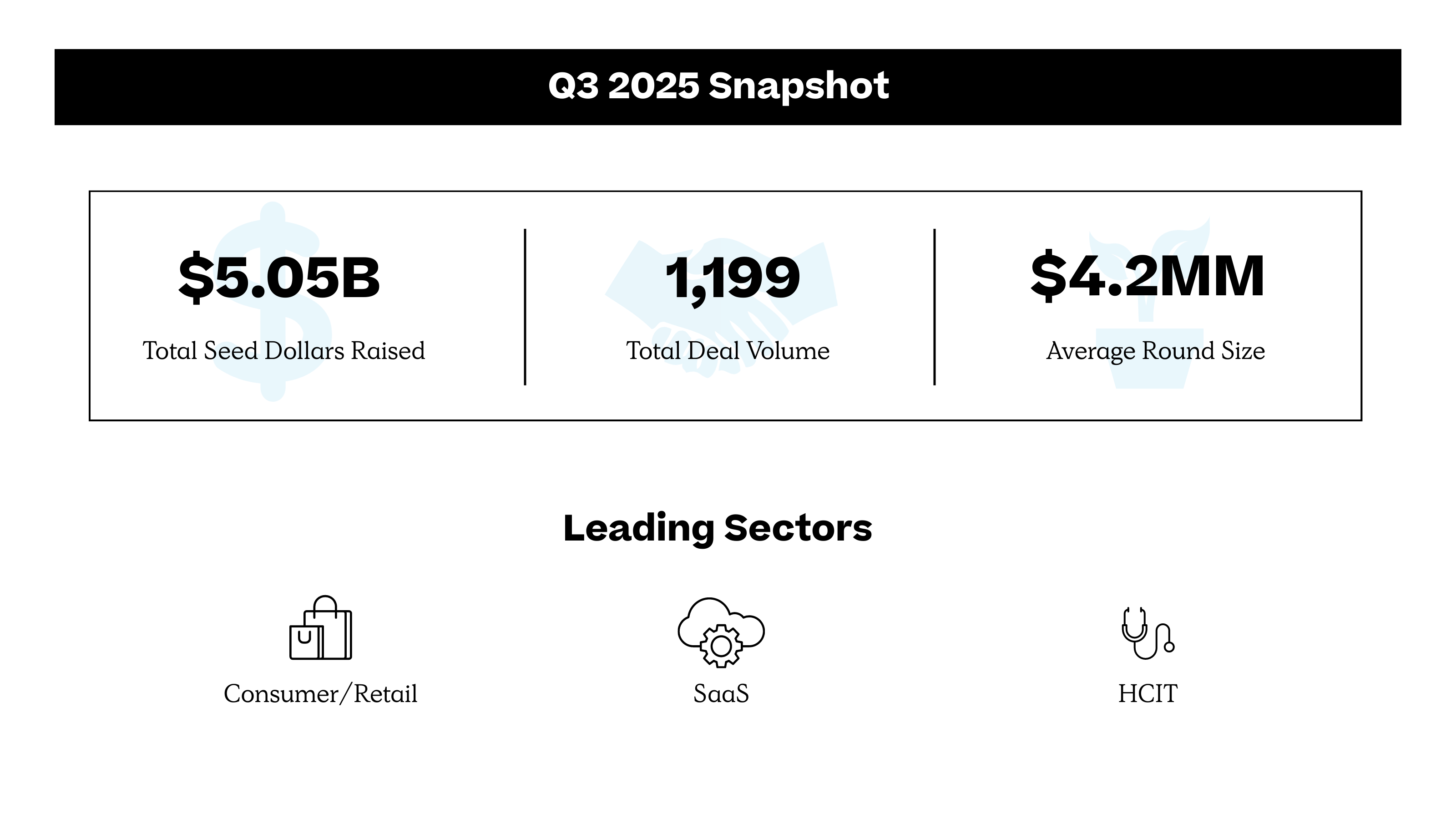

Seed Funding Picks Up Nationwide in Q3 2025

Q3 saw a national increase in seed activity, with larger rounds and continued concentration in AI, healthcare, and fintech.

New York’s seed market strengthened in Q3 2025. Deal volume rose 38% quarter over quarter, from 105 to 145 rounds, marking a clear rebound from Q2. Average round size increased from $4.3 million to $5.6 million, and a larger share of rounds fell in the $6–10 million range (29% of deals—compared to 14% last quarter), indicating investors are taking higher-conviction bets.

AI, healthcare, and SaaS remained the leading categories, together accounting for 34% of all deals. The number of AI companies in New York increased 45% quarter over quarter from 11 to 16, highlighting sustained enthusiasm for intelligent automation and applied AI across sectors. Healthcare and SaaS activity held steady, reinforcing their role as stable anchors within New York’s seed ecosystem.

Overall, Q3 reflected a disciplined but confident investment environment. Capital is consolidating around proven verticals, round sizes are expanding, and investors are demonstrating a continued willingness to fund startups showing tangible traction and technical depth.

If Q2 was about momentum, Q3 was about convergence—the blurring of lines between Fintech and Enterprise AI. Roughly half of the quarter’s seed deals sit at this intersection—where finance is becoming code and AI is becoming accountable.

One of the clearest shifts was the institutionalization of private markets—a move toward software that treats private markets with the same precision and automation as public markets. The likes of F2 AI, Bridge, and Trove are building intelligent data and decisioning infrastructure for fund managers and allocators. Our very own Maybern sits at the forefront of this movement, serving as the operating system for modern fund operations.

Meanwhile, the convergence of Fintech and ecommerce is reshaping transaction infrastructure itself. Taxwire automates global sales tax and compliance across jurisdictions in real time—turning what was once a back-end liability into a seamless part of the customer experience.

