The Path of Least Resistance Growth Levers You Might Not Have Tried Yet

Retention is always the cheapest form of growth. Here are eight concrete tactics to make sure you’re maximizing your net dollar retention rate.

When SaaS growth rates began to compress coming out of the 2021 frenzy, net dollar retention quickly became the talk of the town. Net retention is certainly not a new or novel concept in SaaS, but it took centerstage because of the simple reality that retention is always an organization's cheapest form of growth. Irrespective of the consulting world’s exact data point du jour, it is widely understood that retention is significantly more cost-effective than acquisition—so in a world where a market slowdown yielded shocks to new logo cycles, all eyes moved to the installed base.

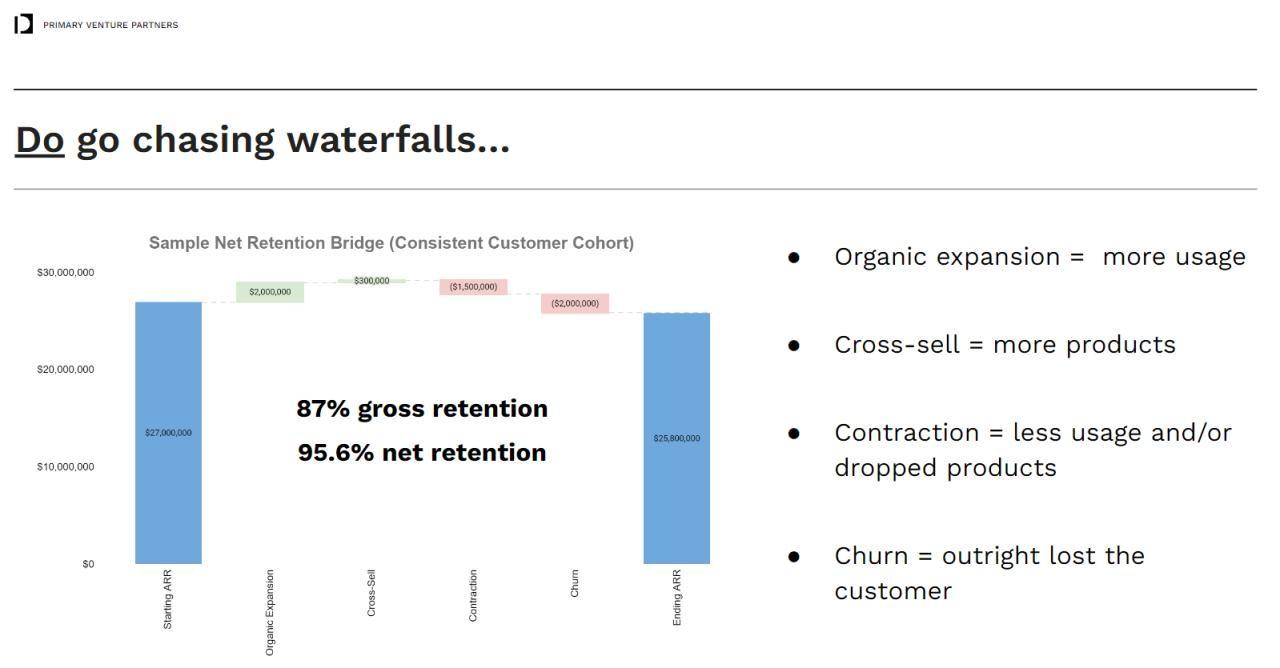

(As a reminder, net dollar retention rate is the composite metric of organic expansion and upsell/cross-sell—good stuff—as well as churn and contraction—bad stuff—typically calculated at a cohort level on either a calendar year-to-date or trailing 12 months basis.)

