Your Team Can’t Be Aligned If Their Compensation Plans Aren’t

You read enough about market trends; here, Cassie Young offers SaaS founders and operators actionable perspective.

Subscribe to future editions of the Tactic Talk newsletter here.

“Show me the incentive and I'll show you the outcome” -Charlie Munger

In our inaugural Tactic Talk installment last month, I asserted that “far too many executives spend too much time working in the business versus on the business” and warned of the perils of the swim lane trap: employees optimizing toward vanity metrics for their specific departments versus rallying around the metrics that matter most to the business at large.

This may sound obvious, but rest assured that I write it for a reason: to effectively build alignment around the metrics that matter most, leaders must 1) identify and memorialize the most important metrics (hint: these should act in service of driving enterprise value) and 2) over-communicate those targets to employees in a clear, consistent manner.

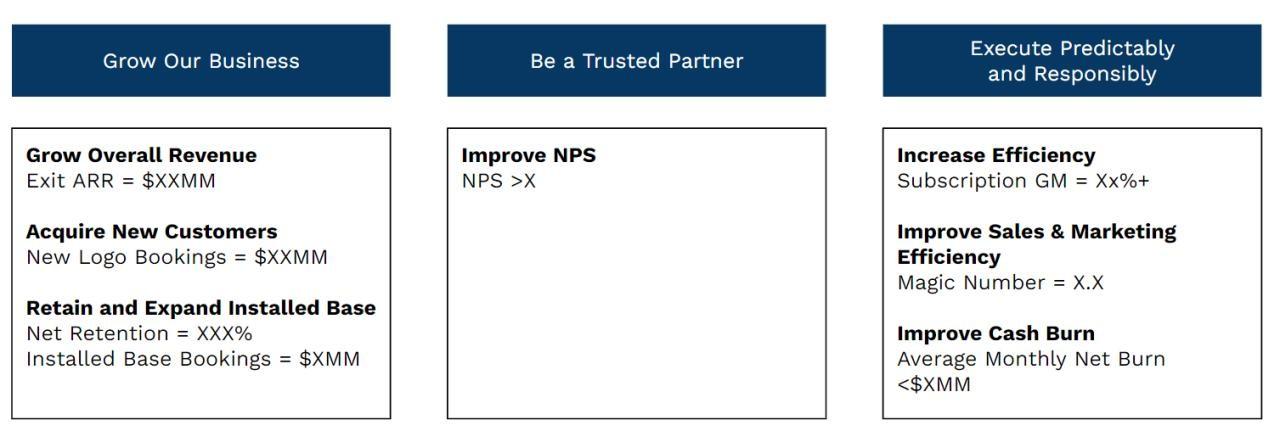

During my time as a Sailthru executive, we used a slide like the one below to start every monthly All Hands for more than three consecutive years(we also kicked off every board meeting with the same slide). Sure, the targets were ever-evolving and in some cases, some of the metrics slightly changed (e.g. cash burn evolved into a EBITDA target once the business was cash flow positive), but the consistency carried us far: after seeing this same slide 40+ times, you can bet your bottom dollar that most employees recalled what we cared about.

Clarity and overcommunication are powerful mechanisms for driving alignment, but make no mistake: variable compensation plans are the most straightforward and productive way to drive out comes around the business metrics that matter most. The concept of “First Team” leadership—the need for leaders to serve the most senior team they sit on before their direct reports of functional teams—is important on its own, but translating it to compensation ensures that every team is literallybought inon the overarching business objectives.

To bring this to life, I’ll further expand on the Sailthru example. We introduced this metrics summary in 2015, when the business was suffering from serious “ease of use” debt with our customers; both net promoter score (“NPS”) and churn were pretty dire, but while we had identified those business challenges some time earlier, the metrics were stuck. We had recently onboarded a new CEO, Neil Lustig, to help us get the business on stronger footing and upon his arrival, Neil schooled us all on the importance of having an aligned executive bonus plan. We changed the executive bonus plan so that each member of the leadership team had exactly the same targets: a payout that was 30% of annual base compensation and was calculated using the same three metrics for everyone: 1) exit ARR, 2) NPS, and 3) cash burn. You can argue the merits of each pillar of our plan, but they made sense for us at the time; yes, NPS is a lagging indicator, but ours was so bad that we knew we would not be able to effectively compete in the market if we did not turn things around.

