Seed Funding Soars to Close Out 2024

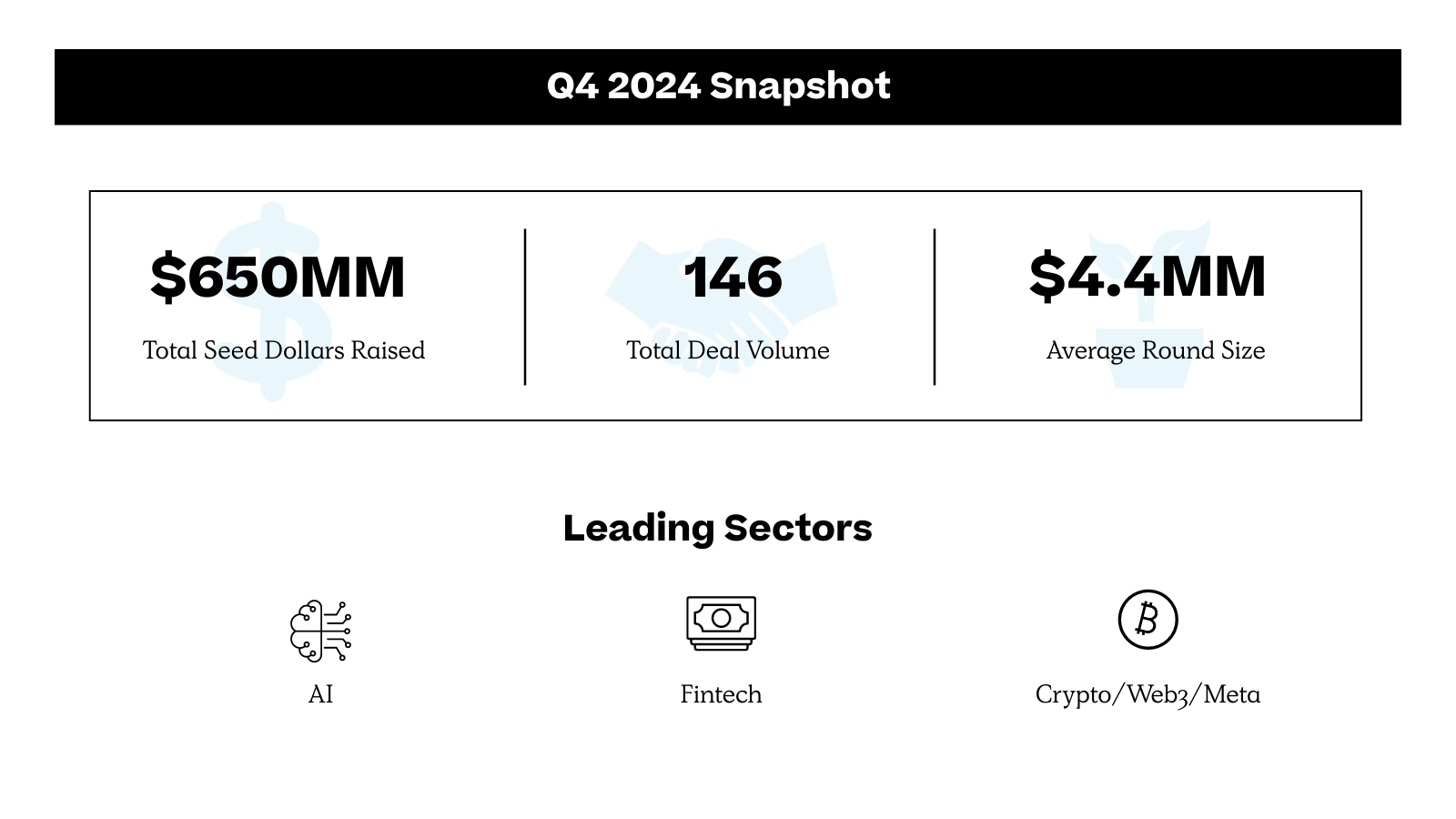

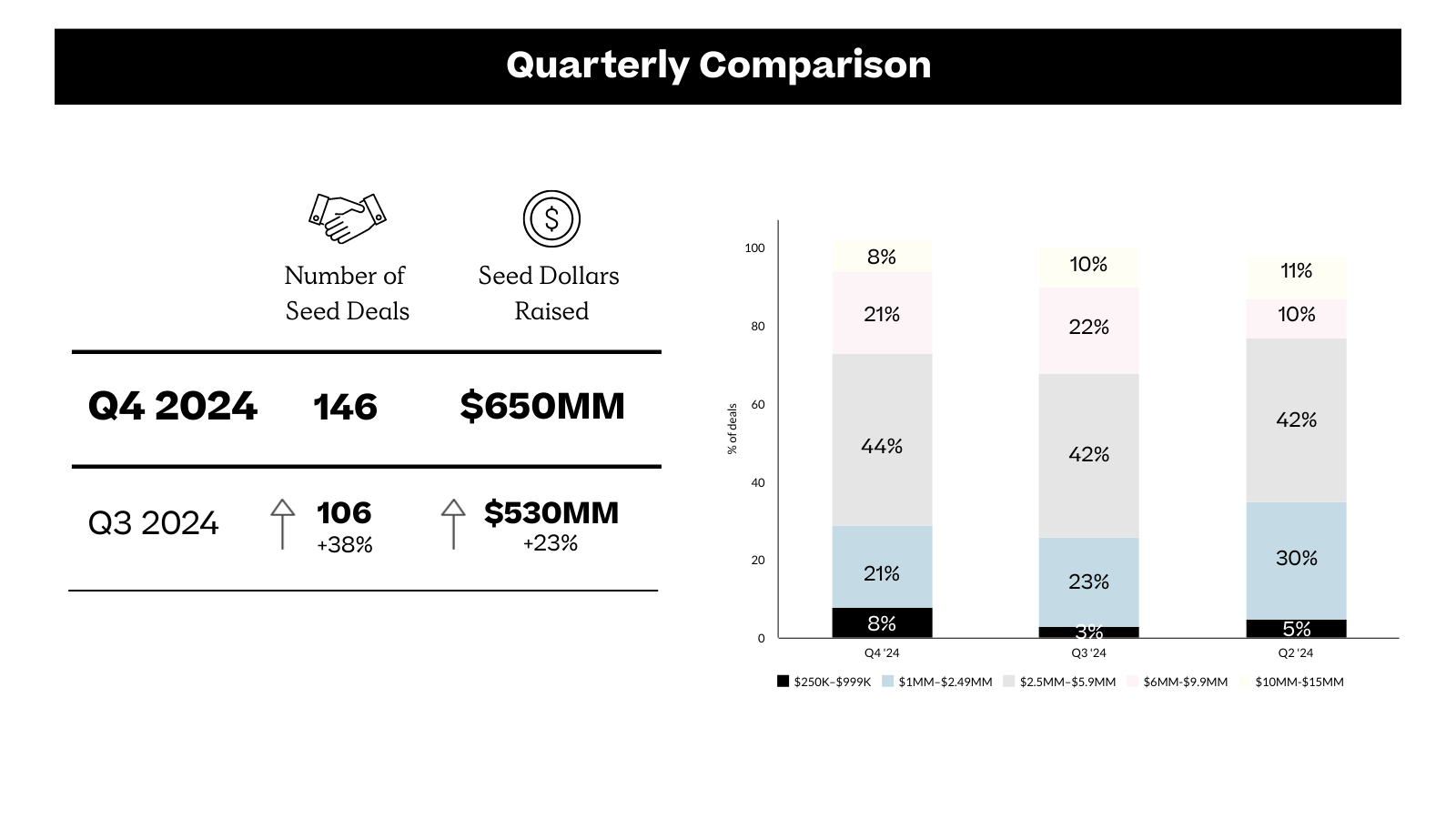

The NYC seed fundraising landscape experienced a remarkable rebound in Q4 2024, with total deals surging by 38% from the previous quarter.

The NYC seed fundraising landscape experienced a remarkable rebound in Q4 2024, with total deals surging by 38% from the previous quarter, reaching 146. Total funding also climbed by 21%, reflecting a significantly more active and optimistic investing environment.