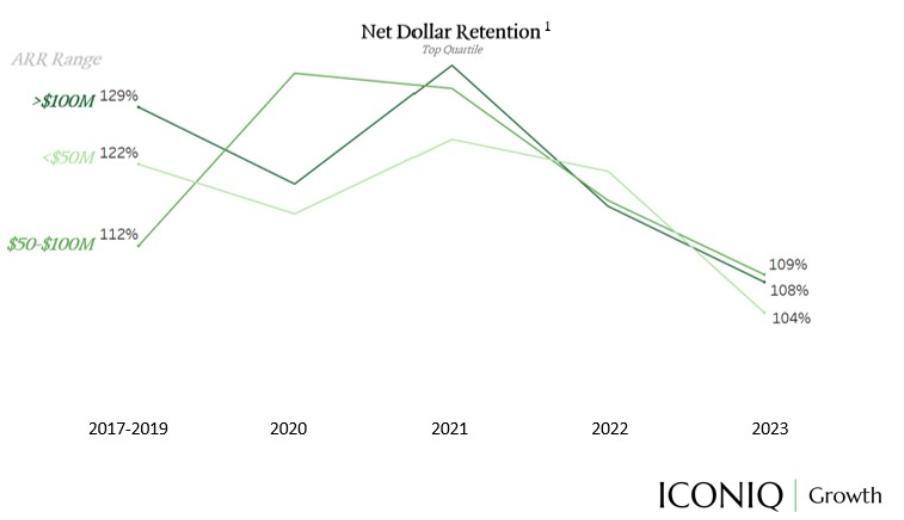

That said, recent data suggest that net retention rates have also compressed alongside year-over-year ARR growth; this is somewhat intuitive given that organic expansion and upsells/cross-sell sit in both metrics, but nevertheless leaves SaaS companies thinking about the levers they can pull to 1) retain more customers (prevent churn) and 2) grow (or at least maintain!) customer average contract values.

In their pursuit of net retention improvements, companies will invariably talk about how investments in tech and AI will help them supercharge their efforts while also doing more with less. This is invariably true, but make no mistake: there are plenty of good old fashioned “elbow grease” tactics to help you get points on the board without operationalizing new software.

Here are eight high-impact, lower-effort strategies to help you keep and grow your current customers:

1. Pop the question: if the renewal were tomorrow, would you be continuing?

This technique sounds obvious, but rest assured that I mention it for a reason: Most companies are not in a regular rhythm of asking customers outright if they plan to renew. This is a powerful question to pose at any point in a partnership, but can feel most natural coming out of an account review: We know the renewal is a number of months away, but if it were imminent, would your intention be to renew the contract?

It is never too early to pose this question. The worst case scenario is that your customer shares they are not intending to renew, but sunlight is the best disinfectant! Armed with this information (and more context around their answer), your team now has an opportunity (and ample time!) to course-correct and influence a different decision.

2. When it comes to executive sponsorship programs, don’t boil the ocean

Executive sponsorship programs–the practice of aligning a member of your company’s leadership team to executive sponsors in your customer orgs–can be extremely effective, but most businesses massively over-complicate them by attempting to “boil the ocean:” They aspire to be as far-reaching and inclusive as possible. As a result, a company may commit to assigning an executive sponsor to any customer above the $X ACV level, which could leave each of your executive sponsors “managing” a dozen or more accounts, but really not accomplishing much at all.

When designing executive sponsorship programs, lean into what I’ll call your Pareto Proxy; sure, your ARR might not follow an exact 80/20 rule, but perhaps your top 15 accounts make up 40% of your ARR base. If that’s the case, those 15 accounts would be a very wise place to focus time and energy. When you prioritize a smaller universe of accounts for these programs, each sponsor can get much more richly engaged in the various relationships they manage (regularly meet with the customers, sit in business reviews, etc.).

Editor’s note: if you are running an executive sponsorship program and don’t have the entirety of your executive team participating (including Finance and HR), consider that homework!

3. Ensure your pricing model allows for organic expansion opportunities

Your net retention metric includes both organic expansion as well as upsell/cross-sell; the former is significantly lower effort to bear than the latter, but only if your pricing heuristic is designed to make it that way. You should select an atomic unit of pricing that ensures that you could hypothetically do absolutely nothing and a customer’s contract value could still expand. Editor’s note: we aren’t suggesting “doing nothing(!)” as a business strategy, but you get that point.

