slowdown leaves New York City’s early stage startup ecosystem in a very strong spot.

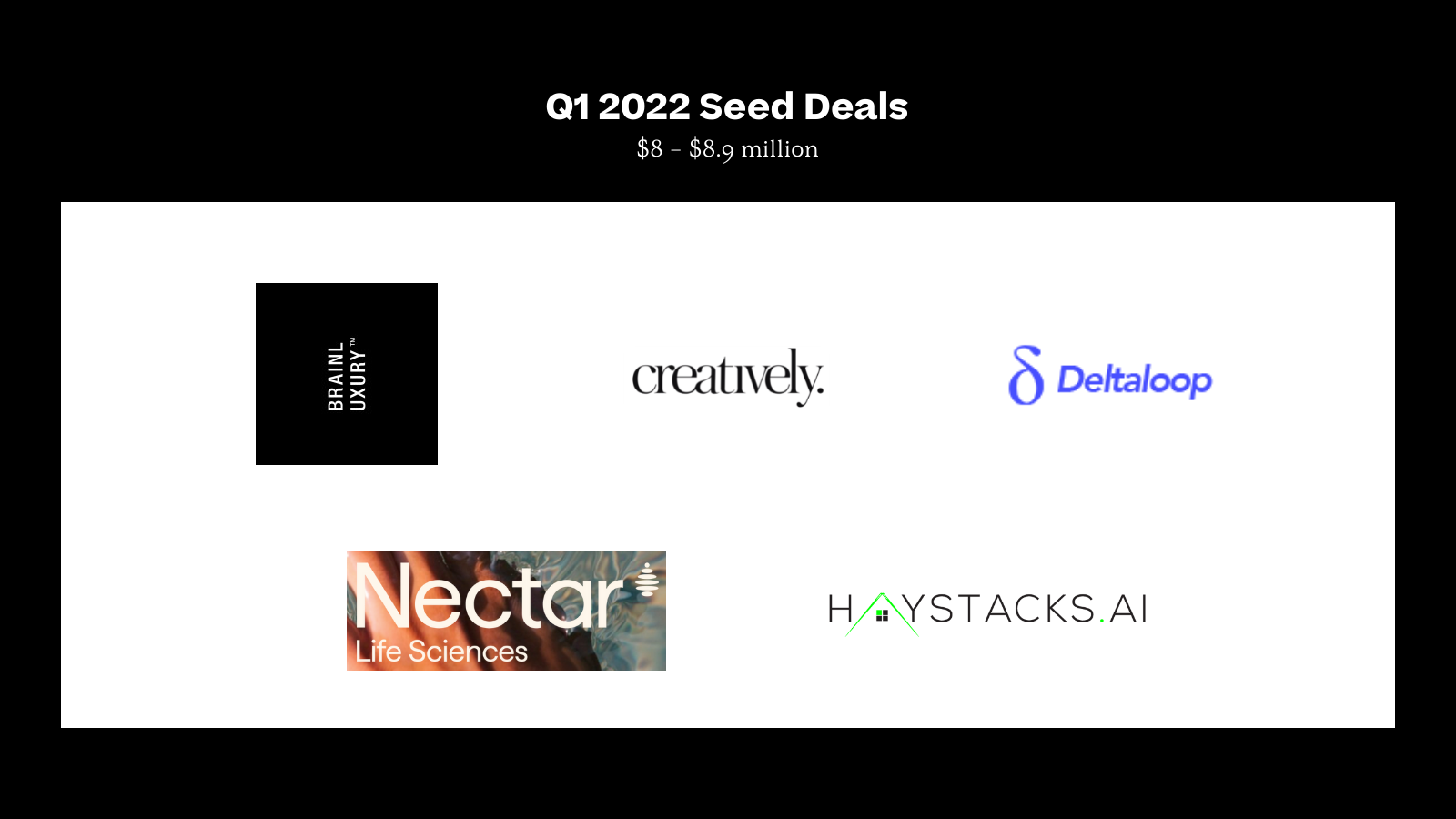

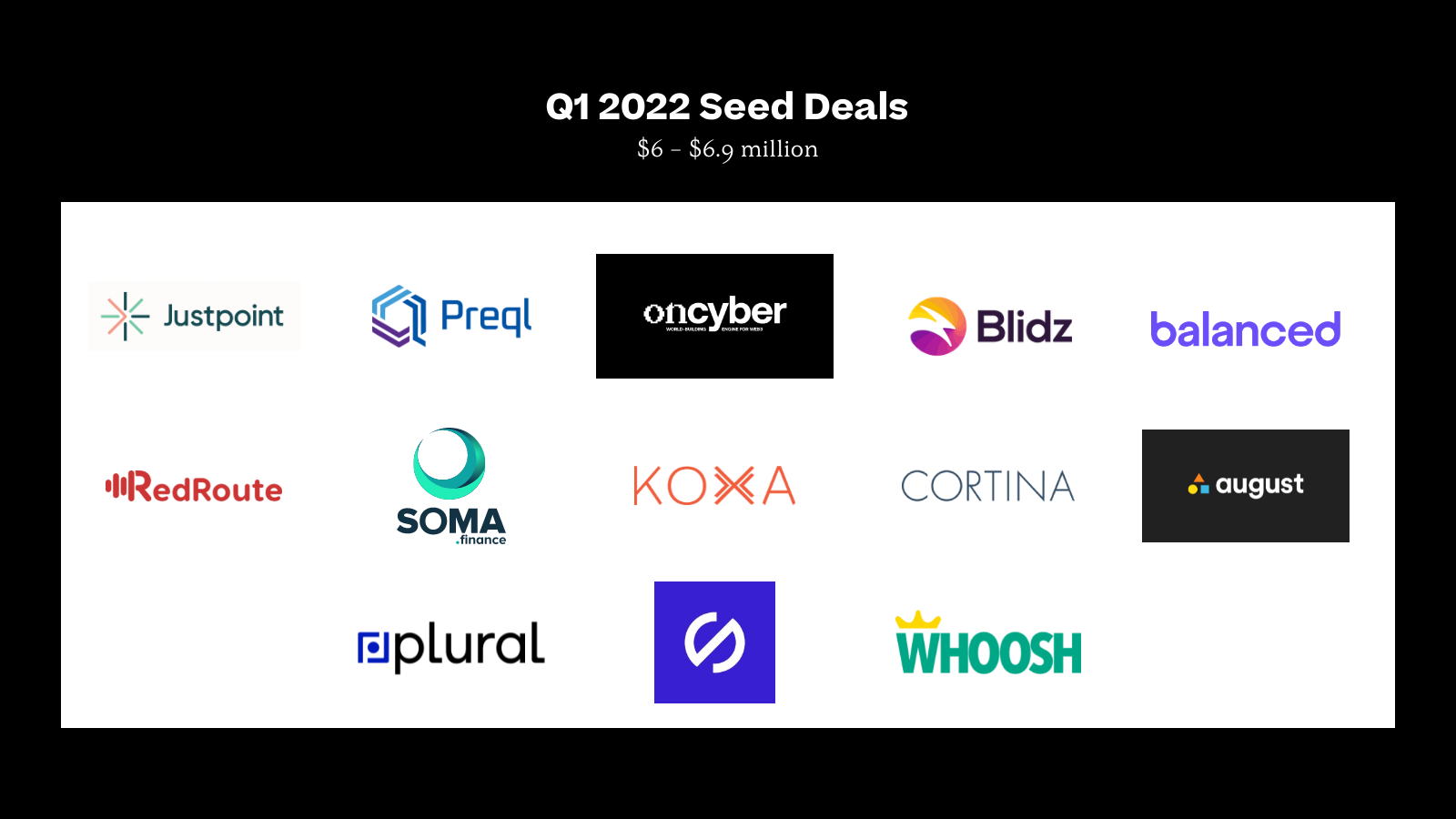

