Should early stage investors even invest in healthcare companies?

A look back at healthcare unicorns and liquidity since 2010, and why incubations, the HITECH act, and creative financing structures are set to flip the script.

Subscribe to future editions of the Health newsletter here.

Going into 2024 and thinking about the types of early stage founders we hope to meet this year, we wanted to take a step back and better understand the past decade of healthcare private markets, to build a more informed point of view for deep partnership with founders.

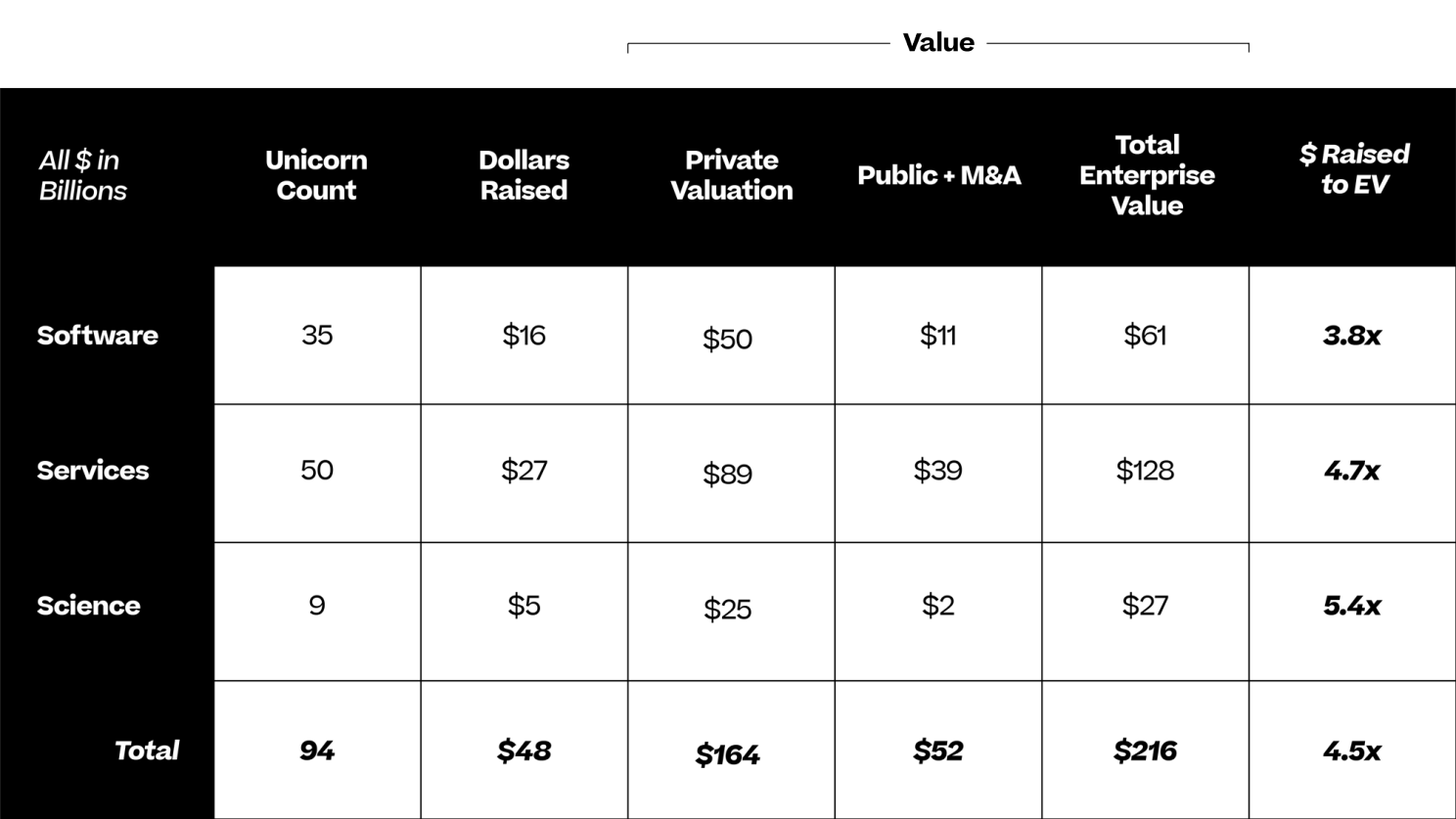

We analyzed current healthcare unicorns, companies that went public, and M&A for companies created since 2010 onwards and looked at a combination of healthcare subsectors, enterprise value/market cap, and liquidity.