If API calls are your atomic unit, your contracts should be written in a way whereby if the customer exceeds named volume thresholds for API calls, the contract automatically expands accordingly. The same logic applies if you’re charging on email volume, weekly reports, etc.

4. Pull and push: Pull forward renewals and push out their contract end dates

Here’s a hot take: SaaS companies should never have to do contract renewals! Let me unpack that: If your atomic unit of pricing is set up in a way that the customer is growing rapidly and (automatically) expanding, you can provide a great customer experience by offering to let them “open up” their current contract and renegotiate their base unit price based on their actual utilization/higher volumes. What’s in it for you? In exchange for opening up the contract and renegotiating the rate, the customer commits to tacking 12 months onto the end of the existing contract end date, so you push out the renewal date and lock in more CARR (committed ARR). If a customer’s utilization continues to grow, you could theoretically do this very often and never have an “actual” renewal conversation.

While volume is typically the most obvious reason to open up a contract, contract scope can present another opportunity: If your contract is focused on certain business units but you know the customer is keen to add more teams to your platform, this approach would be a great way to expand ARR while also offering the customer a lower base rate (presumably unit cost would go down as more business units were added).

5. Map your white space and call your promoters

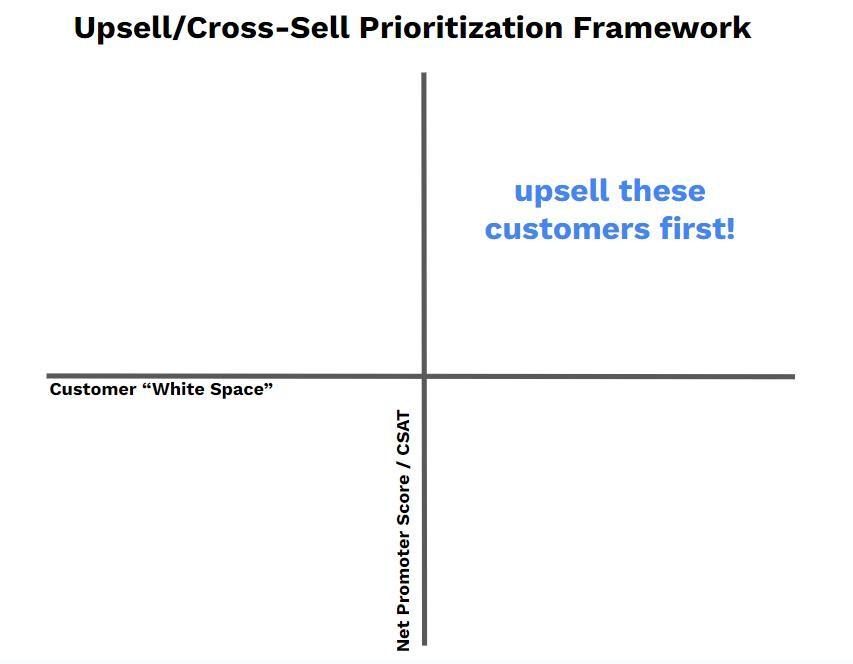

Businesses must of course supplement organic expansion with upselling and cross-selling. This work can feel unnatural to many teams, particularly those introducing add-on products or “unbundling” a product for the first time. Here’s a hack to make this more comfortable: Map all of your existing customers onto a 2x2 like the one below (one axis is NPS or customer satisfaction, the other is “white space,” or how much other stuff you can sell the customer), and focus your energy and efforts on customers in the top right quadrant. Customers who love the products they use today are your lowest-hanging fruit!

6. “Show me the incentive, and I’ll show you the outcome” -Charlie Munger

We covered this topic rather extensively in last month’s Tactic Talk installment; if you really want to drive outcomes, align compensation plans accordingly. In the net retention game, this applies tobothsides of the equation: account growth as well as churn and contraction (the sum of which I’ll refer to as gross churn).