AI and FinTech emerged as clear frontrunners this quarter, with AI deals accounting for 18% of all transactions and FinTech close behind at 16%. The growth in AI was particularly striking, with the number of deals nearly doubling from 15 in Q3 to 27 in Q4, highlighting investors’ sustained interest in the potential applications of artificial intelligence.

This resurgence signals a strong recovery in NYC’s seed fundraising market, driven by a focused enthusiasm for high-growth sectors like AI. Total funding this quarter marked the highest level since Q3 2022, showcasing the ecosystem's resilience and adaptability. As the NYC seed landscape evolves, we remain committed to supporting its dynamic growth and innovation.

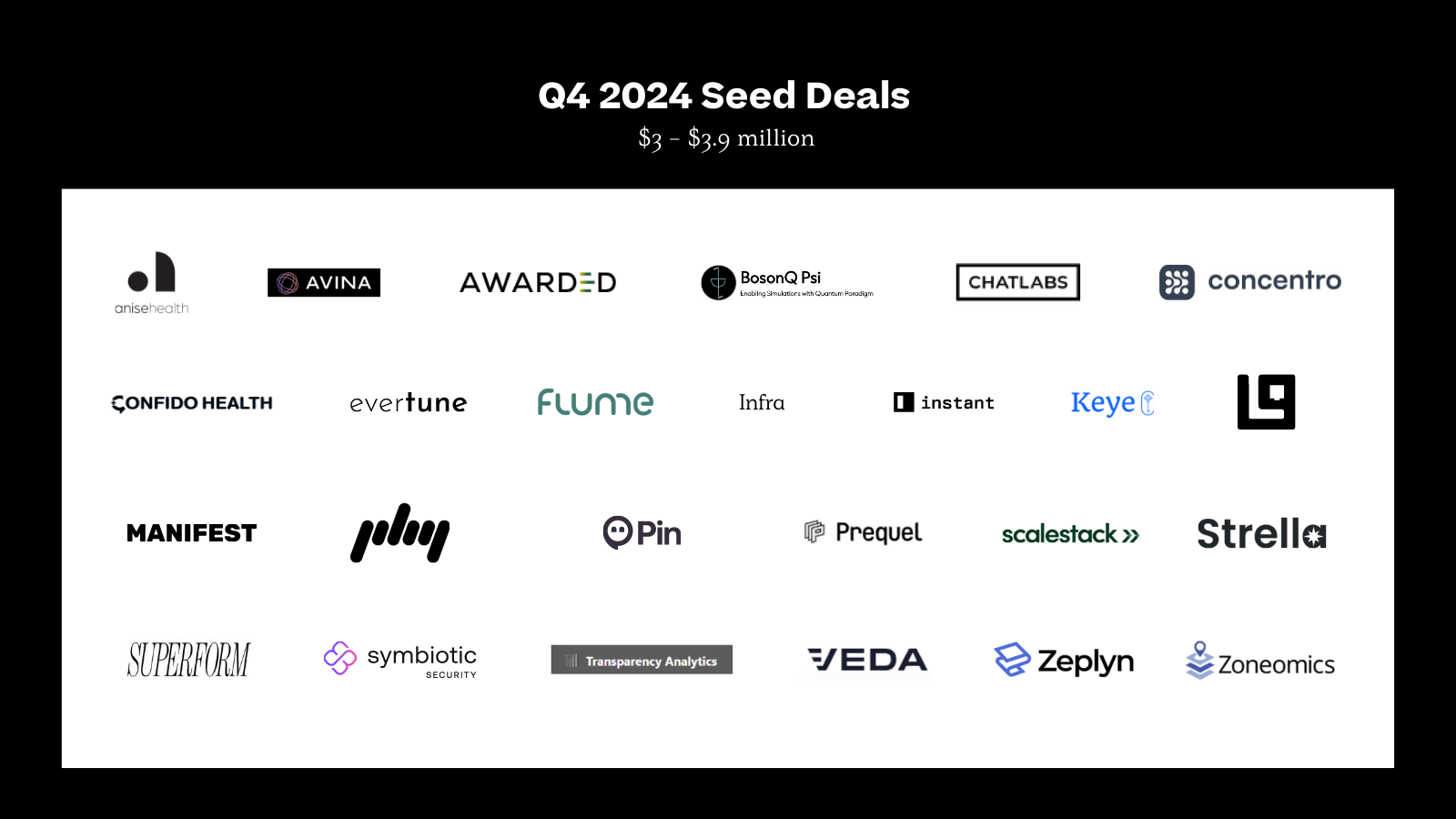

As 2024 came to a close, pharmaceutical companies continued to pour significant resources into clinical R&D, marketing, and software solutions. At Primary, we’ve been increasingly intrigued by the unbundling of pharma services and commercialization engines - from clinical trial support to prescription adherence and access. The traditional pharmaceutical process, which spans R&D, regulatory approvals, manufacturing, and sales, is notoriously complex and fraught with inefficiencies. Rising drug development costs, mounting regulatory pressures, and growing demand for personalized treatments underscore the need for specialized innovators to reshape the industry.

