What’s Next in Embedded Payments

Now that vertical software platforms own cash inflows, the race is on to own cash outflows too.

I and many others have written extensively about the promise of embedded finance and the opportunity to allow both consumers and businesses to interact with financial products at the point of need. While we continue to see progress made across different embedded product families (banking, lending, insurance), there’s no doubt that the furthest along use case today is embedded payments processing.

A couple weeks ago, an announcement from Bill.com and Adyen on expanding their partnership beyond acquiring to include issuing caught my eye. At a product level, this is not particularly new functionality for Bill.comc ustomers. However, this is a teaser of Adyen’s (and, I’d argue, every other scaled modern acquirer’s) longer term ambitions. Given how competitive payments acquiring is today, I believe that every modern payments infrastructure provider is racing to become a complete end-to-end platform by stitching together acquiring and issuing at an infrastructure level.

Historically, acquiring (money coming in) and issuing (cards for money going out) are opposite bookends of the payments ecosystem. Increasingly they will converge. And the combo has the opportunity to be a win-win for all parties involved:

- Platforms(e.g. vertical software providers, ISVs) - increased depth of product offering and ability to monetize GPV both coming in and going out

- Platform end-customers (i.e. SMBs)- faster access to funds and broadened availability of credit

- Payments infrastructure partners- deeper engagement with platform customers, new higher take rate revenue stream

Let’s dig in.

Payments acquiring is a hair on fire problem for SMBs

Historically, figuring out how to accept payments in store was an expensive and tedious affair, especially for smaller businesses. The order of operations as a new business owner include:

- Register the business and get licensed by the appropriate government entities

- Get a point-of-sale system (POS) to help manage ordering and inventory

- Figure out how to start accepting card payments

- Reconcile amounts back to individual transactions in the POS

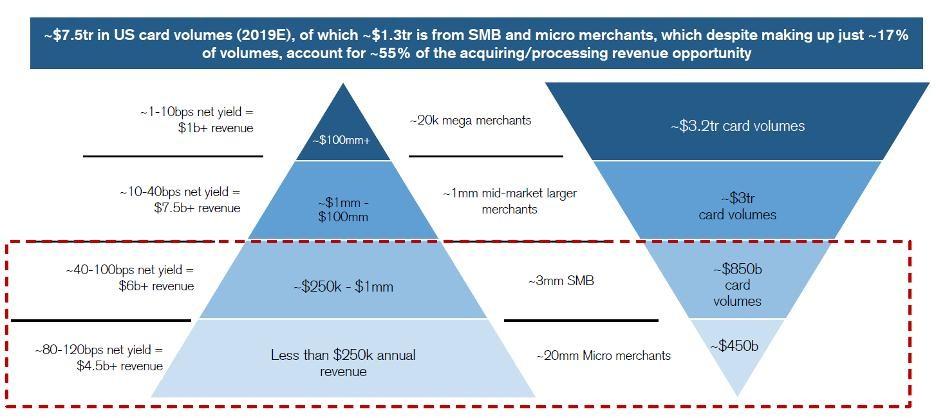

Traditionally, step 3 is very painful and involves lengthy applications to set up a merchant account, coordinating multiple middlemen/parties to get the requisite hardware and agreements in place, and then trying to parse insanely complex network fee schedules. Without operating history or credit, it was often difficult to get underwritten at all. Those lucky enough to get approved pay on average 10x+ higher transaction fees compared to larger merchants with negotiating leverage.

With the introduction of embedded payments processing and the popularization of the payment facilitator (“payfac”) model, many new businesses today can now combine steps 2-4 by choosing a payments offering. By bundling payments into their offerings, modern business management tools (POS, scheduling, etc.) save their SMB customers the headaches of navigating the traditional acquiring landscape. In most cases, this convenience means platforms earn the right to higher payments monetization via “flat rate” processing.

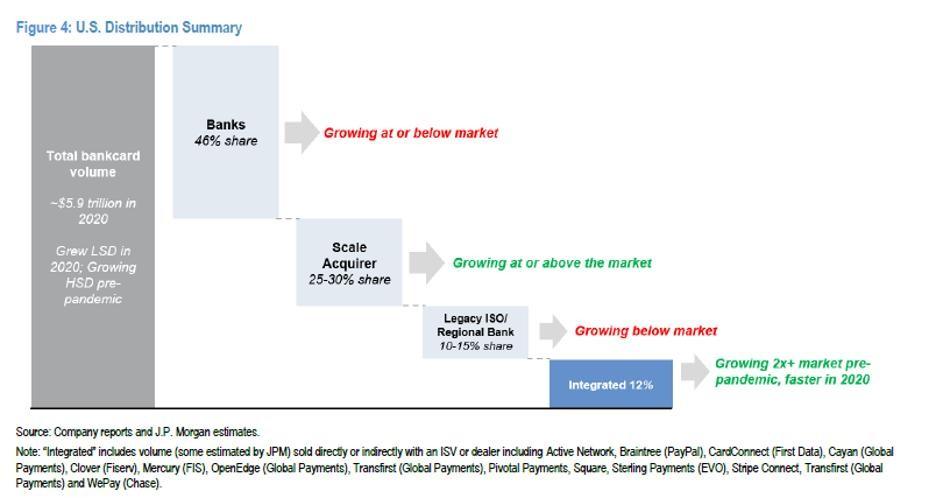

And it’s working. According to a Visa survey, 87% of U.S. merchants choose their payment provider at the same time as their business software. “Integrated” payments offerings are rapidly taking share from banks and legacy independent sales organizations (ISOs).