Because it is a composite metric, net retention is in and of itself a relevant and popular KPI for bonus plans, but you may also want to consider using one of the metric’s component parts (e.g. expansion bookings or gross churn). The most effective variable compensation plans focus on a business’s ripest opportunity areas. If you’re suffering from an acute gross churn problem, you may want to double-dip and includebothnet retention and gross churn in the bonus calculation (or perhaps even more impactfully, give greater weight to gross churn!). Alternatively, if your churn numbers look healthy but you’re struggling to drive ACV expansion, think about augmenting the net retention number with an explicit expansion bookings target.

Editor’s note: last month’s newsletter offers many other approaches and pragmatic examples for how to align variable compensation to business outcomes.

7. Include time-bound offers in your Order Forms

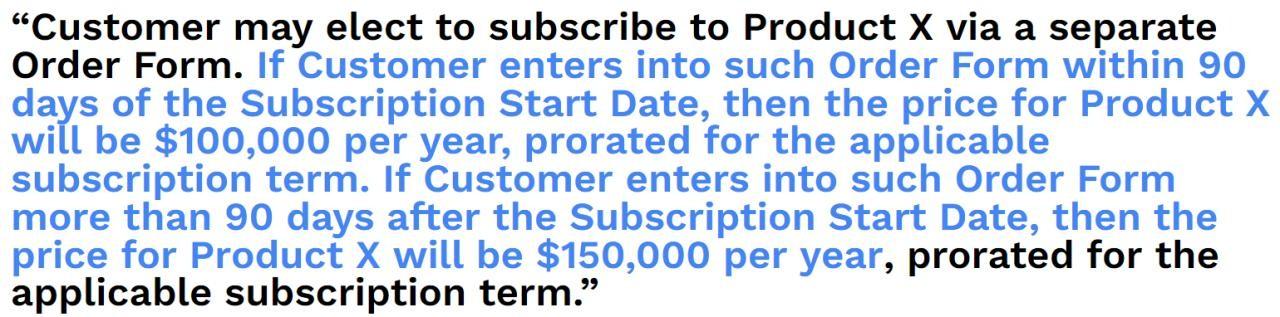

Sales teams are always working hard to get new customers to buy as much upfront as possible, but it’s not uncommon for a deal to get de-scoped at the end of a procurement process: The customer decides to drop one or more products you discussed, they opt to start with less volume, etc. Customers will often promise to revisit that conversation a few months later, but it can be helpful to make that worth their while: consider language like the example below, where the customer is guaranteed a certain rate if they commit to moving forward with an expansion or add-on product by a certain date.

