The First Sign of a Quiver in Quarterly NYC Seed Deals

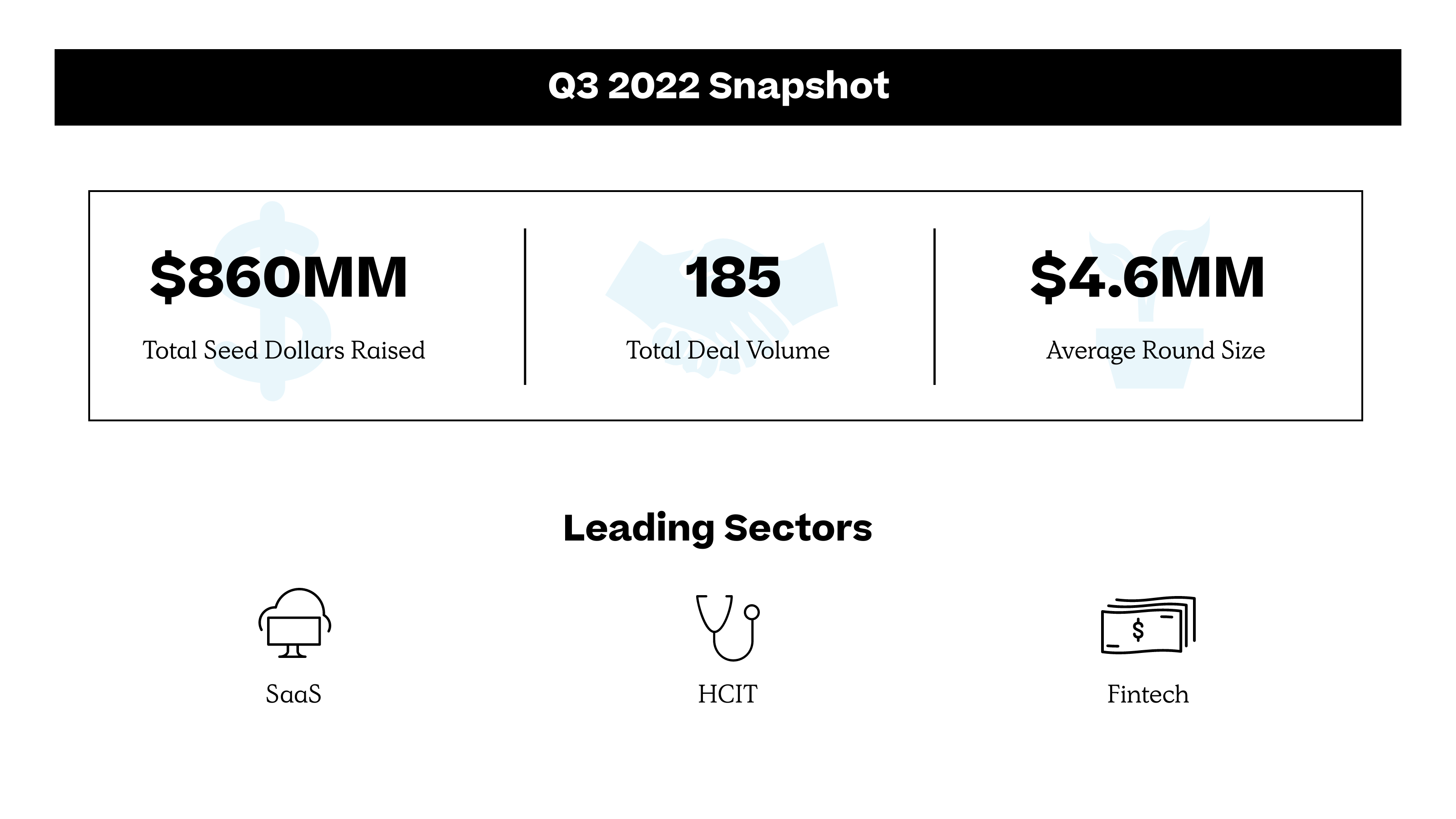