Guess what? When your Head of Product’s annual bonus is being dictated by ARR, NPS, and cash, behaviors really start to change in an organization. Suddenly we were living in a world where we were allocating 70% of our roadmap resourcing to improving the experience for existing customers vs. shipping novel new features with mixed adoption rates. In the two years that followed, we increased NPS by 51 points and cut gross churn by 60%.

Of course there were some nuances to this bonus structure. For instance, because a revenue leader is typically on a more aggressive variable compensation plan, they need a slightly different structure to ensure their incentives are a mix ofboththe executive team plan and team performance. That said, theexecutiveportion of the bonus should be consistent with everyone else: If the Chief Revenue Officer is on a traditional 50/50 base to variable structure at $300K/$300K, their $300K bonus purse would break down into a $90K potential executive bonus (30%) and the $210K balance would then be measured with a more traditional commission plan.

The power of aligned incentive plans extends well beyond the executive suite.

Example: Account Executives

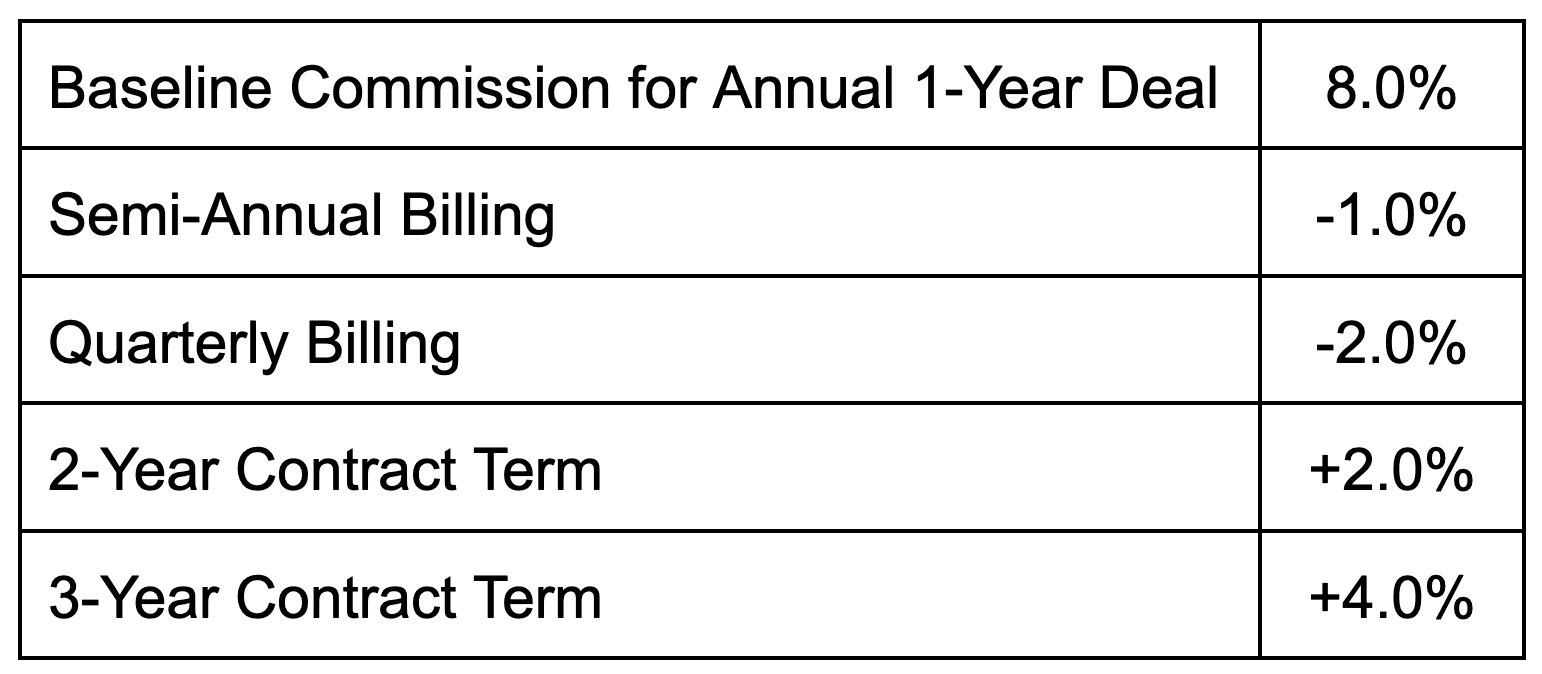

While most sales commission plans start with a base % rate (e.g. 10% of first-year contract value), businesses can and should add accelerators or decelerators for contract mechanics that are meaningful to the business (which avenue you choose depends on your preference for a carrot or a stick!). If your company is focused on cash flow profitability and working capital optimization, payment terms matter! And of course multi-year deals always help with customer-lock in and retention rates. Pay up accordingly.

Example: Sales Managers

Sales managers are often compensated purely on the bookings performance of the immediate teams they manage. That could be the right approach, but if a business is suffering from a net retention or churn problem, they’ll need all hands on deck to help with mitigating it—remember First Team?! In that scenario, it is worth exploring a hybrid plan where part of the sales manager’s compensation is tied to over all net retention rate (or even churn) to ensure they are working closely with the customer success and account management teams to maintain and grow the installed base.

Example: Marketing and Sales Development teams