8. Embrace the power of benchmarking to increase product usage

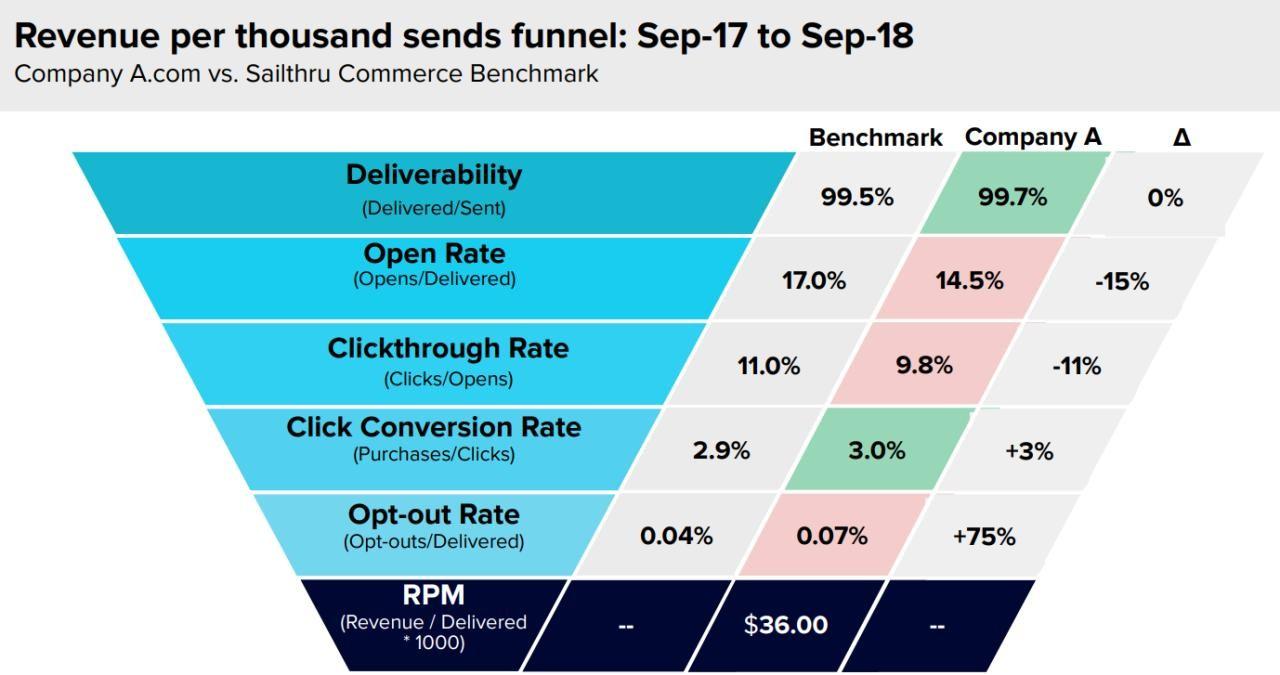

You can “challenger sell” all day in the pursuit of driving product adoption, but nothing ever gets customers on their feet quite like benchmarking them against their peers. When I led the post-sales organization at Sailthru, we started every business review with a slide like the one below to ground customers in how they were doing vis-a-vis their industry benchmark. Customers were more likely to listen to CSM recommendations tailored to their “red zone” metrics and even better yet, sometimes those red zones allowed us to entice the customer with an add-on product. In the example below, where the customer had an unsubscribe rate 75% worse than the benchmark, the metric provided an excellent jumping off point for pitching an add-on product focused on opt-out predictions and optimizations.

And before you even ask the question: Yes, even early stage companies can embrace the power of benchmarking! While certainly nice to have, you don’t need hard numbers and historical data to effectively draw comparisons between customers.