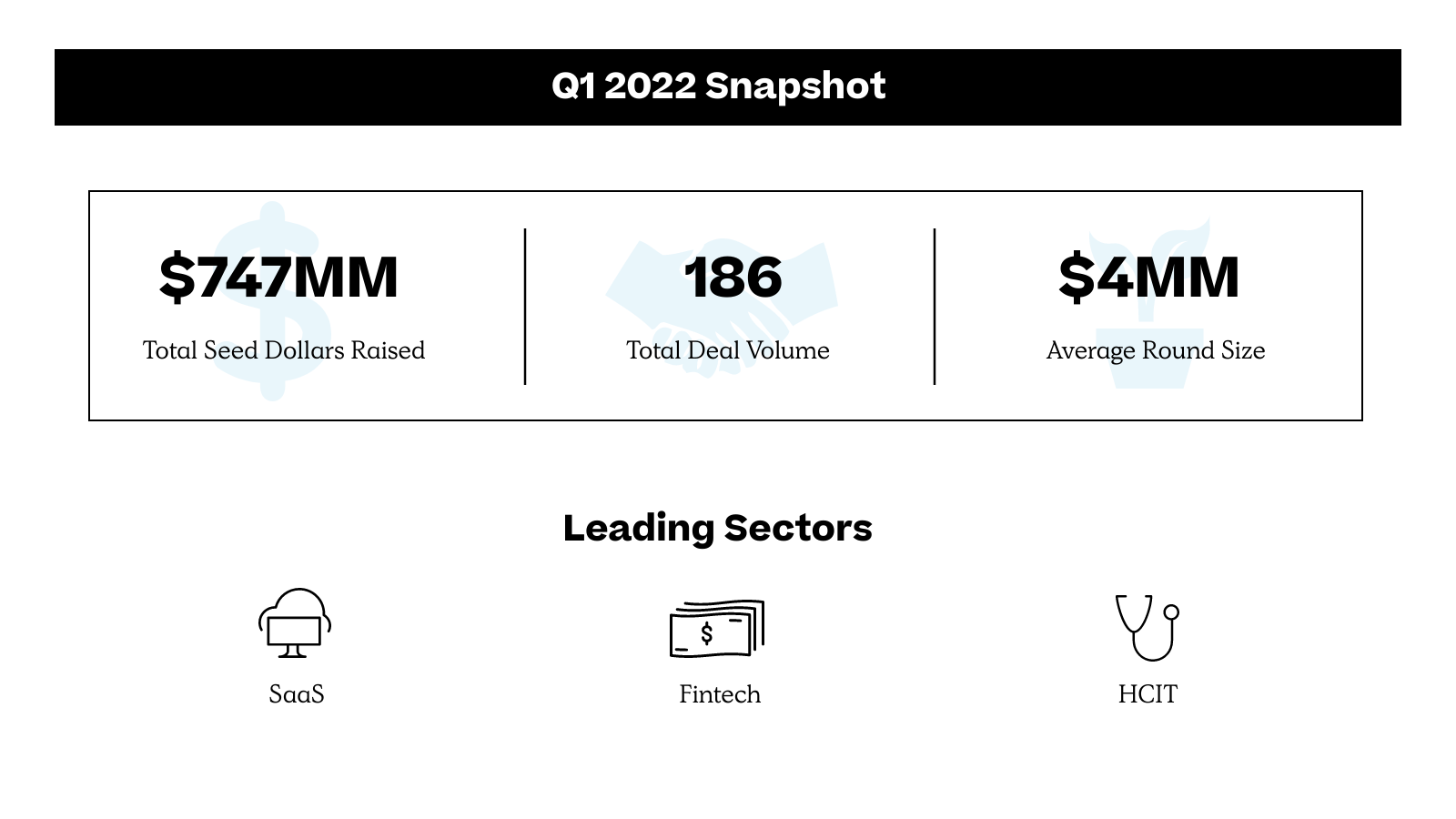

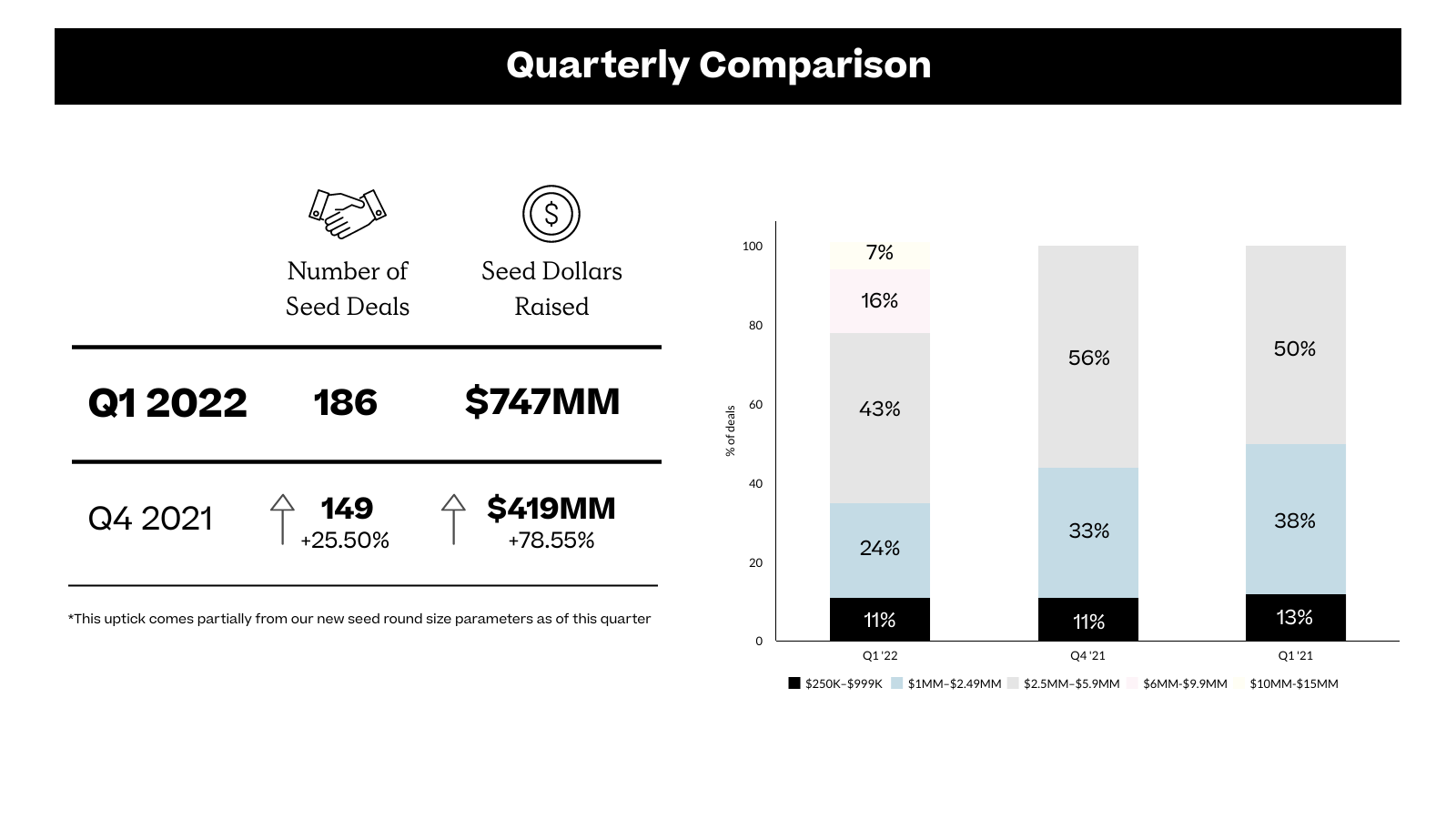

To kick off our record keeping for 2022, we finally got around to something we had been considering since last year: We widened the range of seed deal values we analyze in this report. While previous years’ seed reports tracked deals up to $6 million, that cutoff simply became outdated in this past year’s crazy market. Starting now, we’ll include rounds up to $15 million—we’re seeing nearly 25% of all deals this quarter fall in that range.