The more transformative story is agentic commerce—and our recent investment, Circuit & Chisel, is leading the way. Their MCP-based protocol (AXTP) allows AI systems to negotiate, execute, and settle payments autonomously within set financial and compliance parameters. This unlocks an entirely new value chain across discovery, procurement, and payment—a frontier we’re actively exploring.

The same architecture powering these agentic systems underpins the next phase of Enterprise AI infrastructure. Startups like ScaleKit and Oraion are building the scaffolding for enterprise-ready autonomy: model evaluation, permissioning, observability, and safety. The enterprise AI stack continues to deepen.

The connective tissue across these areas is becoming increasingly apparent. As transaction systems learn to act and enterprise systems learn to reason, the line between a transaction and a decision is disappearing.

What comes beyond text? This was the natural question that followed the success of OpenAI’s GPT-3 model. Text provided the perfect training ground for transformer architectures—abundant, structured, and deeply expressive data that made it possible to model reasoning, creativity, and conversation. But text has been fully explored, and founders are turning their attention to new modalities to express the full potential of human thinking and understanding.

Just as GPT-3 unlocked language, the next generation of models seeks to unlock new dimensions of understanding. Two fundraises this quarter capture this evolution. LGND, with a $9 million seed from Javelin, is building “ChatGPT for the Earth.” They are giving developers the tools to create and manage geographic embeddings, which enable geospatial foundation models to reason over maps and satellite imagery. These capabilities open high-value applications across sectors like mining, renewable energy, and transportation, where spatial reasoning is critical for efficiency and safety.

As models move beyond text and image, a missing piece of intelligence is emotion. Nuance Labs, with a $10 million seed led by Accel, is building “emotional AI” with the first human foundation model—one that understands and expresses emotion in real time across speech, facial expression, and body language. Nuance is betting that emotional understanding will be essential for closing the “uncanny valley,” powering more human-like interactions across avatars, agents, and voice interfaces.

Both companies reflect that the frontier is moving forward at a fast clip. It’s been less than three years since ChatGPT was released, and the pace of innovation has been nothing short of extraordinary in the time since. We’re moving quickly beyond text into new modalities that are closing the gap between human and machine.

Tracking a package, from start to finish, is no simple task. It’s a multi-step journey—from the point of packaging, through multiple warehouses, to the customer’s doorstep�—and every transition introduces opportunities for error. This quarter, several startups emerged with new technologies designed to bring clarity to fragmented supply chains, improving visibility both inside the warehouse and at the final point of delivery.

Dockware and Doorstep.ai embody this shift toward visual intelligence and hyper-accurate delivery verification. Dockware, with a $2.5 million seed led by Zenda, uses computer vision and AI to accurately capture freight dimensions, physical condition, barcodes, symbols, and other data in seconds. Their product uses both hardware and software to improve dimensioning, inventory, and identification of packages. Doorstep.ai, with a $7.8 million seed led by Canaan Partners, is using indoor tracking technology to track parking, entrance, floor, and drop-off—giving teams precise visibility into every delivery. Their sensor fusion technology runs on a driver’s smartphone, even in GPS-weak environments like dense urban cores or indoor facilities. Failed deliveries are costly for brands and logistics providers alike, and Doorstep’s solution ensures every handoff is verifiable and transparent.

Technologies like Dockware and Doorstep.ai are transforming the delivery process into a fully observable system, where every shipment can be tracked, from inception to delivery, building trust and dependability in our supply chains.

After years of digital health solutions that promised virtual care but delivered little human empathy, a new wave of founders is rethinking how AI can bring empathy and presence back into care delivery. This quarter saw a rise in companion AI platforms that use conversation to support cognitive health, aging populations, and long-term care environments.

Startups like Meela and AcquisitionAI are early examples of this. Meela is building a personalized voice companion for seniors that supports social engagement, wellness reminders, and caregiver coordination through natural conversation. AcquisitionAI is focused on long-term care, where its AI agents handle daily check-ins, scheduling, and medication adherence to reduce staff burden and improve patient connection.

What unites both is a focus on empathy as infrastructure. Rather than automating clinical tasks, these companies are using AI to extend the reach of caregivers, create continuity between visits, and address the emotional and social gaps that traditional digital health ignored. As caregiver shortages grow, these emotionally intelligent interfaces could become a foundational layer in how chronic care and aging in place are delivered.

Seed-stage AI startups this quarter are coalescing around a shared insight: the software stack is being rewritten to center not on screens or scripts, but on intelligent actors. What’s emerging is a new operating layer—one defined not by click paths, but by intent, delegation, and decision-making.

Companies like Intuigence, Leo AI, and Julius AI are early signals of this evolution. Intuigence embeds synthetic AI operators in complex industrial environments—refineries, chemical plants, and power systems—where they interpret documentation, trigger automation, and support human operators in real time. Leo AI transforms design workflows by turning specs, sketches, and engineering constraints into manufacturable CAD assemblies. Julius AI focuses on data analysis, replacing dashboards and formulas with natural language exploration across enterprise datasets.

Rather than building “copilots,” these companies are building colleagues—agents capable of reasoning, acting, and iterating across entire workflows. That autonomy is sparking demand for a new category of tooling: stack components like ScaleKit and TensorZero, which manage access control, memory, reliability, and context-awareness in agent systems. These are not just dev tools—they are the foundations of an execution-first software stack.

The implication? Software is no longer a static surface for input and output. It's becoming a living system—reasoning, adapting, and collaborating. And in that system, agents aren’t helpers—they’re the new default interface for work.

This quarter’s surge in agentic seed funding points to a future in which we no longer build apps for users, but intelligent systems that act on behalf of them.