Most SaaS companies will suffer acute quantity-quality tension around leads and pipeline at some point but surprise(!), the right compensation structure can alleviate it. If the marketing team is incentivized on top-of-funnel leads or meetings set but the broader go-to-market team is suffering from a pipeline coverage problem, the incentive needs to be adjusted. Aligning marketing and SDR/BDR team plans to qualified sales pipeline is usually a reasonable fix. (Note: when new SDRs/BDRs are onboarding, meeting targets can be an easy and quick way to drive activity, but the goal should evolve as they settle in and better understand which attributes actually advance in the funnel.)

Example: CSM Teams

Net dollar retention rate is a commonly used bonus metric for “classical” customer success teams (e.g. noncommercial general quarterbacks of accounts). But you can’t look at net dollar retention in isolation from gross dollar retention. Business #1 with 100% net retention and 95% gross retention has room for improvement with existing customer expansion, but Business #2 with 100% net retention and 80% gross retention needs to focus its attention on its churn/contraction problem.

Organizations can and should mix and match metrics to drive the right outcomes. In the example of Business #2, gross churn is a big deal. While a bonus plan that is ⅔ net dollar retention and ⅓ gross churn technically “double dips” on the churn number since it’s already in the net retention number, it also ensures employees are appropriately rigorous about churn and contraction. Double-dipping can make sense when there are extremely material problems to fix. (In the example of Business #1, perhaps they would carve out a separate bookings target for upsell/cross-sell in addition to overall net retention instead of factoring in gross churn.)

Retention rates aside, think about what other SPIFs could make sense for CSMs. When we hear “SPIF,” we invariably think of the sales organization (perhaps because of the name—SalesPerformance Incentive Fund), but SPIFs can be powerful across all functional areas. Let’s consider the example of a new cross-sell product that the business is just putting in market: The CSM team will be the easiest way to build “CSQLs” or qualified leads from the installed base. A SPIF such as a lotto program can really accelerate momentum: Give each CSM a $X kicker for each completed cross-sell, and also offer them a “lotto ticket” for every qualified lead they generate. At the end of the SPIF period, raffle off an extremely compelling prize (e.g. weekend for two in Miami) for the lotto; simply having the opportunity to win that prize will likely incentivize many qualified opportunities!

Example: Account Managers/Renewal Managers

Now onto the more commercially-oriented account managers. In the same way that CSM variable compensation should be closely aligned to renewal outcomes, bonus plans for account managers and renewal owners should be tightly aligned to company objectives, including net dollar retention.