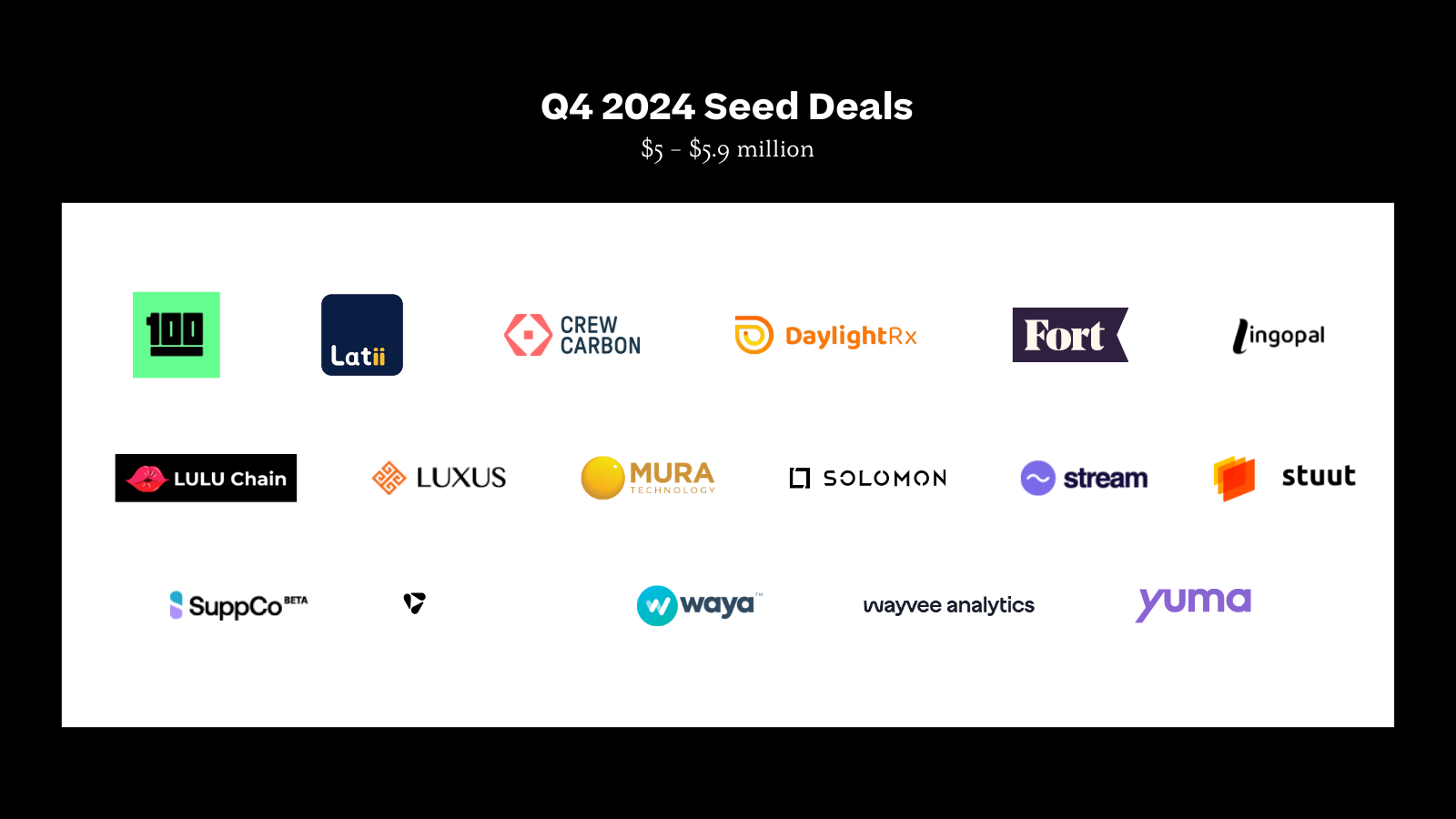

Over the last half of 2024, we’ve seen a number of businesses focused on reinventing the traditional pharma development process. One such example is DaylightRx, which raised $5.8M from Healthy Ventures. The company leverages analytics and optimized workflows to help pharmaceutical companies and pharmacies address operational inefficiencies and reduce inflated prescription drug prices.

We predict this trend will continue into 2025 and we’re encouraged by startups tackling inefficiencies in the pharma value chain and driving toward a more equitable, effective, and patient-centric industry.

The industrial sector has seen a renaissance over the past few years. Much focus has been on software providing workflow acceleration to traditionally manual tasks. AI has further fueled this transformation. However, 2024 marked a notable shift in investment from bits (software) to atoms (hardware). More dollars were invested in startups taking big swings, building complex, physical systems for massive industries, albeit riskier and more capital intensive.