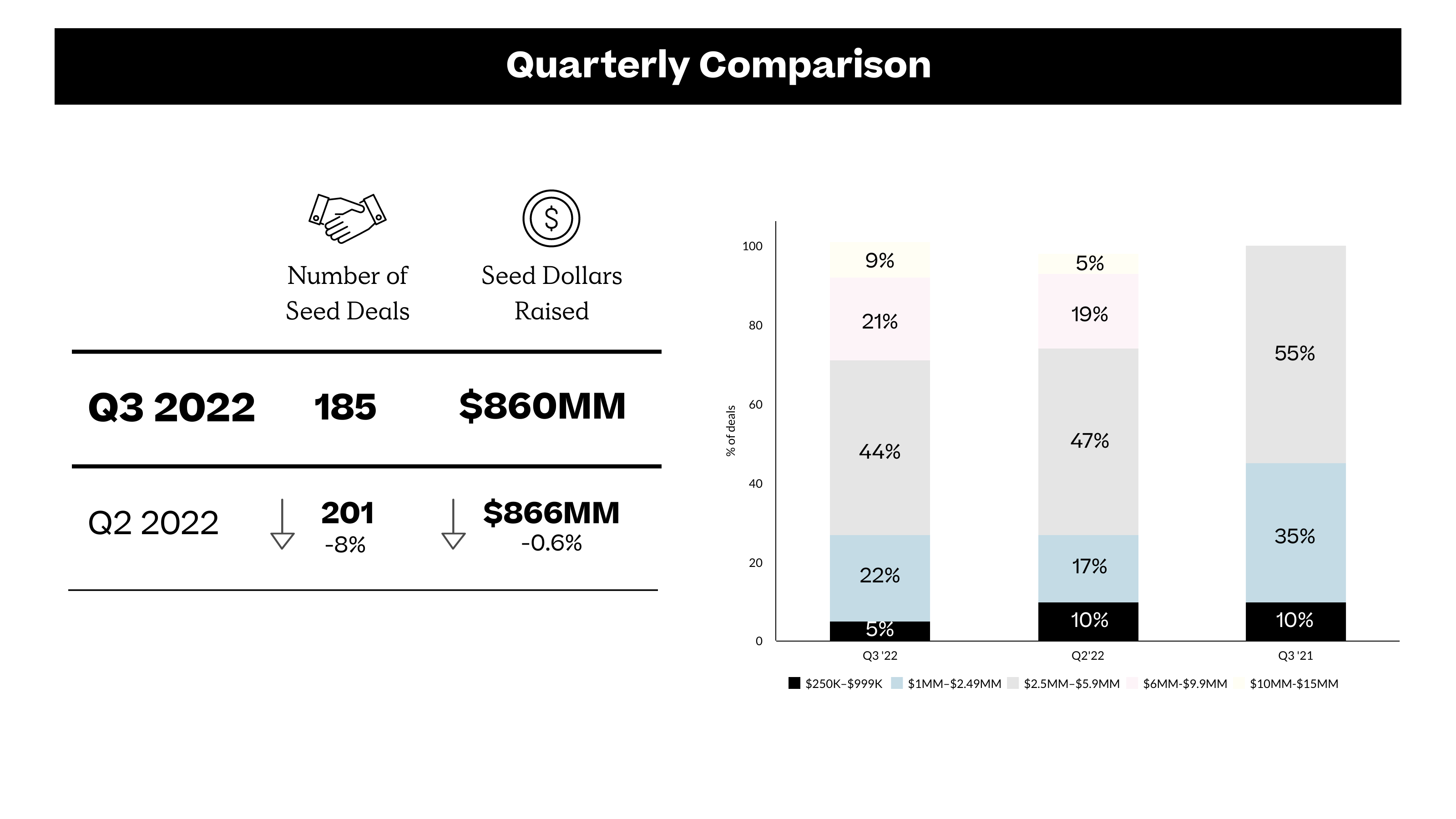

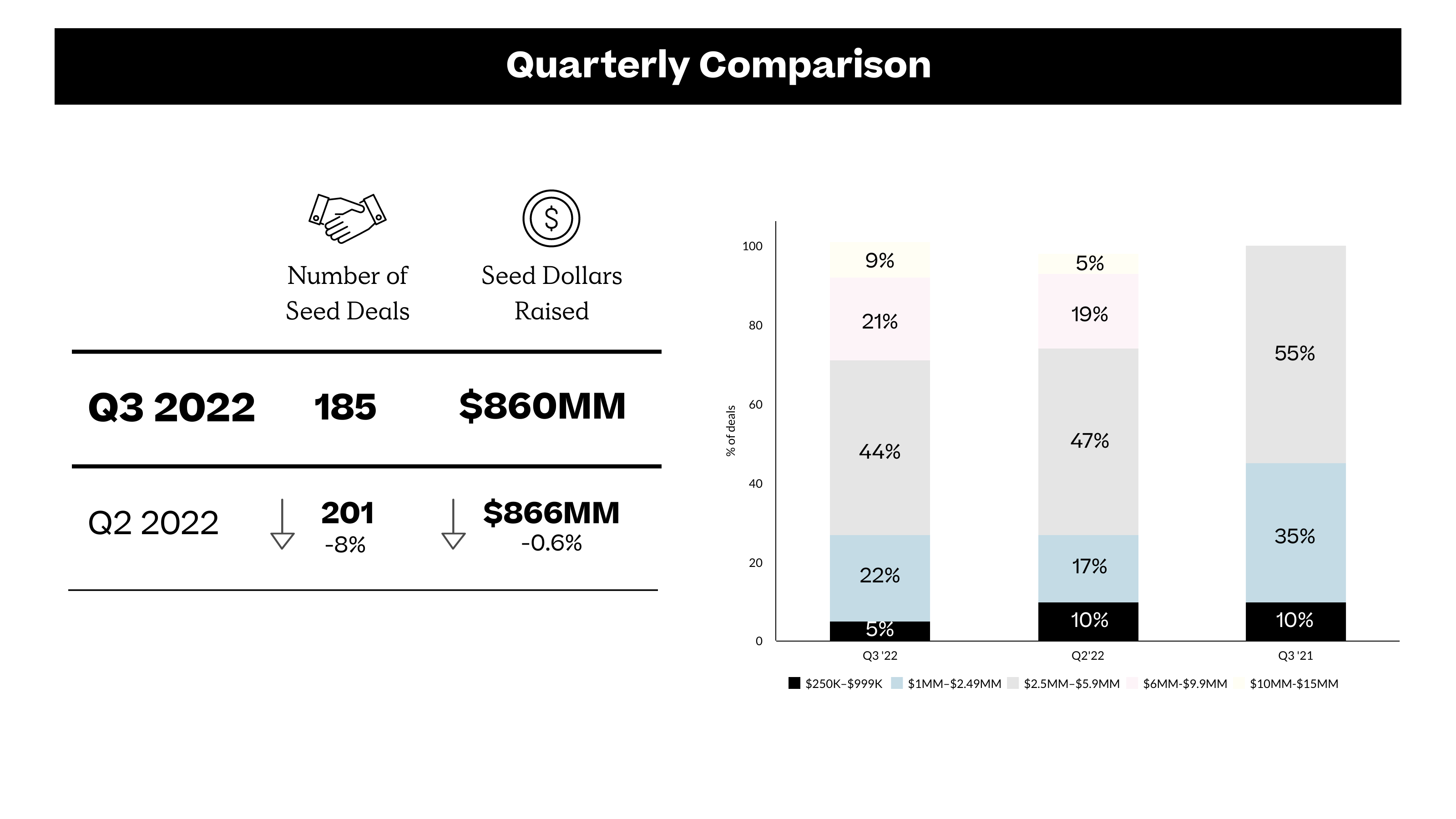

Primary's Q3 roundup sees a very slight decline in deal sizes and volume for the first time since 2020. Get to know the 185 teams charging ahead in these choppier waters.