If renewal/account manager compensation plans are tied only to upsell/cross-sell bookings, the company can still suffer from a gross churn issue. If the account manager is crushing a bookings target, inherently they will care less about net retention rate. A hybrid plan that accounts for both existing business bookings (upsell/cross-sell) and net dollar retention rate once again double-dips on the bookings metric, but it ensures that the more commercially-oriented account manager is equally focused on churn mitigation and price preservation.

Other tips and tricks...

Bonus General Managers on Just That, General Management

General managers are usually responsible for the overall performance of their business unit, geography or whatever they are “managing,” yet so many GM variable plans are tied to sales versus overall performance. Exit ARR is a very powerful metric for GM compensation plans, because it factors in the full gamut of new logo growth, expansion, churn and contraction.

Use “Catch-Ups” to Align to Annual Performance

Depending on the go-to-market motion (read: sales velocity) of an organization, quarterly or monthly bonuses usually make the most sense for customer success and account management teams. If a CSM knows they have a significant churn/contraction in the period, they can work to offset it with a material upsell or cross-sell. However, a large churn event in-period can also be demoralizing (particularly if it’s due to the “death or marriage” scenario of a company going bankrupt or getting acquired), so an end of year “catch-up” can be helpful for offsetting that type of blow. If CSMs (or AMs, or whoever) achieve their annual targets, offer them the opportunity to “catch up” for any monthly or quarterly bonuses they might have previously missed. For example, if the quarterly target is 98% and the CSM has a quarter where their net dollar retention is 80% (missing the bonus payout) but their annual net dollar retention rate lands at 101% because of other overperforming quarters, they get paid back for that missed quarter at the end of the year.

Inspire Healthy Competition

President’s Clubs have long been used to drive healthy competition in commercial organizations, but there are several other ways to recognize employees for outperforming their peers. For example, for CSM teams, you could offer a spot bonus to the CSM with the highest CSM-specific customer satisfaction rating that quarter, the person who drove the highest volume of cross-sell opportunities, etc. (Editor’s note: I also love the idea of finding ways to include top-performing post-sales team members into President’s Club.)

Don’t Sweat the “Double-Dip”

Earlier tactics referenced “double-dipping” in comp plan metrics (e.g. CSM plan including both net retention and gross churn, effectively double-counting gross churn), but this same logic holds when thinking about “double-dipping” across internal teams. If an existing customer is a churn risk because the customer has had staff turnover and a new evaluation team is in place for the renewal, you should absolutely pull your new logo team back into the mix given the process of saving the account will look a lot like a fresh sales cycle. Yes, this may require paying commission on any expansion realized from this exercise in addition to giving credit to the net retention bonus, but it’s worth the double-dip. (Editor’s note: this is where very clear “rules of engagement” matter for sales and CS teams. Personally, I prefer to leave all existing business commercial activity to the account management teamexceptwhen there is a new evaluation team or process in play, in which case I recommend pulling in the new business team back into the mix.) The same logic applies when you consider the CSM SPIFs for cross-sells; that SPIF exists in addition to the bookings credit the account manager receives, but usually the outcome is worth it.

Leverage Milestone Dates to Accelerate Momentum

Companies should always be trying to accelerate their paths to key milestones, and one-off kickers are a great way to build a sense of urgency around as much. For early-stage businesses, it can be powerful to offer a team-wide incentive for hitting certain targets faster, e.g. a $X kicker to everyone on the team if the business hits $1MM ARR by June 30, and a 50% less attractive kicker if they hit it by September 30. This tactic is also fruitful for later-stage companies that are trying to accelerate momentum from a new product, etc.

—

The aforementioned examples are not intended to be exhaustive or even silver bullets, but hopefully they prove to be helpful frameworks in considering what variable compensation structures could make sense for your own businesses. As the late great Charlie Munger famously said, “show me the incentive and I’ll show you the outcome.” The most effective variable compensation plans focus on a business’s ripest opportunity areas; identify the metrics that matter for your business and align compensation plans accordingly, and magic will happen.