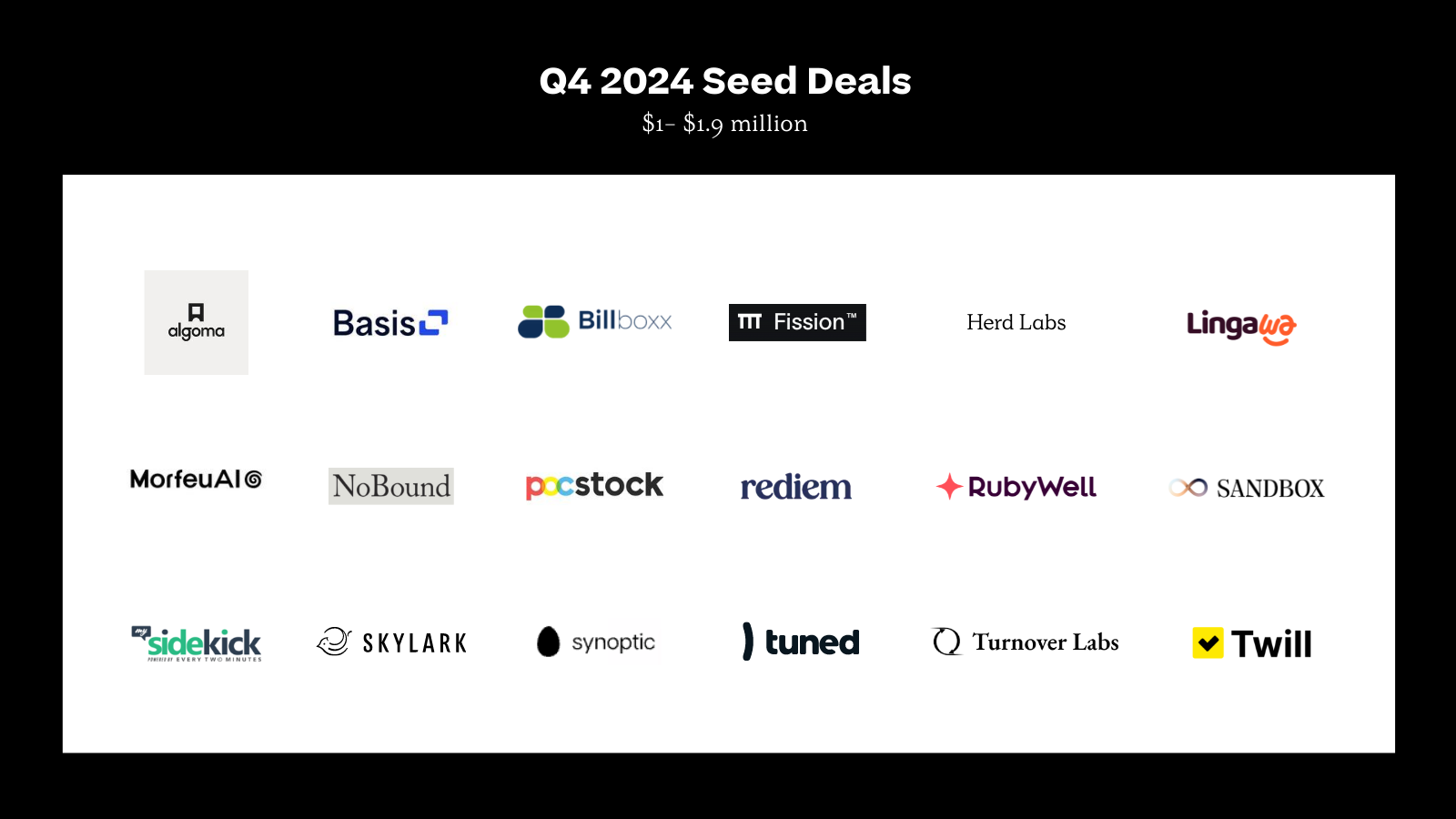

In Q4, this trend continued, particularly with investments in climate solutions for heavy industry. With 23% of US emissions stemming from sectors like chemicals and mining, we’re excited to see several startups building climate-focused solutions for these industries. Turnover Labs raised $1.4M from Collaborative Fund and Pace Ventures to provide on-site synthesis of chemical feeds that are carbon neutral, providing sustainable alternatives to petroleum-based products. Meanwhile, Crew Carbon raised $5.3M from Counteract Partners to improve wastewater treatment and capture carbon dioxide emitted.

We continue to see climate-focused industrial solutions emerge and are optimistic about the new technologies and innovations in 2025.

—Zach Fredericks, Gaby Lorenzi

Coming into 2025, infrastructure startups are doubling down on enabling real, scalable adoption of AI for both enterprises and small businesses. Over the past few years, we’ve seen lofty promises of automation and replacement thanks to AI, but there’s still a significant “POC chasm” to bridge before we get production-grade, safe AI. In Q4, we saw Elvex raise $6.4M from m]x[v capital and Funders Club to enable enterprises to build AI assistants more effectively, for tasks like onboarding new hires and preparing for meetings.

The problem of AI adoption is even harder if you’re not a big enterprise or F500 company with the ability to throw resources at keeping up. This month, Cake announced their $10M Seed Round, led by Gradient, to provide open-source infrastructure for AI to teams of all sizes. By building on top of open-source infrastructure, Cake reduces traditional cost barriers, empowering teams of all sizes to accelerate their AI development.

We’re eager to watch the year unfold and find more ways that AI can create value in our daily lives thanks to infrastructure that makes building AI applications accessible to all.