As the later-stage market has wrestled significant declines this year, our Seed Report team has wondered when the trend would finally show up in our corner of the investing world. This is that quarter, friends.

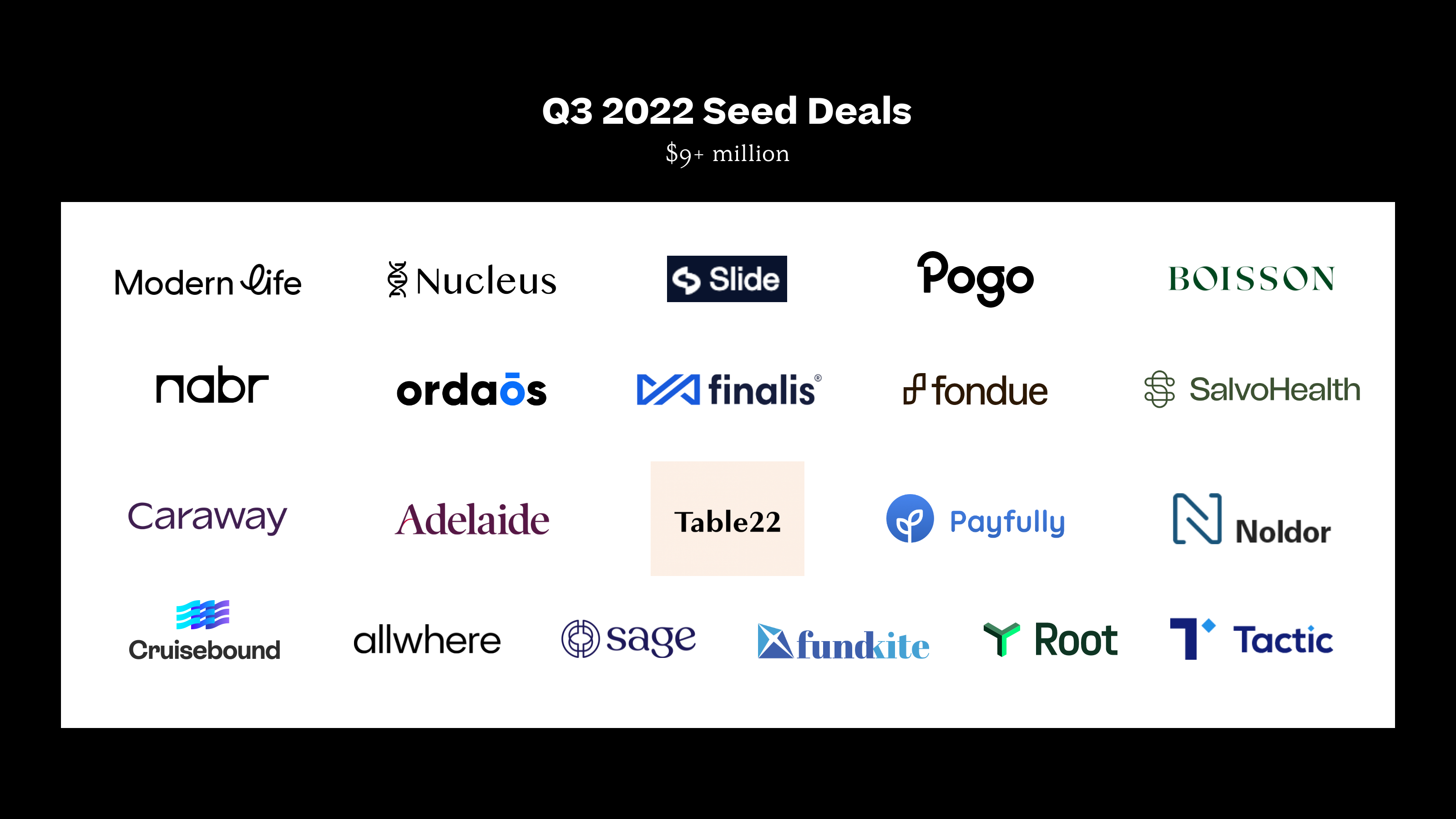

For the first time since 2020, we saw a small downward nudge in the numbers, coming out to $860 million in funding across 185 deals.

To be clear, this is a small decrease in what was becoming a somewhat unbelievable trend, and still shows NYC seed to be much stronger than multistage and global averages.

Crunchbase notes that global deals are down by $90 billion (53%) year over year and by $40 billion (33%) quarter over quarter, and seed-stage startup funding, while less depressed, remained flat year over year and went slightly down quarter over quarter.

Here are some trends that stood out to our team, followed by a full roundup of every company that raised this quarter.

Working on initiating your own fundraise process next quarter? Head to SharpSheets for ideas on the top NYC venture capital firms (including us).

Despite the public markets absolutely trouncing many service oriented care delivery businesses, the early stage care delivery market continues to see lots of momentum and some very large seed rounds came together in the past quarter here in New York, whether this is in the gastroenterology market with Salvo raising $10.5 million, pediatrics with Summer raising $7.5 million, or women’s health—Caraway grabbed $10.5 million.