If you see the past decade’s data in aggregate, it’s clear that healthcare hasn’t been the easiest place to make money in venture. But, if you look in corners, get creative from a financing perspective, and overlay that date with shifting norms and dynamics, it’s clear there are pockets that represent really exciting investment opportunities. We believe that this will continue to be true for the next decade as well.

We still have more work to dive deeper here, specifically re: dilution and ownership assumptions, but when looking at the data there are a few key things that stand out:

- Despite the absolute size of the healthcare market, there has been a relatively small amount of enterprise value and liquidity created via VC backed startups when compared to other sectors. And there have been no real MEGA outcomes ($20 billion+) from companies built in the last 13 years

- There is still an immense amount of enterprise value locked up in private companies, while the public markets have been brutal to healthcare companies that have gone public.

- When evaluating unicorns from 2010 onwards from a dollar raised/enterprise value created, payer and provider software is actually the least efficient category from a value creation perspective. But, if you haircut the services category, this will very clearly change.

- Historically, M&A is the much more lucrative path for healthcare companies, particularly when looking at healthcare services companies.

- Incubation or non-traditional venture financed companies account for ~30% of all the unicorns. And these companies have also greatly outperformed from an exits perspective when compared to the rest of the market — accounting for ~73% of the liquidity in the market from unicorns in this time period

So with the above data and takeaways in mind, we asked ourselves the more provocative question of,“Should early stage investors even invest in healthcare companies?” More on that later…

A few notes on the data. For simplicity sake we bucketed companies into three broader categories, defined below:

- “Services” = Provider of healthcare services and provider networks

- “Science” = Businesses selling to life sciences

- “Software” = Software sold to payers/providers

All the numbers and data are from Pitchbook and are from early January, so are subject to shift given private valuations and public markets (given Pitchbook we can’t link to the data, but you can see the outputs below). Given where we spend time we also removed biotech and pharma, medical devices, and insurance companies.

Using the criteria mentioned above, looking at current unicorns, IPOs, and M&A for companies founded from 2010 onwards, there are 94 companies in the healthcare sector that fall into the above buckets (unicorn, IPO, M&A) 50 are service companies (e.g. Maven, Carebridge, Agilon), 35 are software companies (e.g. Cedar, Dandy, Viz.ai) and 9 are science companies (e.g Flatiron Health, Komodo).

Looking at just unicorns, there are 68 active U.S. healthcare unicorns out of 903 U.S. unicorns (~7.5% of U.S. unicorns). These healthcare unicorns have a combined valuation of $164 billion out of the combined U.S. unicorn valuations of $3.1 trillion (~5%).

When evaluating different categories, we used dollars raised and enterprise value creation as a means to get a sense of efficiency for dollars invested across each of these categories (i.e. dollars raised/total enterprise value).

Looking at the table below, you can see that the services category currently outpaces the others from the dollars raised and also from a value creation when you combine private and public valuations.

Although it is a moment in time, we were admittedly surprised to see software as the least efficient currently. Yet, services is also one of the most likely categories where private market valuations got the most out of whack, and we would expect this reality to change as private tech-enabled service company valuations reset. Should the private valuations be cut by 25%? 50%?

And, as you can see, selling into life sciences and pharma is the most capital efficient category, yet the number of opportunities there continues to be small comparatively.

Perhaps most interesting, when looking at the 94 companies, 30 of them (~28%) were formed through an incubation, merger, or some larger/non-traditional early stage financing structure. In terms of the percentage of unicorns created, incubation creates more success in healthcare than any other sector. More to come on that later…

