The NYC Seed Report: Notable Spikes Kickoff 2023

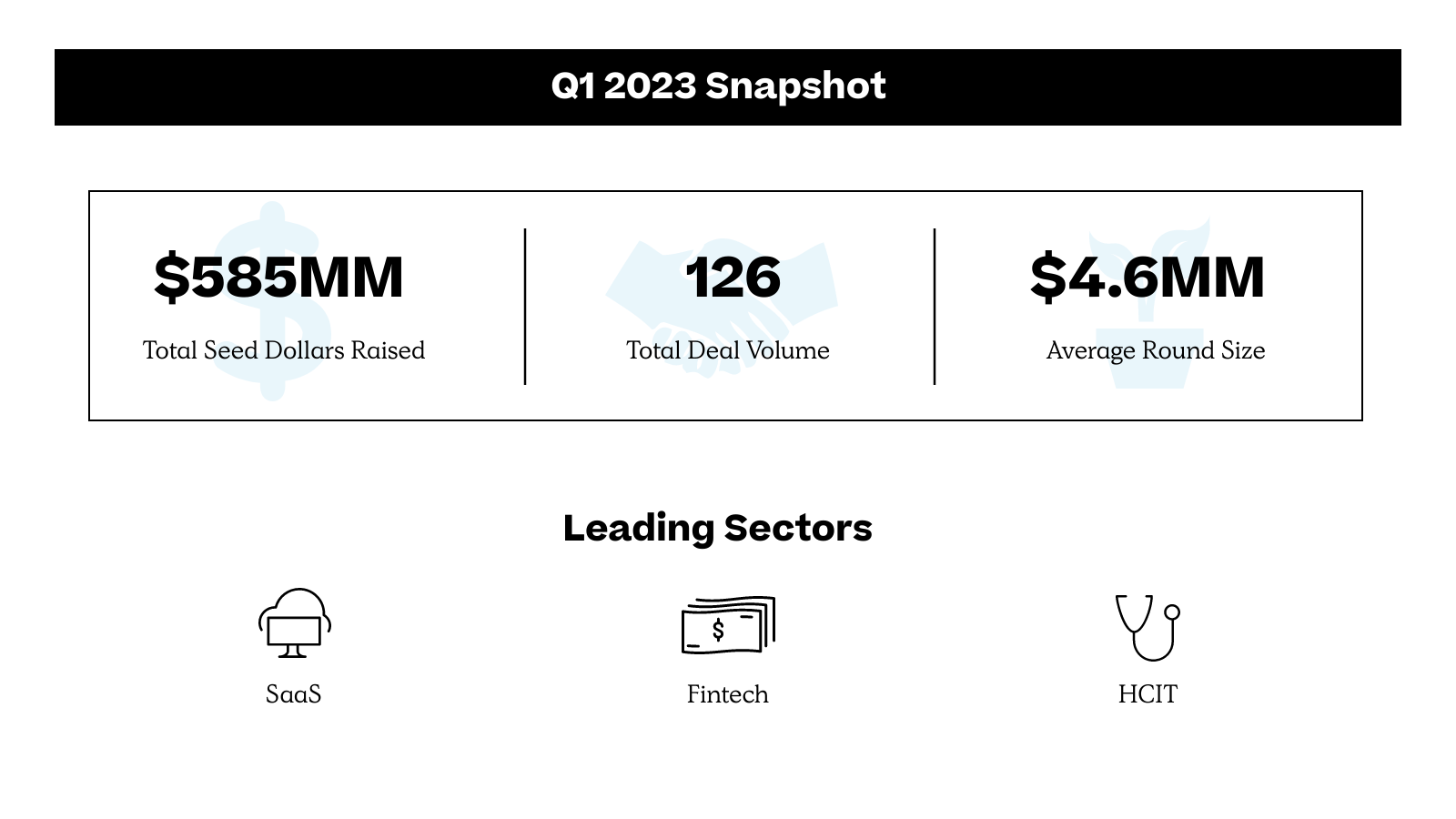

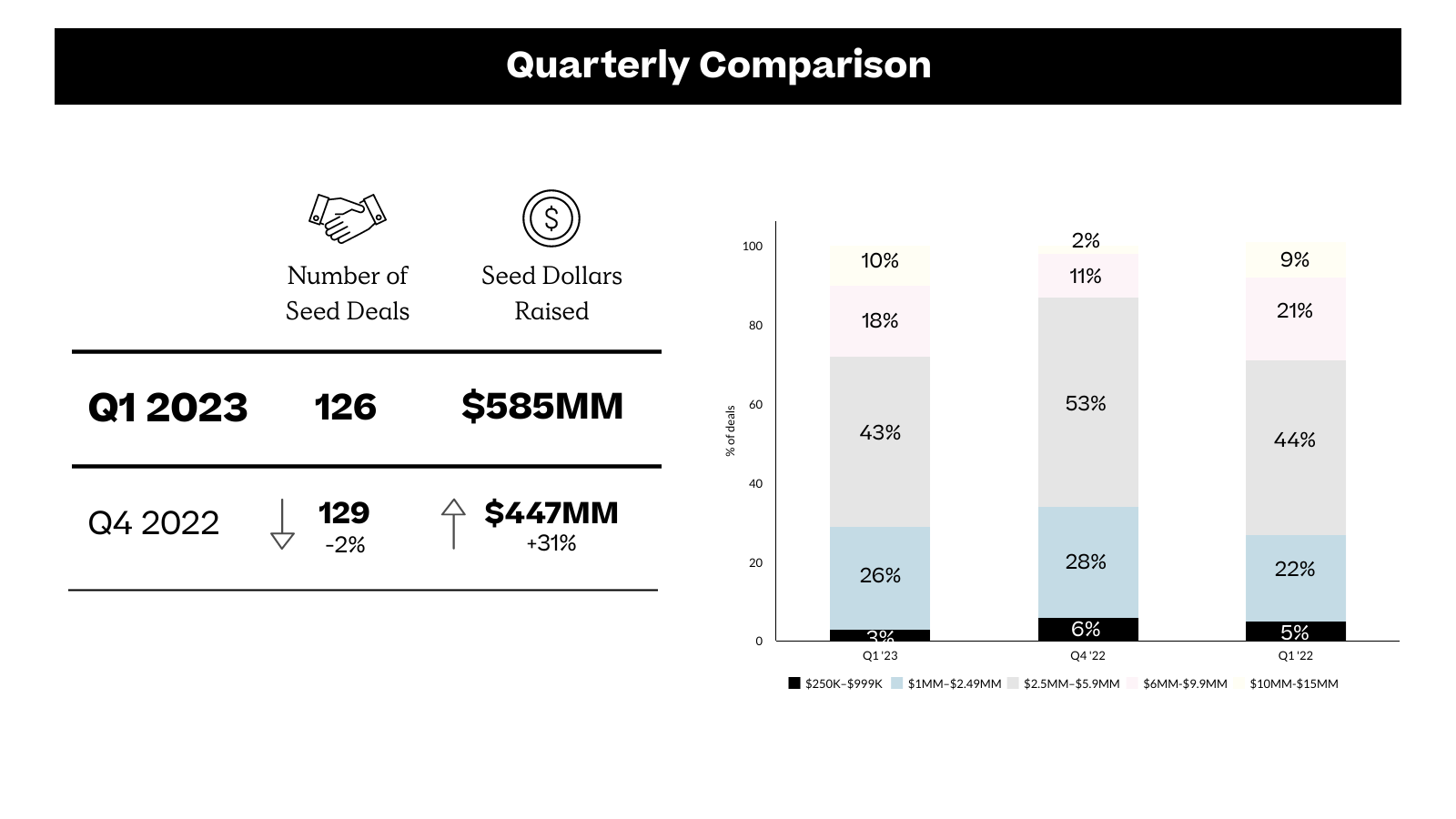

The first quarter of this year resembles its predecessor in some ways, yet presented hopeful numbers. With the Q1 deal count down just 2%, overall investment dollars in the seed stage are up 31% quarter over quarter. We’ll delve deeper into the companies and industries that bolstered those numbers quarter to quarter.

Are we in a great place? No, not necessarily. Could it be way worse? Absolutely.

Between Q1 ‘22 and Q1 ‘23, total venture funding across the U.S. fell 55% and seed funding fell 52%. U.S. VC firms are slowing down too, raising just $11.7 billion in Q1—a pace that suggests this year could fall back to the types of numbers we were seeing in 2017, representing a 73% drop from 2022 totals. To be clear, this is in many ways a return to normal—2017 was by no means hard times.

It’s not easy being a clinician these days - working in increasingly capacity-constrained environments, managing post-covid burnout, persistent financial pressures, higher than ever acute patient volumes, and the list goes on. For most U.S. clinical organizations, workflows must evolve with a focus on increased efficiency and collaboration. This quarter, we saw companies funded that are aiming to increase collaboration among providers to work smarter, not harder. Chiefy, raised a $4.2 million seed round, focusing on aligning surgical teams (surgeons, anesthesiologists, nurses) across pre-op huddles, surgery checklists, and debriefs to improve patient care. Florence Health raised a massive $20 million seed (yup) from investors such as BoxGroup, GV, Salesforce Ventures, and Thrive Capital to tackle the core problem of clinical capacity, building a patient engagement platform that spans intake through discharge planning and arranging follow-up care. Personally, as the spouse of a clinician, I hope to see more companies focused on clinician-friendly workflow tools. If you are an entrepreneur working in this space, let’s connect!