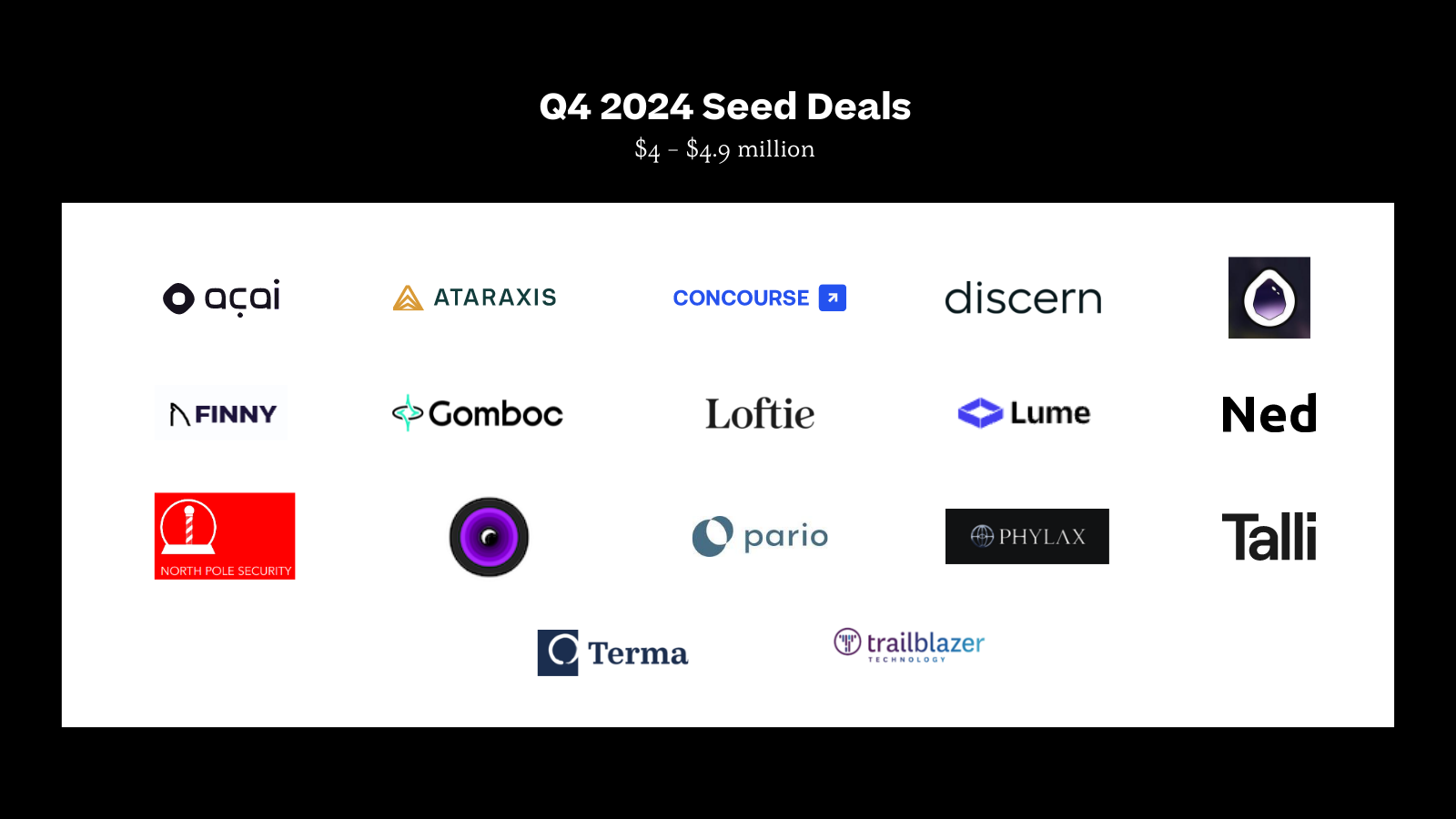

Back in October of 2024, Jason Shuman and I published an article on how AI will unlock billions of dollars in savings for real estate developers. We explored how AI will drive down soft costs - costs associated with financing and service work like architecture and engineering - lowering the overall cost of construction for developers. In Q4, we saw two NYC based startups doing exactly that. Zoneomics, which raised a $3m seed round led by Rosecliff Ventures and others, helps developers quickly and efficiently understand the specific zoning requirements of different areas, which can help expedite both the diligence and permitting phases of pre-construction. These phases are traditionally time-consuming and expensive, with delays in permitting having a severe negative impact on developers’ IRRs.