With that change, of course our scales are tipped when comparing this quarter to previous ones. If not for the 37 deals that came in above $6 million, this quarter’s checks would have stalled out at just about the same volume and value as last quarter: 150 total compared to last quarter’s 149, with less than a percentage point change in total funding. (And that was a record-setting quarter, for what it's worth.)

But even with these caveats, the NYC seed environment is seeing phenomenal success compared to the widespread cooling in other geographies and funding stages. Data from CB Insights indicate global VC funding dropped 19% quarter over quarter. Crunchbase also noted this slowdown, the first in a year of record funding globally, but caveats that overall funding is still 7% ahead of Q1 2021. For New York City’s seed-stage founders, that silver lining is even brighter: Deal volume is up 192% and total funding is up 360% year over year.

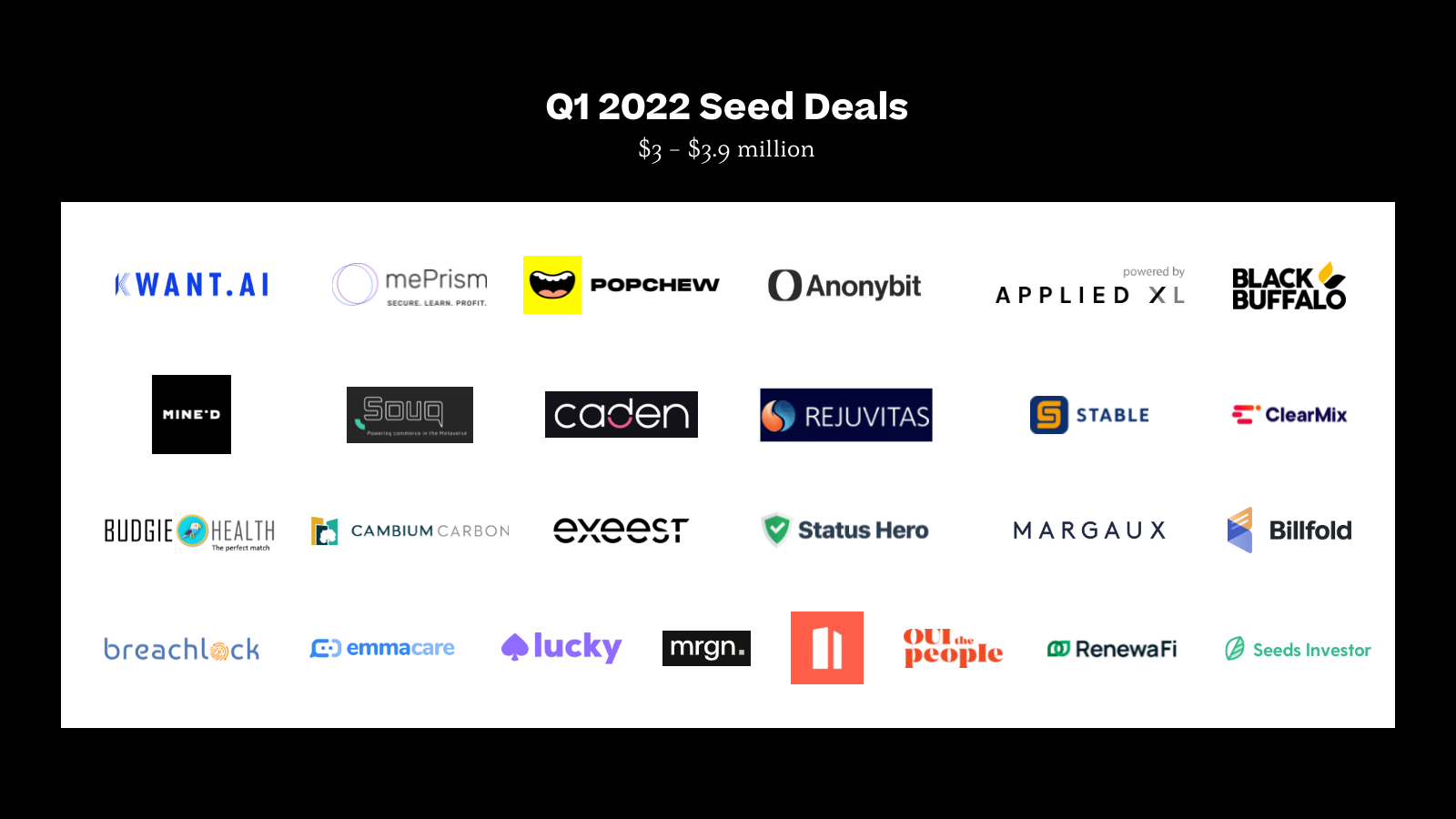

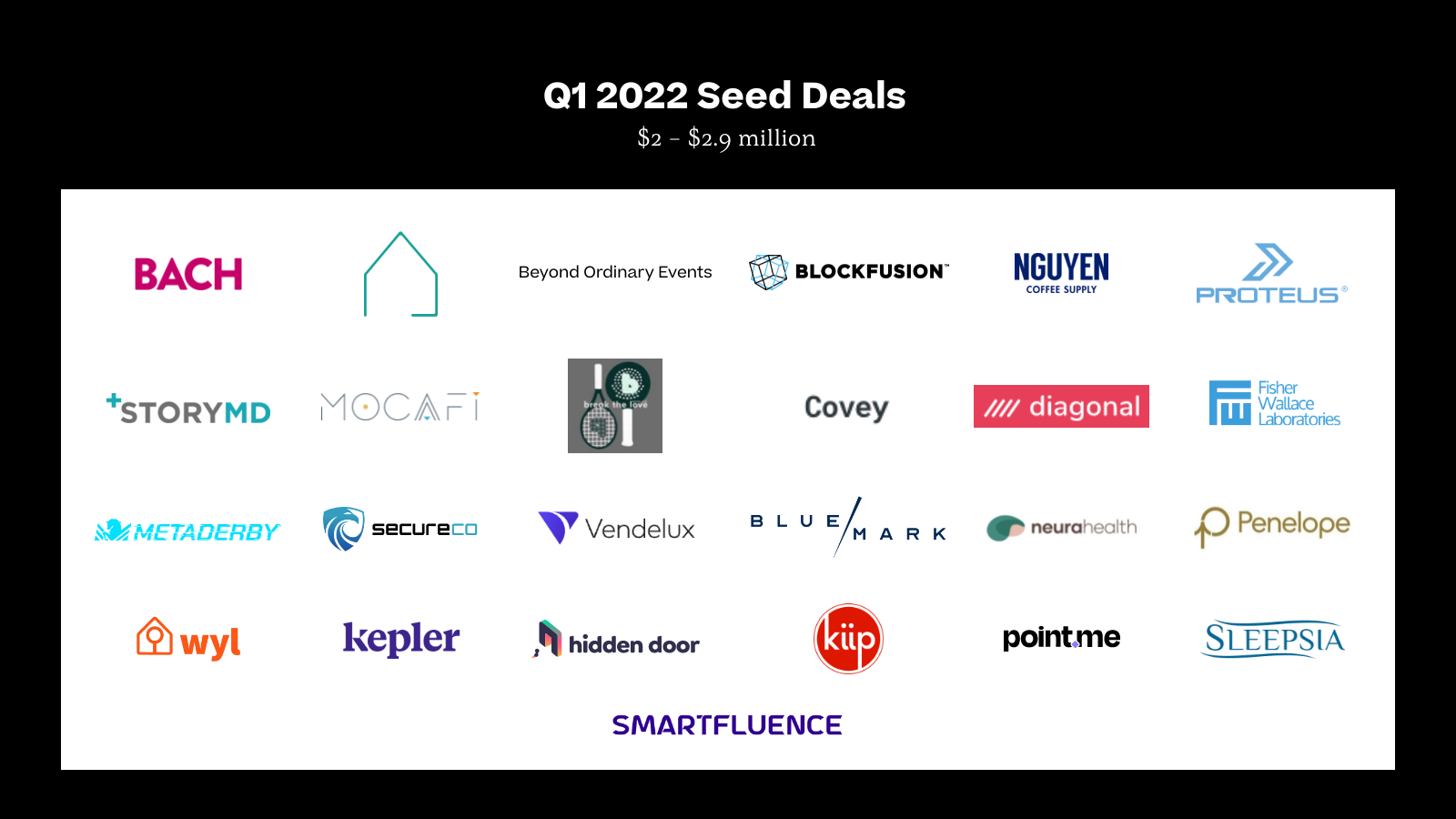

Here are some of the trends within that wider story that particularly stood out to our team—and keep scrolling for complete snapshots of all the companies that announced seed rounds this quarter, based on Crunchbase, PitchBook, and our own proprietary knowledge of deals.