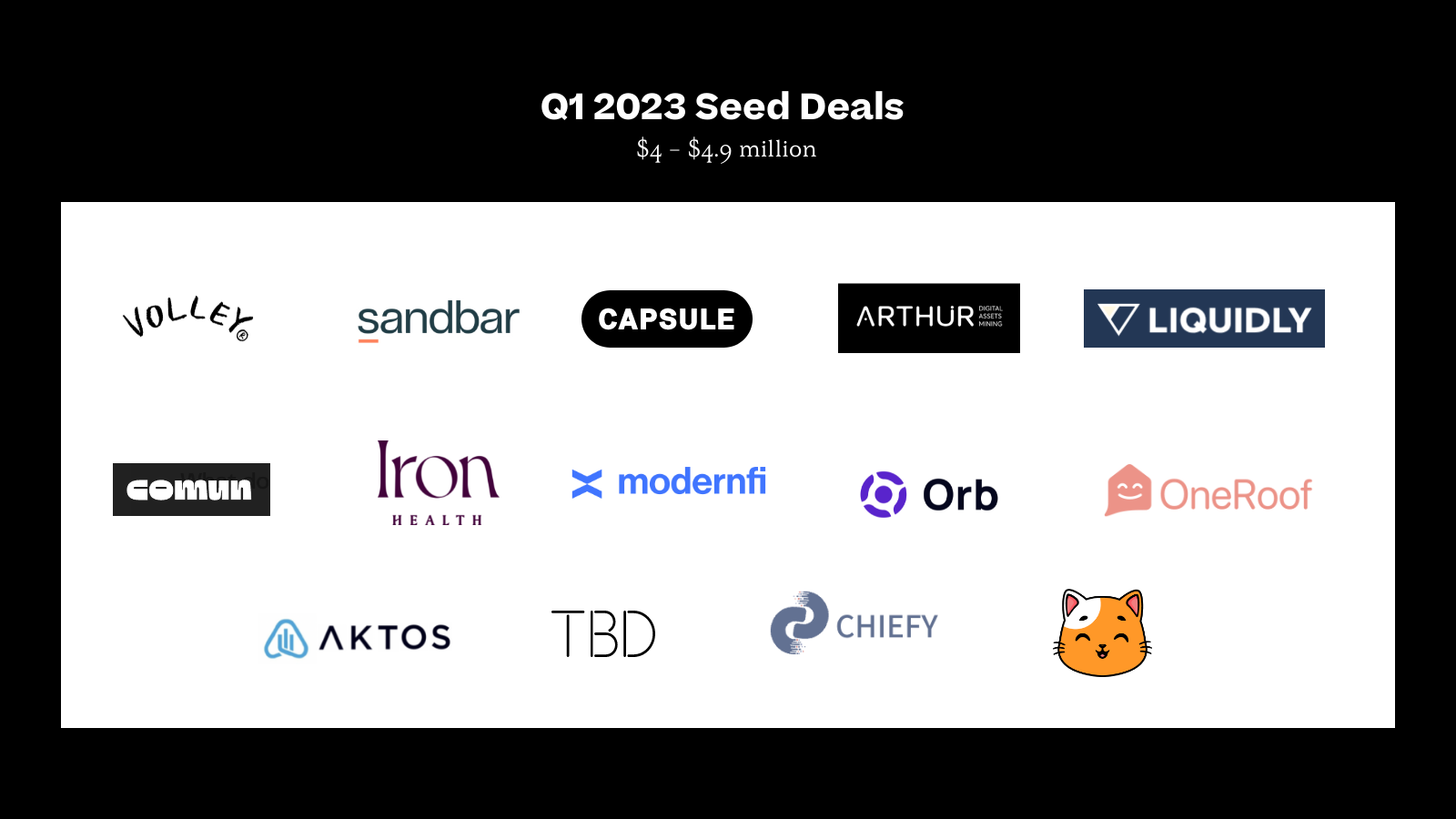

Managing your personal finances feels ever more pressing in a time of high interest rates and consequently growing personal debt payments. As the center of financial services, it’s unsurprising that NYC's fintech ecosystem remains acutely aware of consumers' need to diligently manage their personal finances. We’re seeing a number of promising startups in the space that are rapidly building a broad suite of personal finance tools that give consumers the power to holistically and proactively manage their finances. Whether it’s building a financial super app that gives consumers access to top-tier rewards (see Fierce which recently raised a $10 million seed round) or expanding financial inclusion to underbanked populations (see Comun fresh off their $4.5 million seed round led by Costanoa Ventures) — NYC fintech is building tools with the consumers’ needs in mind.

At Primary, we are believers in Generative AI and the potential for this technology to be a true platform shift, leading to 100X better experiences across a variety of software categories. We’re seeing talented founders build at all levels of a stack, from applications to infrastructure to hardware. New York City has become a real hotbed of that activity, and funding announcements are already hitting the newswires. We expect this to dramatically accelerate in the quarters to come. For example, Normal Computing, which raised an $8.5 million seed round, is making AI more scalable and useful. On a smaller, yet equally important scale, EmoShape raised a $1.7 million seed round from Quake Capital to develop AI to deliver high-performance machine emotional awareness.

AI is extending software’s promise of productivity enhancement by transforming applications from informative to instructive. This is providing a powerful additional impetus for adoption in traditionally tech-resistant industries. We’ve seen a number of companies in the NY tech ecosystem go after low-hanging fruit in spaces where writing and data entry are heavily manual tasks. These include legal writing, order intake, sales outreach, and more. For example, we can see Macro raised a $9.4 million seed round led by a16z to build an AI-powered workspace for legal and financial documents.