Seed Report Q2 2025: Taking Our Trend Watch National

As Primary expands beyond New York, this quarter’s Seed Report takes a broader view—capturing early-stage momentum across the U.S., not just in our home market.

For the first time this quarter, we bring you a Seed Report looking at the entire country, not just NYC. Though Primary considers the city a beachhead, it's actually now where a minority of our investments are made and deal nodes are based, so we're opening up a wider aperture for this quarterly readout.

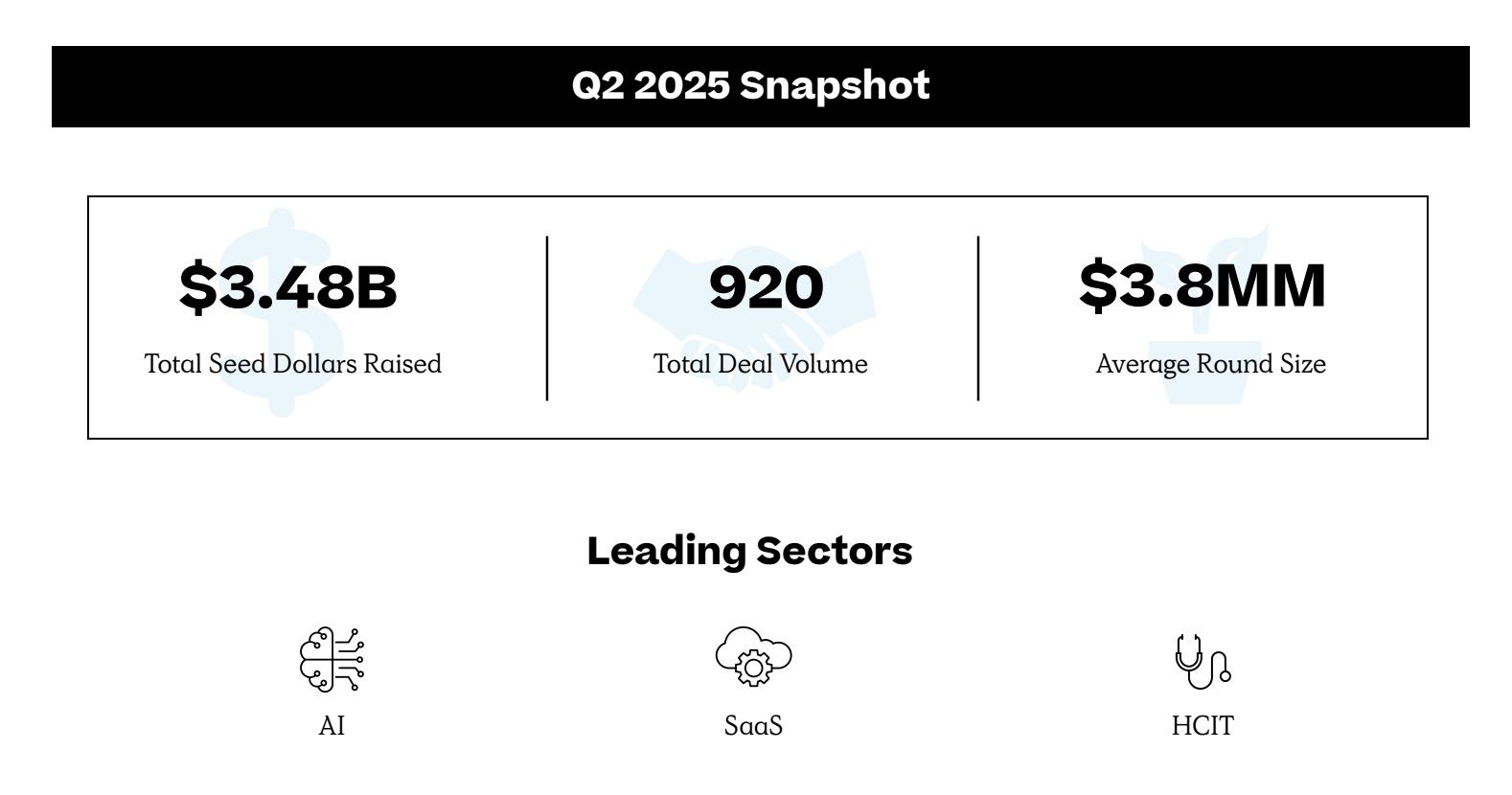

In New York specifically, seed deal volume fell 17% from Q1, dropping from 127 to 105 deals—a sign of a more cautious investment environment. But while activity slowed, conviction held: Average round sizes remained stable, suggesting investors continue to back the companies they believe in.

Sectors like AI, HCIT, and SaaS dominated the quarter, accounting for 36% of all seed deals. Out of these, healthcare led the pack, recording 14 deals. The average round size in healthcare reached $4.6 million, slightly up from $4.4 million last quarter, underscoring sustained interest in the space.

A notable trend was the rise in mid-sized rounds, with deals in the $10–15 million range making up 10% of all deals, up from 6% in Q1. This shift suggests that while fewer rounds are closing, capital is concentrating in companies showing strong growth potential.

Overall, Q2 reflects a recalibrated pace in seed investing—more measured, but still focused on backing high-impact sectors.