To be clear, the main value to the platform’s SMB customers isconvenience and not cost. Many platforms utilize a bundled fee (e.g. 3% flat fee for all processed payments) vs. a more traditional interchange+ or a tiered pricing model. By being deeply integrated with SMB customers’ core day-to-day workflows, the integrated acquirers earn the right to charge a higher all-in take rate.

The ecosystem of infrastructure providers enabling vertical software platforms to monetize payments is fairly mature. There are many different models and nuances, but broad strokes there are a few major categories:

- Acquiring / gateways: Stripe, Adyen, Braintree, and Moov make payments acceptance (i.e. acquiring) easy

- Payment facilitator (payfac) infrastructure: Payrix (acq FIS), Finix, Tilled, and Rainforest allow platforms to become payment facilitators

- Modern Issuing: Marqeta, Lithic, Highnote, Galileo, and Unit all provide the ability to issue cards

There is a mature and rapidly growing crop of winners that have executed on the acquiring side of the embedded payments playbook, most notably Shopify, Toast, Mindbody, and ServiceTitan. These multi-billion dollar businesses are in some cases earning 60-70% of revenue from processing payments on behalf of SMB customers.

What comes next?

Now that platforms have successfully helped their end users get paid and monetized the fund inflows, what if they could “double dip” and also monetize cash going out?

Today, most SMBs will have two bank accounts: a merchant account that is provided by the merchant acquirer for settlement of incoming payments and a business account (the “checking account”) from the SMB’s primary bank that is used for expenses (inventory, payroll, etc.). Funds typically take 2-4 days to clear and settle into the business account.

Hypothetically, if these were powered by the same platform and underlying infrastructure provider the SMB customer could benefit in two major ways:

- Access to credit- Most small businesses struggle to get access to credit due to high failure rates and limited operating history. A platform that not only has insight into revenues earned butalso sits in the direct flow of fundscan better underwrite risk and open up access to credit.

- Instant access to funds- The average small company only has cash reserves for 27 days and 52% of SMBs would be willing to pay a 1% premium to get real-time settlement. Combining acquiring and issuing under one roof makes instant access to earned funds possible

So what’s the catch?

The value here seems almost too obvious. If this really is such a no-brainer, why haven’t we seen more examples of double dipping platforms to date?

In reality, platforms face real obstacles to linking the two sides together:

- Unclear adoption rates (and therefore ROI): The jury is still out on what ultimate end merchant adoption and utilization of an embedded card product would look like. And there are real upfront costs associated with scoping, launching, and marketing any new product. At low levels of merchant penetration, the ROI math can be challenging.

- Lack of turnkey infrastructure: While there are many third-party infrastructure providers that can help platforms power an acquiring or issuing product, there are very few that do both in a well-integrated way. In fact, over a quarter of platforms/ISVs cite integration as their top challenge to innovation (h/t to Emily Bartels’ Linkedin post on this topic)

- Coordination and reconciliation challenges: Related to the above, the operational burden of reconciling a constant stream of transactions and balances across multiple partners at scale is incredibly complex. Managing the technical, regulatory, and operational requirements of stitching together multiple providers and making sure the numbers all tie out significantly raises the total cost of ownership.

The race to own end-to-end infrastructure

In order for this opportunity to become a reality, there will need to be an end-to-end infrastructure provider that can accept payments, hold balances, and issue cards.

Acquiring and issuing are each incredibly complex businesses on their own. Merging them together into an end-to-end platform is no easy feat—nor is it a new idea. In fact, much of the bull case for the 2019 Global Payments and TSYS merger was based on this vision, although execution against it ultimately fell short.

In the last decade, cloud-native and tech-forward acquirers have reached significant scale but are now searching for the next product extension to drive continued growth and differentiation. Companies like Stripe, Adyen, Braintree, and Checkout.com have built incredible businesses off modern acquiring and are not held back by legacy tech. My money is on Adyen, whose advantage lies in the fact it’s a fully licensed bank. Stripe is also a major contender, having launched issuing in 2018. Newer players like Moov have also quietly combined acquiring, wallet infrastructure, and issuing.

For these infrastructure providers, powering the full double dip opportunity not only will be an important way to differentiate and increase customer stickiness, but also has additional potential benefits in enabling the monetization of float. On a longer time horizon and at scale, it could even lay the foundations of a closed-loop network. More to come on this at another time…

So where are the startup opportunities?

The landscape has evolved to a point today where it’s incredibly challenging to compete as a net new player in pure acquiring or issuing. However, we think there are still pockets of opportunity left to be addressed.

Some problem areas that we’re keeping close tabs on and we think can be interesting wedges into an ecosystem include:

- Embedded vendor and expense management solutions

- Vertical procurement, AR/AP, or accounting

- Cross-border cash flows and FX management

- Chargebacks and dispute management and resolution

- AI-tooling that tackles inertia (e.g. paying by check, ordering through email)

Huge thank you to my good friends Emily Bartels, Kyle Maloney, Subham Agarwal, James Ho, Charley Ma, and Mahdi Raza among others for providing feedback and challenging my thinking on this topic!