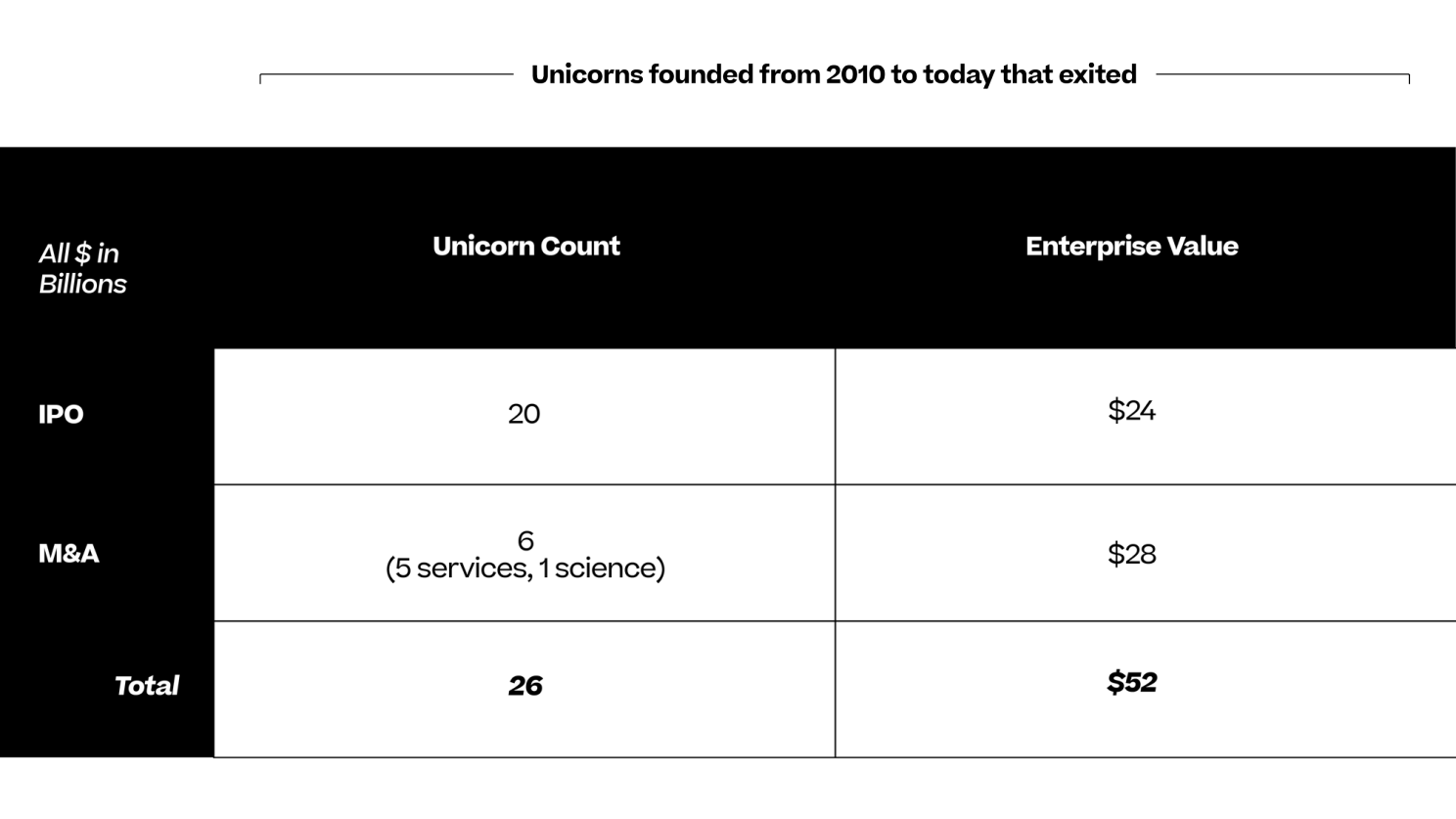

To try and decouple things from private market valuations of the last few years, we then looked at actual liquidity events. During the last few years, the public markets have been particularly brutal for public venture backed healthcare startups and M&A has been the more lucrative path.

- 12 of the 20 companies that have gone public now trade at below $500 million in market cap, while 9 of those 12 trade at basically $0.

- There are eight companies that have market caps over $1 billion, accounting for ~$22.8 billion of the total $24 billion. Four are software companies and four are service businesses, while the top five companies are: Doximity, Agilon, Evolent, Lifestance and GoodRx account for ~$17.2 billion of that $24 billion today.

- Meanwhile, M&A across six companies accounted for ~$28 billion of liquidity.