Over the past few years, payments went from becoming an innovative way to add in additional revenue streams and improve market size, but recently, the idea of payments has become table stakes. Companies like Finix paved the way for any sized business to be a payments business while even encouraging some big players to consider bringing payments in house—Apple just recently announced Project “Breakout,” which is an initiative for Apple to develop its own payment processing technology. Recently, including last quarter, there has been a trend around the verticalization of payments—Boom Pay, Sika, and Billfold are three businesses tackling exactly this. Boom Pay is allowing individuals to both pay their rent directly through the platform but also help them establish credit. Sika Health is a payments solution for the healthcare sector, allowing shoppers to pay directly with their FSA/HSA account at checkout. And Billfold is a payments solution for the live entertainment industry. Payments will continue to be a major part of the success of companies, so I’m ready to see what’s next.

In the world of technology and startups, it’s a well-known fact that the healthcare sector has been on a funding tear over the past few years as the industry continues to modernize. To help support this much needed shift, money continues to flow into “healthcare infrastructure” companies that aim to help healthcare organizations move from pen and paper to software. Last quarter in New York City, we saw this trend continue with multiple fundraises. Companies like Alaffia raised $5M led by Anthemis Ventures to automate the auditing of medical claims to help eliminate overpayments. Meanwhile, CertifyOS raised $4.5M from Upfront Ventures, Max Ventures, Arkitekt Ventures and others, to help automate the onerous process of licensing and credentialing medical providers. Focused on helping healthcare payers better build and manage their medical provider network, J2 Health, a Primary portfolio company, raised $4.4M from us, Tiger Global, and Box Group. These three companies are only a handful of the businesses that raised in the healthcare infrastructure world in the past quarter and we’re excited to see more companies in this part of the healthcare sector.

Open source software continues to be a powerful distribution and community-building approach, putting best-in-class software in the hands of developers before large enterprises. Although the west coast has historically been the hub of open source software activity, the east coast, specifically NYC, is catching up. PreQL raised a $6.8M seed round to enable developers to more easily visualize their PostgreSQL databases. Plural, a Primary portfolio company, raised a $6M seed round led by SignalFire to help enterprises more effortlessly deploy and manage open source applications. Both of these companies are making software tools more easily accessible to developers, one form of “arming the rebels.” Deltaloop, which raised an $8M seed round, is trying to bring AI to every business. Although quite different than PreQL and Plural, which are focused on open source, Deltaloop is democratizing access to AI tools typically reserved for data scientists and other technical specialists - yet another form of “arming the rebels.” Overall, companies making novel technologies accessible to those who previously lacked access to them are raising interesting financing rounds and gaining momentum.

We all know that you can’t have new regulations without a new wave of software tools popping up, and this quarter was no exception. In fact, regulation shifts usually indicate a healthy indicator for up and coming technologies! While there have been many companies that capitalize on regulation shifts, Stark, Caden, and EnquireLabs stood out over the past 12 weeks in the ways they are innovating based on recent changes. One transformation that’s currently underway is the new DOJ Guidelines that are trying to make the web more accessible for the disabled population, and Stark’s value proposition zeros in on this obstacle—Stark’s platform combats the huge amounts of revenue that companies lose due their software being inaccessible. Another big movement happening is the shift to zero party data, which is proprietary data that individuals own and can proactively share on their own accord. EnquireLabs, through surveys, and Caden, through an API, are aiming to equip brands with data that is no longer automatically getting captured in order to help them provide better user experiences. Who knows what is in store for future changes, but we at Primary are excited to see what will come!