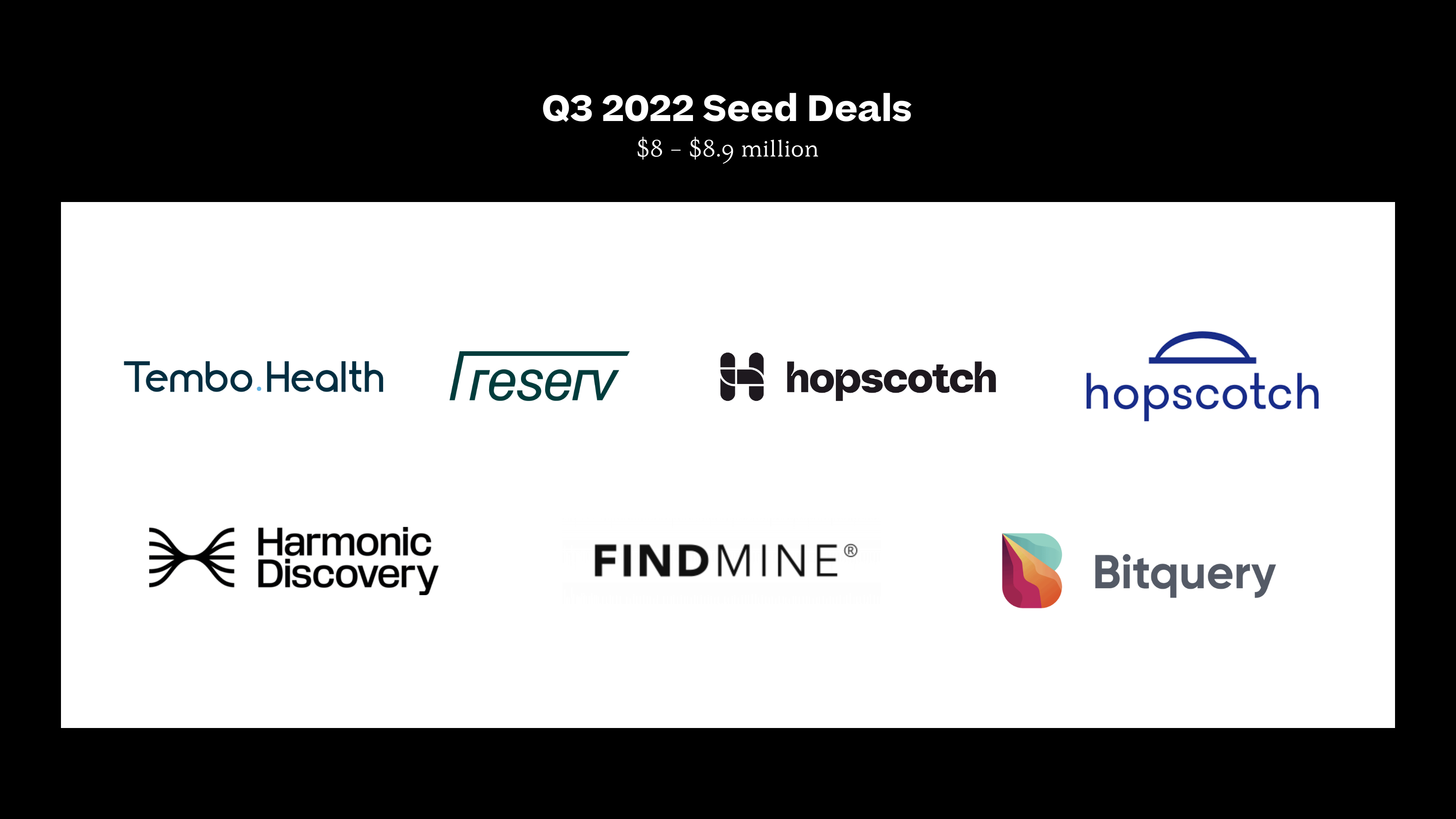

Liquidity crunches are the bane of all enterprises big or small. For SMBs, any payment delay can be lethal given their reliance on timely accounts receivable to make payroll at the end of each month. A number of NYC startups are tackling this challenge by providing SMBs with financing and instant payment tools that cash them out at point-of-sale. Payfully (factoring for commissioned workers), Hopscotch (B2B instant payments), and FundKite (working capital for SMBs) are all solving the critical SMB liquidity challenge and have collectively raised $27 million in seed funding.