Going back to non-traditional VC backed companies, of the unicorns founded since 2010 that exited, 50% of the companies fell into this bucket while also accounting for $38 billion, or 73% of exit value across IPOs and M&A.

In fact, without the liquidity from these types of companies, liquidity from this cohort would be downright anemic.

- Of non-traditional venture backed companies, nine of these businesses IPO’d accounting for ~$13.7 billion of current market cap, while the four M&A transactions account for $24.1 billion.

- Service businesses account for $34 billion of the $38 billion generated in liquidity from these companies.

So where does this leave us…?

This data doesn’t necessarily paint the rosiest of pictures. What it really highlights is that building venture scaled businesses in a venture timeline (seven to ten years) has been incredibly challenging across all parts of healthcare.

We are also struck by the lack of the lack of mega company formation in the healthcare industry — you just don’t have Stripe, Coupang, Coinbase, etc.

Instead, to counteract the challenge of building in healthcare, people have leaned more towards company formation. In fact, it’s clear that non-traditional venture financing structures in Service businesses have ruled the roost since 2010. Funds like Primary, General Catalyst, Google Ventures, Town Hall, Valtrius, General Atlantic, and others have clearly internalized this reality. There is a lot more to unpack here, but a few key learnings from conversations with people familiar with companies that fit this profile.

- First off, most of these companies do NOT have product market fit risk, instead there is execution risk. This is fundamentally different from an early stage investor’s job.

- Second, when looking at round size and construction, many of these companies raised a war chest to weather the storm that is still involved in just “executing” on their vision. They also simultaneously brought on strategic investors early and often. We’ll be doing more work to further explore both of these realities in the coming months….

To answer the more provocative question of, “Does it actually make sense to do early stage venture capital investing in the healthcare sector?,” we believe the answer is still yes.

Our underlying belief is that the healthcare market is too large, too broken, and too underpenetrated by technology to not believe there are venture scaled opportunities. Labor shortages and rising administrative costs alone is a bull case for the adoption of software. But, it’s also clear that the public markets will need to shift for us to be correct here, and some of the current structures and dynamics in venture might need to shift to realize more venture scaled returns.

To really be excited in healthcare investing, you NEED to believe that the profile of software companies and their ability to generate enterprise value will shift in the coming years. What’s core to our belief that this will happen is the data and digital foundation that has been built by EHRs in the past decade. The HITECH act laid the groundwork for clinical organizations to digitize their data and workflows. Yet, we’re still early in this journey. It’s no surprise that even as this was happening, it was difficult for additional software companies to be built on top of this nascent foundation.

We don’t believe that these core underlying EHRs will be ripped out in the next decade, but companies will continue to be built on top of these core operating systems and the more modern data stacks being adopted by healthcare today. Layer in AI, shifts in data interoperability, and a more technically sophisticated buyer, and we think there is a lot of reason to be excited.

Meanwhile, the line du jour in venture today is, “We don’t invest in tech-enabled services companies.” But, at the same time, the vast majority of liquidity in the healthcare sector has come from service companies. We are actively thinking about this reality, specifically as we look to learn from non-traditional VC backed companies that have outperformed.

Although a seed stage firm is unlikely to put in $20 million upfront, should there be different ways to capitalize healthcare services companies? Is part of the problem with Service companies driven by the fact that traditional VC financing structure is just wrong for companies with this profile? We firmly believe that two years of runway is actually NOT the right answer for the majority of service oriented companies given clinical requirements and sales cycles. Layer in the quantum of capital needed to build some of these businesses and it becomes even harder. So is a more creative, non-traditional capitalization structure needed? This likely means more dilution upfront for entrepreneurs and more money at risk for investors, but figuring out the right structure here actually unlocks a broader set of opportunities that become investable.

Additionally, as we’ve written about before, we can start to imagine a world where the dynamics of AI and software start to replace part of the administrative costs of U.S. healthcare, perhaps shifting the unit economics of service companies. So, with a different capitalization structure and a shifting cost structure, are services actually more interesting than people are thinking today?

We plan to continue to explore these topics and others in the coming months that evaluate the broader market. If you’re interested or intrigued by this data, we’re more than happy to keep sharing our learnings. As always, we would love to hear people’s thoughts and reactions to all of this as well!

Feel free to shoot us an email:sam@primary.vc.