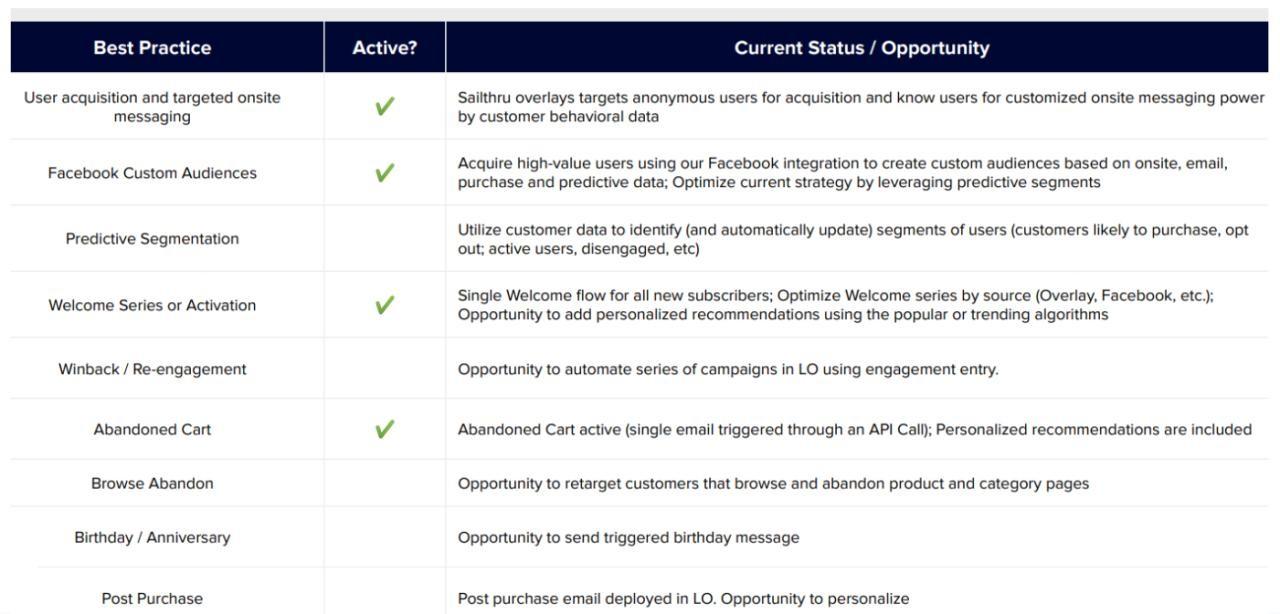

Consider this sample product utilization matrix (also devised in my time at Sailthru). Again, ideally your “best practice” checklist would conveniently align to the need for some add-on products!

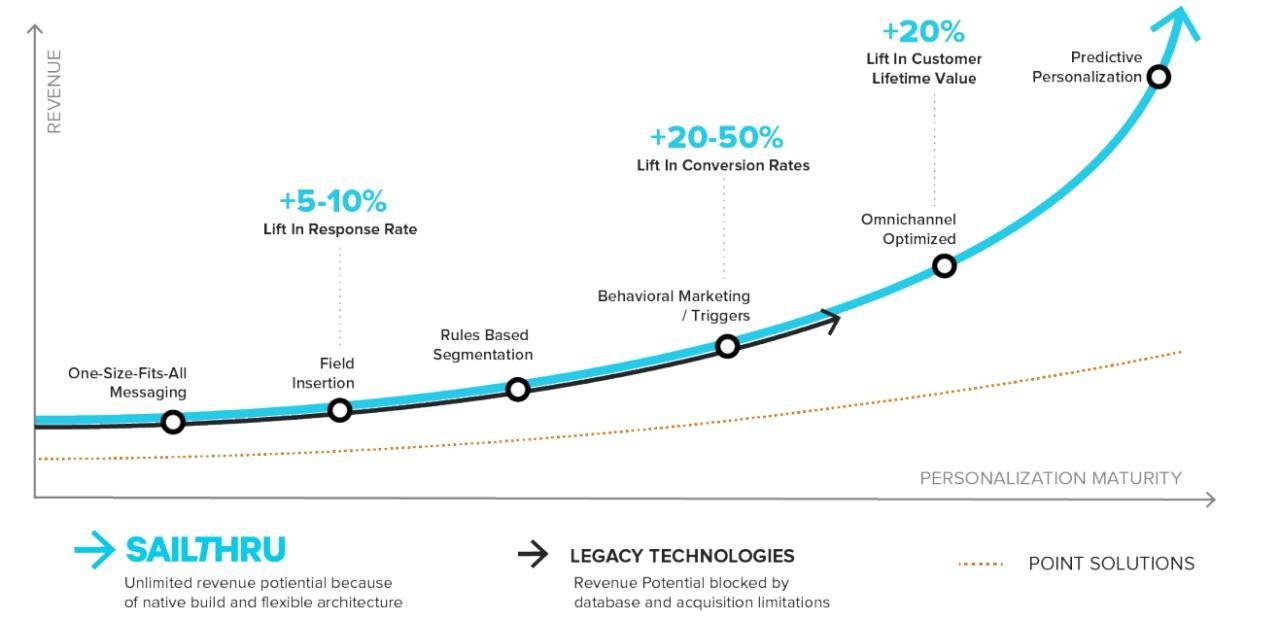

Maturity curves are another way to benchmark and motivate customers without absolute numbers, and they have the added benefit of helping to really articulate your company’s long-term vision. In this example, you would work with the customer to map where they fall on the curve today, and discuss both existing product use cases and add-on product opportunities that could help them move up and to the right.

—-

This hit list of account retention and growth tactics is by no means exhaustive, but hopefully helps you operationalize some quick wins that don’t involve implementing new software or growing your team.