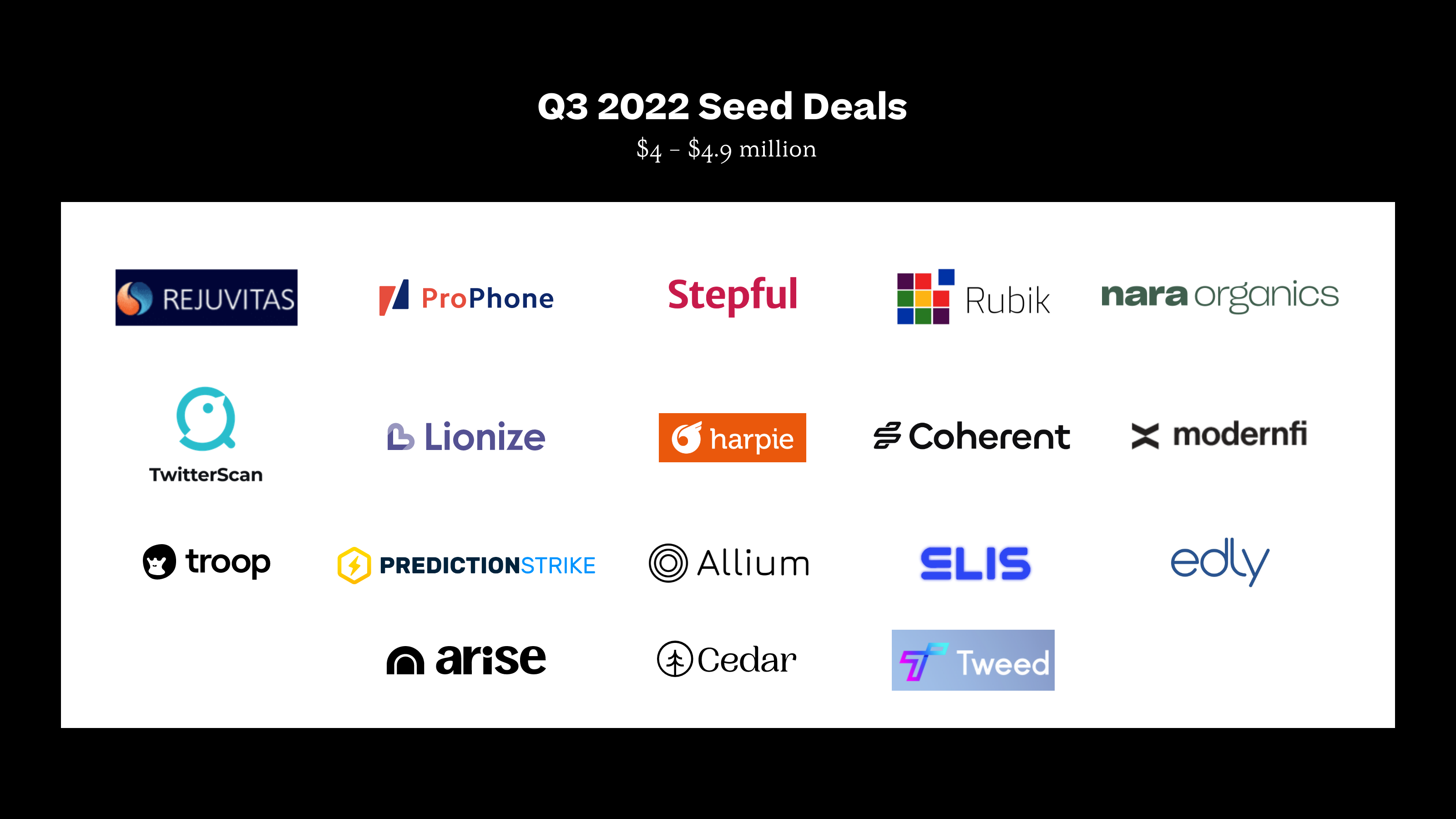

While some may argue that the mental health landscape is saturated, it’s also still true that it remains a massive need. This quarter we saw a variety of mental healthcare businesses aimed at populations that have been traditionally under addressed, underfunded, and/or are hard to treat. Examples include Arise, focusing on holistic eating disorder care, which raised $4.4 million from Greycroft, BBG Ventures, and Wireframe Ventures. Similarly Hopscotch Health, which raised $8 million from Greycroft, Harvard Innovation Launch Lab, and Inspired Capital, among others, focuses on pediatric mental health. Last but certainly not least, Ascend Autism raised a $1 million seed round and focuses on evidence-based ABA treatments for children diagnosed with autism spectrum disorder.