As we round out the first half of the year, fintech is making a strong comeback. With blockbuster IPOs from Chime and Circle, and landmark M&A like Melio ($2.5 billion) and Bridge ($1 billion), it’s clear the sector is staging a strong rebound.

This resurgence is driven by activity across CFO tooling, risk/compliance infrastructure, stablecoins, and software as a service for categories in categories like tax, accounting, and wealth. Filed, fresh off a $17.2 million pre-seed and seed raise, is a standout. The company is building an AI-native tax automation suite to eliminate the paperwork burden plaguing CPAs. Automating tedious tasks is freeing up time for more personalized and more complex services.

At the same time, we are seeing massive opportunity in Enterprise AI. Especially as startups build new AI-native applications from the ground up. Penrose is doing just that. They raised $7.5 million from General Catalyst to help large companies transition from AI-enhanced tasks to fully autonomous processes. It acts as a command center, Penrose layers control and observability across systems like CRMs and ERPs to coordinate AI deployment at scale.

Finally, Chicago-based Moonnox raised $2 million from M25 to build tools for professional services firms to deploy generative AI within client-facing workflows. Their AI orchestration platform allows firms to be more efficient and stay competitive in an increasingly AI-driven market.

We believe the biggest winners will emerge in the Fintech x Enterprise AI space where AI-native platforms can unlock operational leverage in deeply regulated, manual, and complex workflows and we’re excited to see what’s in store.

The “service-as-software” trend continues to reshape every category—cybersecurity included. Traditionally, cyber teams have relied on large benches of junior engineers to handle incident response, code review, and penetration testing, escalating only the toughest cases to senior staff. Team performance was largely a function of headcount. AI is now flipping that model. AirMDR raised $11.5 million from Race Capital to deploy agentic analysts handling over 80% of routine triage, investigation, and response. Auger Security—an autonomous threat-hunting team—raised $6.9M from General Advance to build AI agents that proactively identify and neutralize vulnerabilities. Skyramp, with $10M from Sequoia, acts as a personal “Quality Engineer,” generating, executing, and self-maintaining test suites to streamline CI/CD. Cybersecurity is no longer just a headcount game—it’s a scaling game thanks to agentic teams protecting operations around the clock.

The U.S. power grid is the biggest machine ever created. It’s an engineering miracle, delivering power to 160 million people every day. It’s under unprecedented strain thanks to power-hungry AI workloads. It’s a jumbled web for those trying to add more capacity and those trying to extract more energy from the grid. Data centers have been power-constrained for the first time in a decade, and acquiring power has been a complex process. GridCARE raised $13.5 million to deliver power to data centers, by partnering with AI infrastructure developers and electric utilities to squeeze more from the existing grid. Meanwhile, Rune is taking a different route, tapping into stranded clean energy and powering data centers behind the meter. They raised an additional $4 million in seed funding this quarter from USV and Twelve Hundred VC, rounding out their $11.75 million in seed funding. With no slowdown in sight for AI demand, continued investment will need to go into the grid to ensure power supply and keep up.

While voice technology in healthcare has long promised to improve clinical workflows, past attempts often overreached – chasing bedside assistants or ambient scribe tools before the infrastructure was ready. This quarter, a new crop of startups is approaching voice AI from a more pragmatic angle: starting with operations, billing, and back-office bottlenecks.

Startups like Amperos Health, which raised a $4.3 million seed round led by Nebular and Uncommon Capital, and VoiceCare AI, which raised a $4.5 million seed round led by Caduceus Capital, are a few examples among many others we’ve seen in past quarters and recent YC batches. Amperos is tackling the long-standing pain point of medical billing with an AI-native coder that listens to provider-patient interactions and outputs audit-ready documentation. Rather than trying to replace the clinician, Amperos is focused on eliminating the manual work that leads to burnout and denials.

VoiceCare AI is taking a slightly different path in elder care, where complex patient needs often collide with poor digital literacy and limited caregiver bandwidth. Their voice assistant helps with scheduling, medication adherence, and care navigation – all through natural language interfaces tailored to senior and cognitively impaired populations.

What unites both companies is a wedge into high-friction workflows – places where voice interfaces offer significant lift in efficiency and compliance. As ambient computing finally finds real footholds in healthcare, we expect voice-first infrastructure to become a defining layer in how clinical operations scale.

AI construction tech founders are primarily building for the earliest stages of the construction process. Companies like Algoma, which raised a $2.3 million seed round led by Zacua Ventures, and Prophetic, which raised a $3.2 million seed round led by Entrada Ventures, are both focused on providing real estate investors and vertically integrated developers with the tools they need to find and diligence real estate opportunities. These companies scrape public data and apply AI models to cut out a significant portion of the existing diligence process that is today done by in-house analysts or outsourced to consultants. In contrast, TwinKnowledge is focused further upstream, working with developers, architects, engineers, and GCs to ensure that contracts are aligned and design documents are accurate prior to the construction phase. While Algoma and Prophetic start earlier in the preconstruction phase and may work their way upstream over time, TwinKnowledge is building a product with network effects from day one that may be harder to rip and replace. These companies are likely all vying to become the system of record for preconstruction. The next few years will reveal which wedge wins—and why.