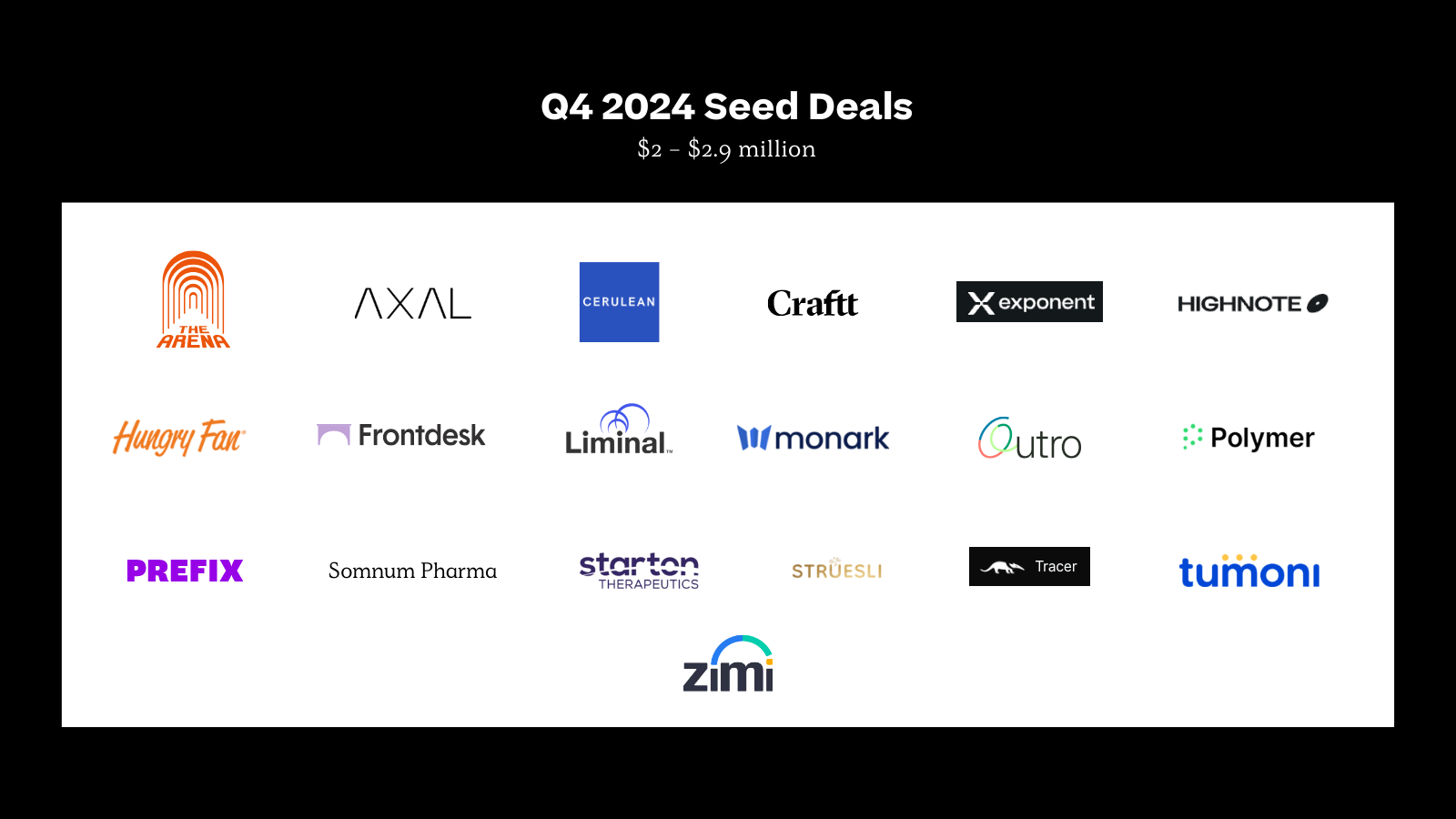

Similarly, Algoma, which raised $1.9m in seed funding from undisclosed investors, is leveraging AI to make real estate feasibility studies for zero-carbon buildings better, faster, and cheaper for developers, cutting out costs associated with long timelines and consultant fees, core drivers of high soft costs. We’re excited to see more startups building software and services to help developers lower the cost of construction, ideally increasing the supply of homes and addressing the housing affordability crisis.

Financial institutions like banks and credit unions are often perceived as slow-moving, held back by outdated systems and bureaucratic processes that result in delays and poor customer service. Meanwhile, Fintech companies have been raising the bar with streamlined, responsive experiences, driving higher expectations among consumers. Customers now demand faster transactions, intuitive interfaces, and superior customer service, pushing traditional financial institutions to evolve. A standout example is Casap, which recently raised an $8.5M seed round led by Lightspeed, with continued support from the FinTech & Enterprise AI team at Primary. Casap leverages AI to help financial institutions manage fraud disputes and chargebacks more efficiently, which has consistently risen year over year since COVID, with more consumers disputing legitimate charges to avoid payment. By automating these processes, financial institutions are able to resolve issues faster and enhance the customer experience, a trend that we expect to see more of.