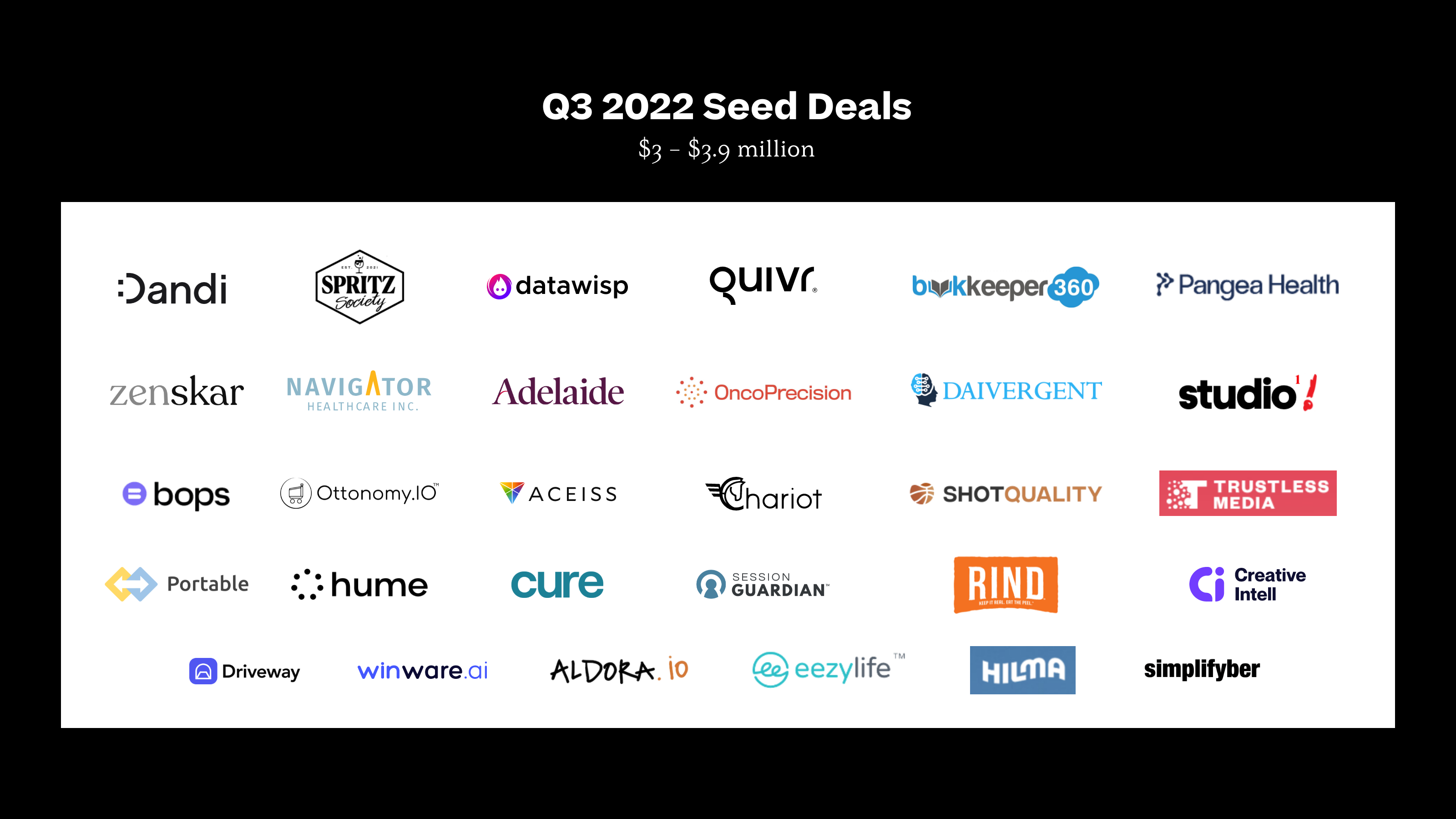

Across software infrastructure and developer tooling, abstraction is an increasingly important theme. Some of the most influential infrastructure projects have been built on the promise of abstracting away or simplifying complex jobs. Projects like Kubernetes and dbt exemplify this, and this continues to be a theme in the sector. Crash Override raised a $5.8 million seed round to take the “busy work” out of security. Additionally, Portable raised a $3.2 million seed to add missing ELT connectors to solutions like Fivetran, abstracting away the need to build these integrations internally.

Carbon tracking is becoming a bigger priority across a long-tail of companies and sectors, following the lead set by major corporations and emitters. Seed dollars are flowing to a new crop of startups that will make it easier for companies to track, reduce, and communicate emissions out to employees and other stakeholders. Climate Club, a provider of employer-focused sustainability software, raised $6.5 million. Alcove Labs, which provides carbon footprint removal services, raised $2.97 million